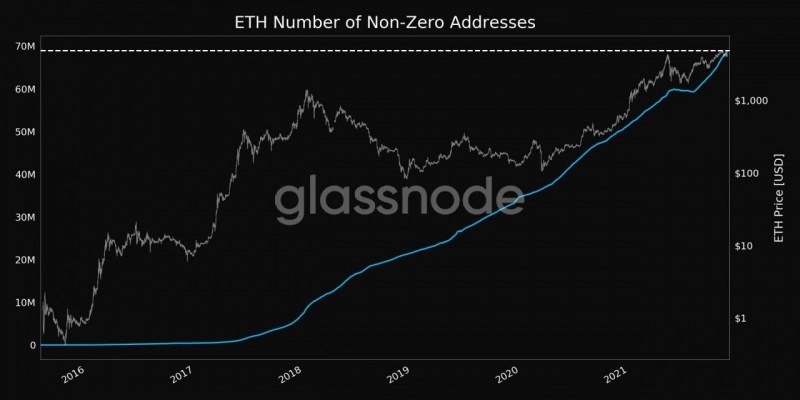

Growth in non-zero Ethereum addresses shows underlying sentiment foreshadows a bullish future

Traders are positioning for a surge in the ETH price in the medium term as there are now more addresses than ever holding Ethereum, according to Glassnode.

The second largest cryptocurrency, Ethereum, fell almost 14%, hitting lows of around $ 3,915 after the global market sold off on November 26.

First, there are more addresses than ever holding Ethereum. The number of non-zero Ethereum addresses just hit an all-time high of 68,933,212 as per data from on-chain analytics company Glassnode.

The growth of non-zero Ethereum addresses seems plausible as crypto adoption becomes more common, with traders flocking to the NFT and DeFi space.

Second, market participants remain optimistic that the U.S. SEC might soon give the go-ahead for an Ethereum based exchange-traded fund. It comes as Kelly Strategic Management, an investment firm headed by Kevin Kelly, files for approval in the U.S. of an exchange-traded fund (ETF) tied to Ether futures, just three months after ProShares and VanEck pulled similar filings.

Security and Exchange Commission (SEC) approval for an Ethereum-based exchange-traded fund could have a positive impact on the Ethereum price, just as Bitcoin hit an all-time high of $ 69,000 after the launch of the first futures contract Bitcoin ETF.

Presently, Ethereum is gaining ground against Bitcoin, suggesting a price breakout may be in the offing. Ethereum was trading at $4,448 as of press time, while ETH dominance representing Ethereum’s share of overall industry market capitalization stood at 20.4%.