Five years ago, there was a large quantity of digital currencies and blockchains, but there were very few trading platforms that dealt with decentralized exchange. Since the decentralized finance boom (challenge), there are now a myriad of decentralized exchange (dex) platforms that allow people to exchange funds privately and not on deposit. These days the biggest dex applications are catering to a variety of blockchain networks via cross-chain technology.

Curve’s TVL nears $ 20 billion, Curve DAO token jumps 82%, Pancakeswap and Sushiswap follow with TVLs of over $ 10 billion

Defi has exploded in popularity over the past 12 months and there are many apps and platforms catering to the needs of traders and liquidity providers. Currently, there’s $245.1 billion in total value locked in defi platforms today across blockchains like Ethereum, Solana, Avalanche, Polygon, Binance Smart Chain, and more.

Data from defillama.com indicates that the Aave lending system has the greatest measure of dominance today at 7.95% of the $ 245 billion, or TVL 19.46 billion. Aave is compatible with Ethereum, Polygon, and Avalanche and the TVL has increased 18.13% during the last seven days.

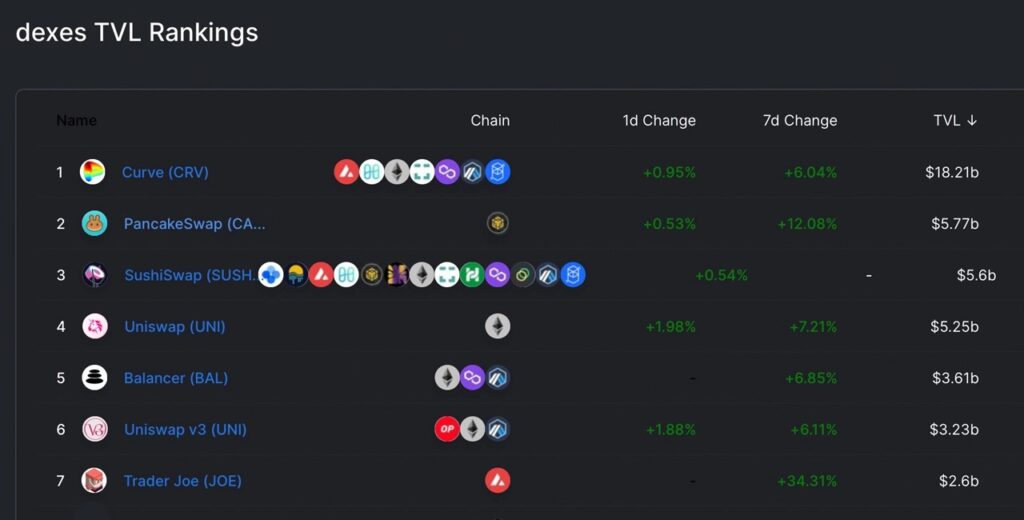

In terms of dex TVL rankings, Curve is the number one contender with $ 18.21 billion and compatibility with seven different blockchains. The Binance Smart Chain (BSC) dex application, Pancakeswap, has the second-largest TVL with $5.77 billion across only one chain.

The Curve dex cryptocurrency, also known as the Curve DAO (CRV) token, has risen in value by 82.4% over the past week. Cake, the native currency for the Pancakeswap dex, is only up 0.7% this past week. Sushiswap is just below the dex BSC with a total value of $ 5.6 billion stuck on 13 unique blockchains. Sushiswap’s native asset, SUSHI, has gained 3.0% in the past seven days.

Uniswap, which leverages the Ethereum blockchain, has a TVL of around $5.26 billion, up 8% during the last week. UNI gained 4.7% last week and Uniswap version 3 is the sixth largest dex in terms of total value owned.

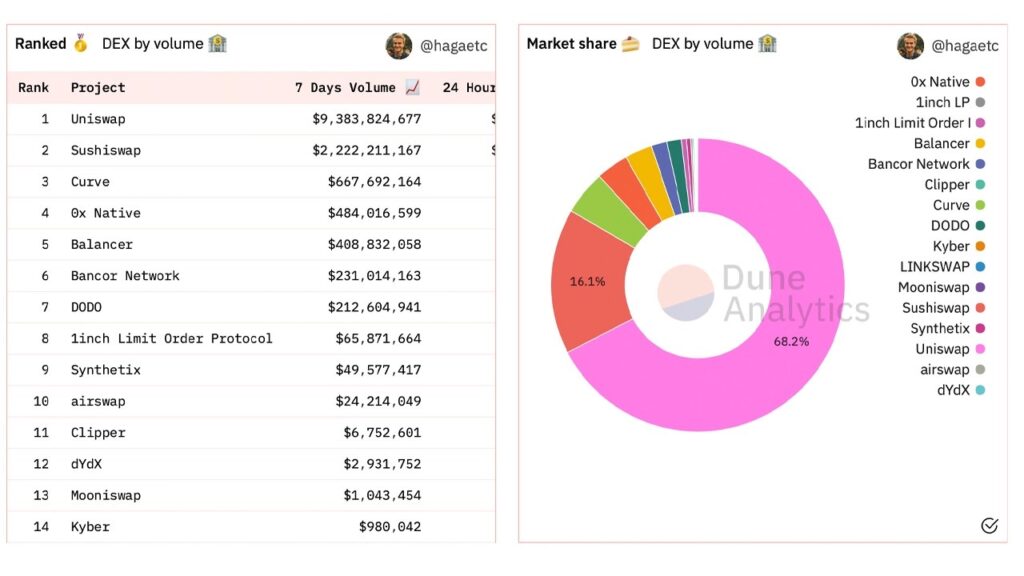

Uniswap’s Weekly Volume Close to $10 Billion, Dex Aggregators Capture 26% of Trades, Non-Ethereum Dex Platform TVLs Rise

Between Uniswap, Sushiswap, Curve, and 0x Native, the dex application Uniswap commands the most trade volume with $9.3 billion during the last seven days. Uniswap captures 68.2% of the volume on 14 different Ethereum-based dex platforms.

Meanwhile, Sushiswap has seen $2.2 billion in volume this week and Curve has seen $667 million. Dex aggregation platforms like 1inch and 0x API account for around 26% of trading volume. 1inch has seen $2.1 billion in weekly trades and 0x API $1.2 billion. In terms of TVL, the main dex apps other than BSC and ETH blockchains include Trader Joe from Avalanche, Saber, Raydium and Serum from Solana, and the Justswap (JST) app from Tron. The Avalanche (AVAX)-based Trader Joe dex has increased its TVL by 33.11% this week and the Solana (SOL)-based Serum’s TVL jumped 20.74%.