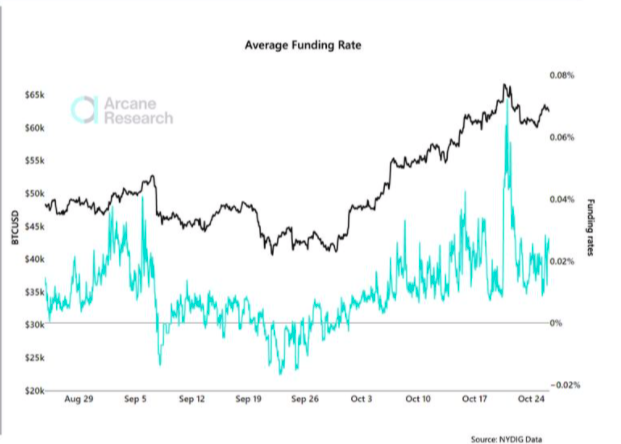

Bitcoin’s brand-new all-time high this month has actually caused a variety of intriguing advancements in the crypto area. The success of the first Bitcoin ETF contributed greatly to the price of BTC finally bursting through the $67K price point and with it has come to a spike in funding rates in the market. The ProShares ETF saw over $1 billion in trading volume in its very first day, signaling increased inflows into the marketplace.

The spike in funding rates moved along with the price movements of BTC in the month of October. This spike kept momentum together with BTC motions. However, as the price of bitcoin has begun a downward trend, funding rates have also evened out to mid-October levels.

Bitcoin Open Interest Spikes

Open interest in bitcoin had actually tape-recorded a substantial spike when the cost of the digital possession had actually moved past $67K. BTC-denominated open interest in perpetuals had since a sharp increase to the tune of 15,000 when the asset reached its new all-time high in October. The spike in BTC-dominated perpetuals had actually increased previous levels tape-recorded throughout the April all-time high.

The increased interest from big money is credited for the spike in the funding rates recorded last week. More particularly short-term traders anticipated the worth of the digital possession to continue to grow and break previous $70K. Funding rates have shown similar movements to the futures market in recent times.

Arcane Research advanced that this boost in open interest and increased financing rates could indicate leveraged long-trades presently in the all-time high variety. If this is so, then this is something to keep an eye on if the price of the digital asset continues to decline in the coming days.

Big Money Moving Into The Market

Institutional inflows likewise saw record volumes following the all-time high breakout recently. A CoinShares report showed that bitcoin saw inflows of up to $1.45 billion in the past week alone. Most of this volume originated from trading in the ProShares ETF that debuted on Tuesday recently. An extra $138 million streamed into BTC items in other areas.

Sentiment on Wall Street is beginning to turn in favor of the top cryptocurrency in the market. Data revealed that the variety of Wall Street brokers thinking about the BTC and the marketplace had actually increased from 5% at the start of the year to 15% currently who state that they are beginning to make financial investments in BTC more seriously.

Market sentiment overall remains positive with the all-time high run of the previous week. However, decreasing rates have actually led financiers down a more mindful course when trading in the cryptocurrency. Bitcoin’s price touched $58K in the early hours of Wednesday ahead of market opening for midweek trading.