ProShares Bitcoin ETF Could Not Hold Record Inflows Figures

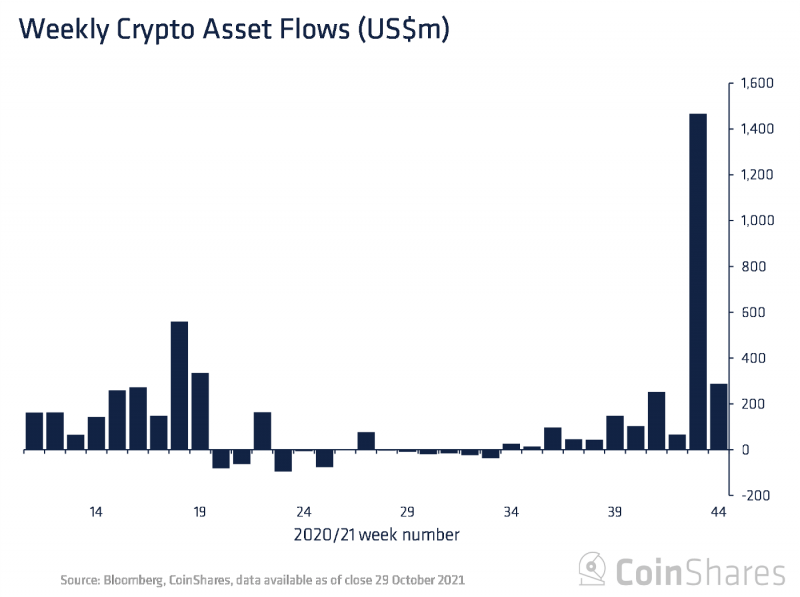

Following the approval and trading initiation of ProShares Bitcoin Futures ETF, the industry faced almost $1.5 billion inflows with the ETF bringing in $1.2 billion singlehandedly. But this week, US entries cooled to around $ 50 million, according to CoinShares.

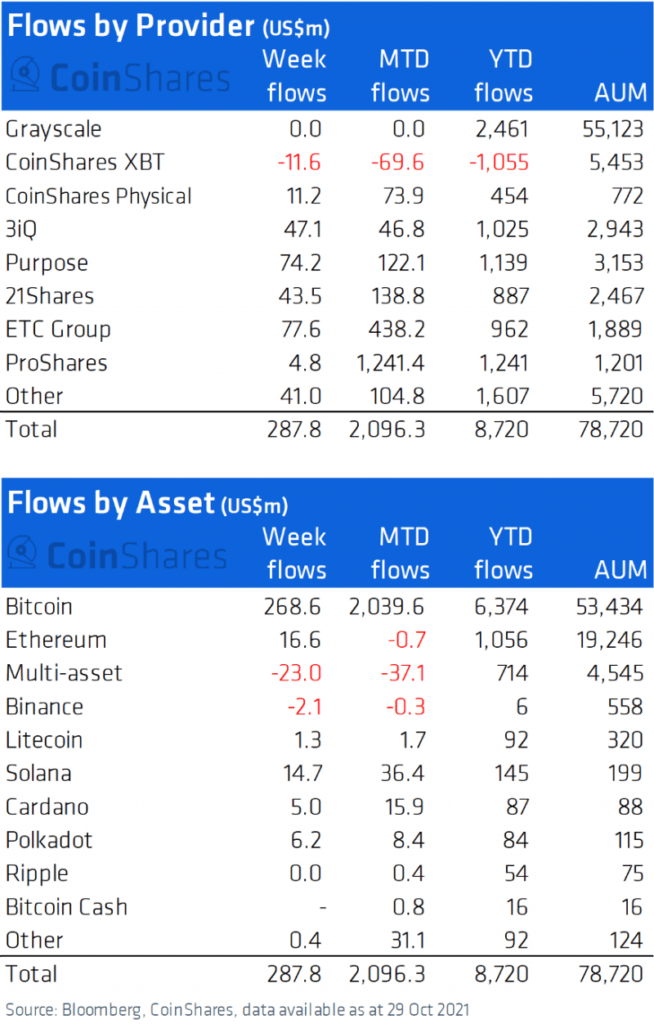

Institutional investments in digital assets have totaled $288 million in the last week, making it almost $9 billion YTD. In comparison to the previous week, total funds invested have been reduced by approximately 20%.

The largest funds provided the previous week were ETC Group and Purpose, with a total of $ 151 million paid into the industry. ProShares has only brought in $4.8 million, which indicates that the new futures-backed BTC ETF currently does not fit all institutional investors.

In terms of flow per asset, Bitcoin, as always, saw the majority of inflows at $ 269 million, bringing monthly inflows to $ 2 billion for October. More than half of the value of the monthly inflows has been reached thanks to ProShares ETF. In addition to US-based companies, FTEs in Canada and Europe have also faced inflows of funds.

Etherum has finally broken the outflow week, totaling $17 million in inflows last week, with YTD inflows remaining at $1 billion. Thanks to the strong positive performance of the altcoin market, Ethereum’s market share rose to 32%.

Other altcoins like Solana, Cardano and Polkadot also faced inflows, as well as Ethereum, totaling $26 million. Multi-asset investment products are the only products to experience cash outflows totaling $ 23 million. The main reason for this is the popularity of specific products that bring something unique to the market like Polkadot, Bitcoin or Solana.