Over the past two years, institutional involvement with major assets such as Bitcoin, Ethereum has been a common affair. However, it has been a difficult task to identify all sources of investments. By the end of 2020, Grayscale’s build-up of Bitcoin was seen as the most influential institutional interest. However, it slowed down in 2021.

And yet, capital continued to flow from accredited traders.

In this article, we’ll highlight each fund that owns Bitcoin and Ethereum and how their activity has created an impact over a longer period of time.

The long list of Bitcoin, Ethereum admirers

As previously mentioned, the difficulty of identifying every fund involved with BTC, ETH has been a major dilemma. Therefore, we will list all the trusts currently invested in the two digital assets at the end of this article.

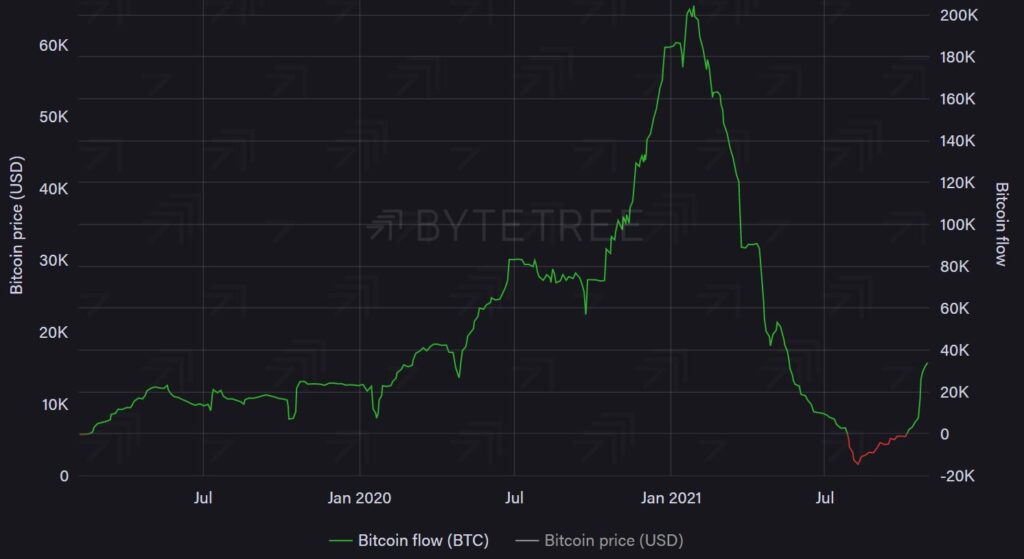

Now, according to data from Bytetree, the amount of Bitcoin held by funds since the beginning of 2020 has almost tripled up to the present day. In fact, the BTC held went from 316,615 to 834,156 over a period of 670 days.

Similarly, capital held by funds for Ethereum has quadrupled, rising to 4,232,327 ETH from an initial accumulation of 1,080,705 ETH on 1 January 2020.

Another interesting observation that can be made for both Bitcoin, Ethereum funds is that the majority of investments were made in calendar year 2020. And, in 2021, the same has slowed down considerably.

Can it create a bullish divergence?

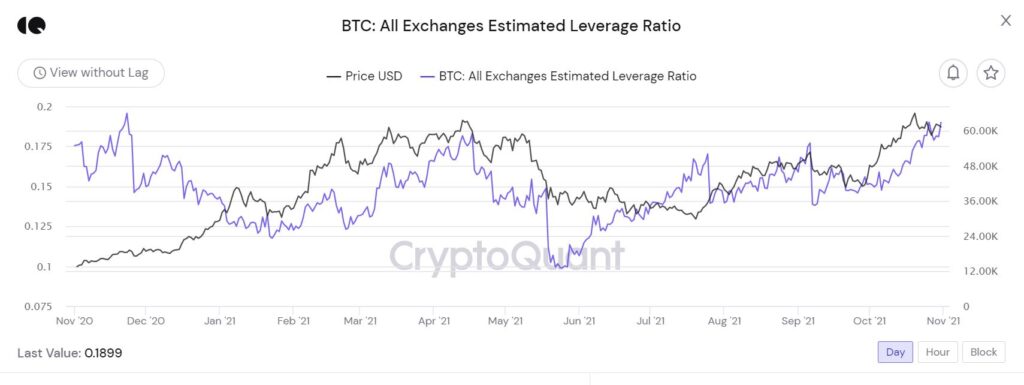

As Bitcoin and Ethereum consolidated above $ 60,000 and $ 4,000, respectively, the estimated leverage ratio of asset exchanges has reached a high annual level. While this factor does suggest that investors are confident in their positions and believe in bullish sentiments, reversals have been identified around this range over the past year.

However, this is where cash inflows can provide a clearer picture.

As can be identified from the attached chart, BTC inflows in and out of these funds have largely indicated price bottoms and tops over the past year. July 2021 marked the bottom in terms of exits and since then a tilt has been observed, which induces a bullish character.

A similar structure was observed for Ethereum as well, and it can be concluded that institutions remain positive despite Futures market concerns.