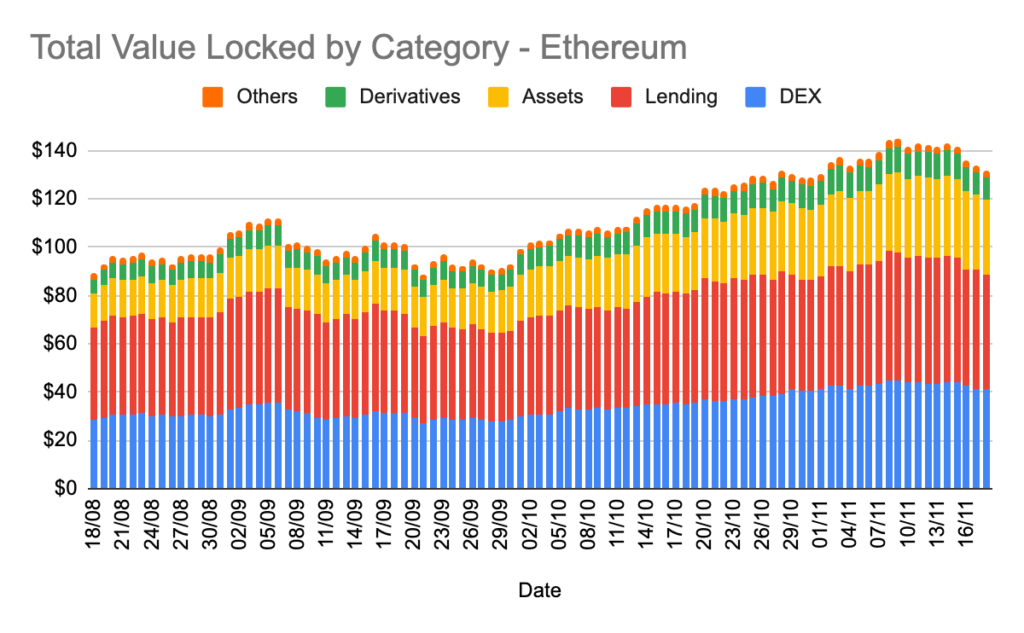

November was a difficult month not only for the spot market but also for the DeFi market, and Ethereum is the best example of this.

Even though Ethereum holds 66% domination in the DeFi space, halfway through the month of November the DeFi king lost about $18 billion from its total value locked (TVL) and has since been making its recovery slowly.

Ethereum’s DeFi debacle

The biggest disappointment came from some of the derivative protocols which saw a fairly large drop of 13.21%, followed by loans and DEX at 9.17% and 6.51% respectively.

Some dApps are making major gains and supporting the recovery of the lost TVL. Loopring, for example, turned out to be one of the biggest protocols this month, rising by over 281% from $206 million to $785 million in market cap as of yesterday.

However, there are also other lesser-known dapps that have made it big. One of them was an Origin Dollar stablecoin protocol that saw its TVL increase by 492%.

Another multi-currency stablecoin protocol handle.fi shot up 1580% and is currently sitting at $3.4 million. Loopring even sent out ripples in the spot market when it rallied by 813% this month.

So why is recovery slow?

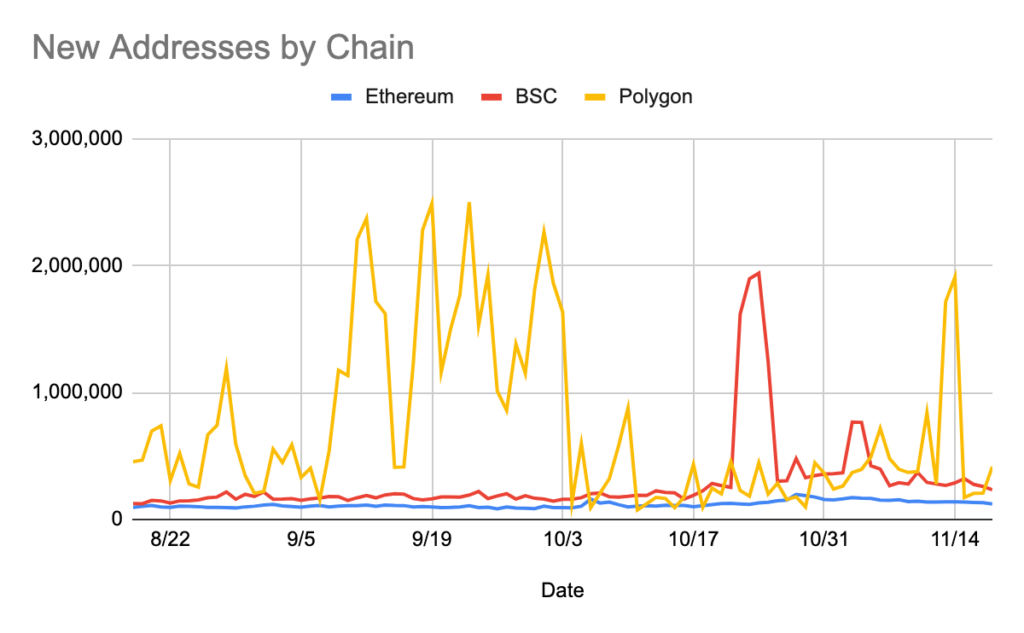

The problem here is not with the protocols. Ethereum has a myriad of active users on the network, but it still needs to add more. Even though it has the highest number of addresses compared to competing chains like Binance Smart Chain (BSC), Solana, etc., the pace at which it adds addresses has not changed for a long time.

On a daily basis Ethereum only sees an increment of 134k addresses, whereas BSC adds about 275k, and Polygon at one point this month added 1.9 million addresses in a day.

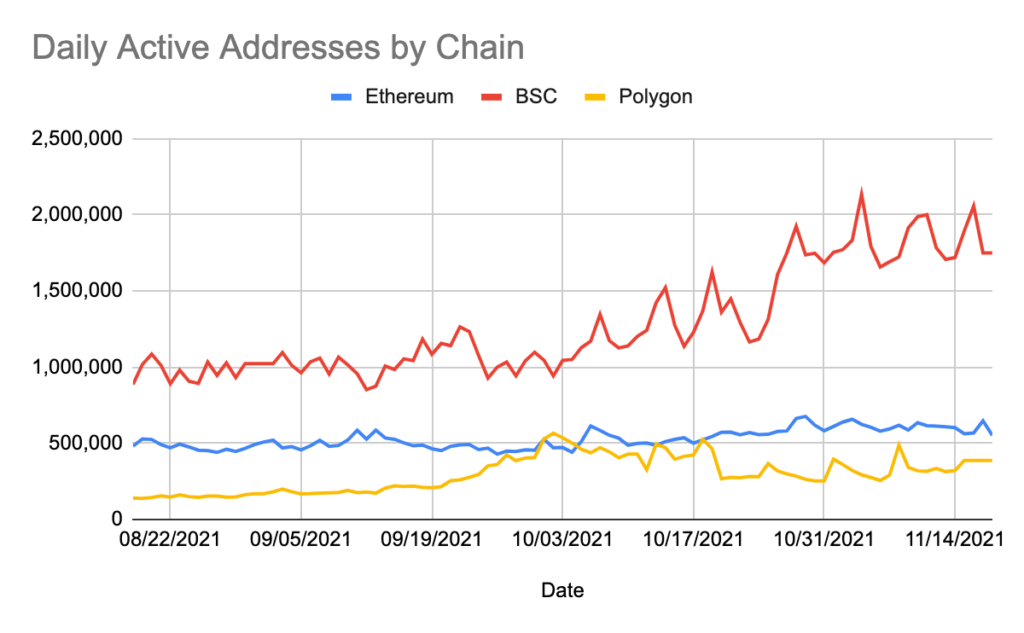

Additionally, across all of these chains, Ethereum routinely only has 590,000 active addresses, which is well below BSC’s 1.8 million active addresses.

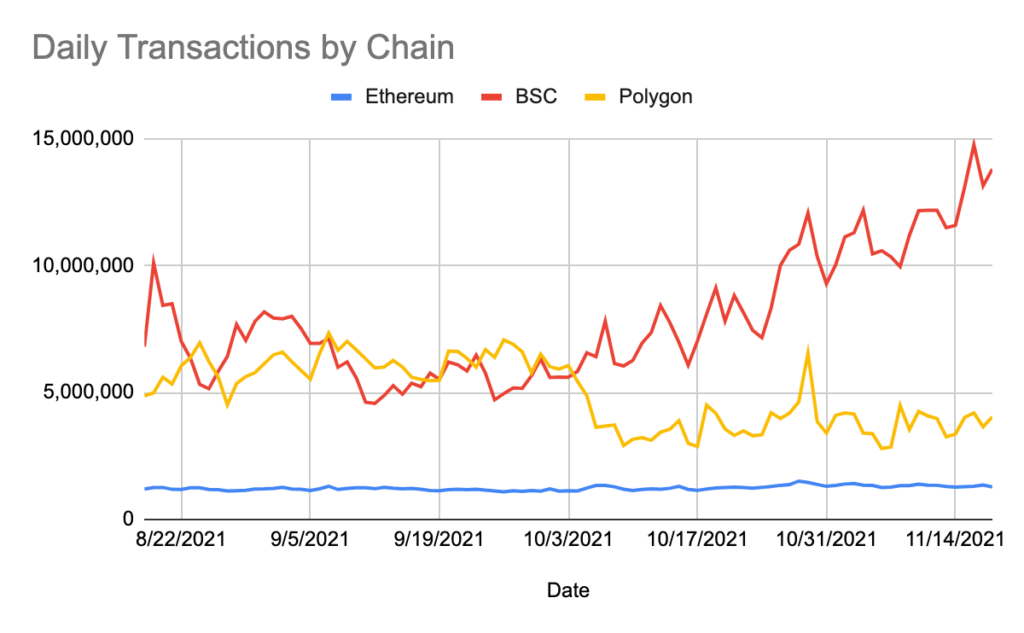

Consequently, the number of transactions conducted fell to just 1.2 million. On the other hand BSC and Polygon regularly conduct about 15 million and 4 million transactions respectively.

What is important to understand here is that dApps and protocols will go up and down and since Ethereum has over 310 protocols, they cannot be considered a stability factor. However, if chain participation increases, it would lead to higher transaction figures and larger entries. The tides could then change and Ethereum could recover much faster.