The beginning of December saw the trajectories of the two main coins accelerate, after a rather relaxed November. Bitcoin has seen gains of over 4% while Ethereum has risen over 10% over the past two days, taking the market by surprise. However, this was not the first time that Ethereum has outperformed BTC and other major alts.

Ethereum outperforms

The top altcoin on a wave of renewed anticipation saw a clear break above the $4,200 resistance zone and the 100 hours simple moving average on 29 November. This breakout above the bearish trend line and a major resistance near $4,205 on the hourly chart pushed ETH’s price up.

Additionally, the asset’s price was in a descending channel as seen above which presented strong support at $ 3,960 for ETH. Ethereum’s over 5% jump on November 29 helped the asset decouple from Bitcoin’s negative performance, pulling its price from the descending channel.

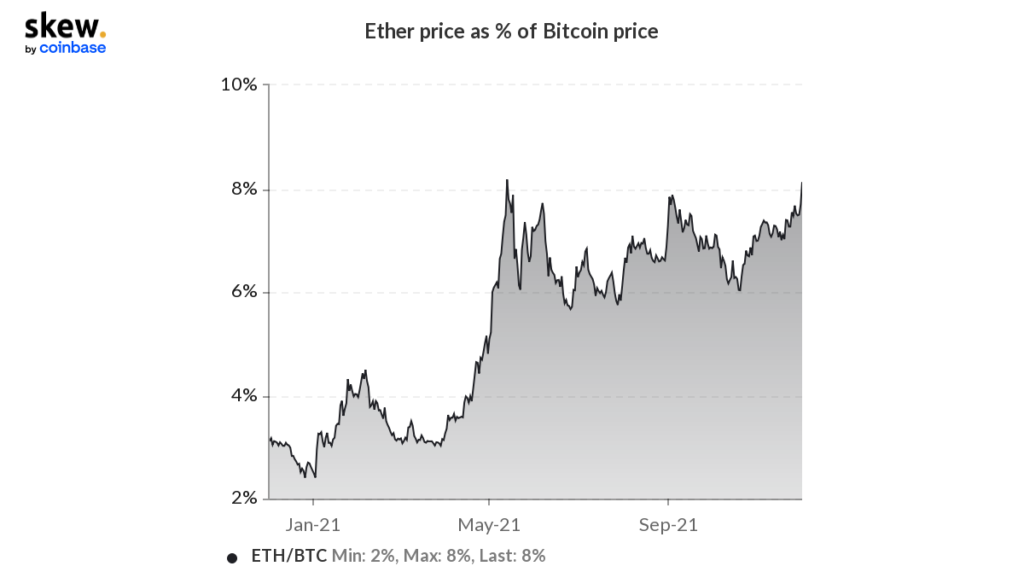

At the time of writing, ETH was approaching its ATH and traded close to $4,715 while BTC was roughly flat around the time. Further ETH/BTC ratio, was attempting a breakaway above the five-month trading range after a daily close above 0.080 for two consecutive days.

ETH overrun: here’s where it will go

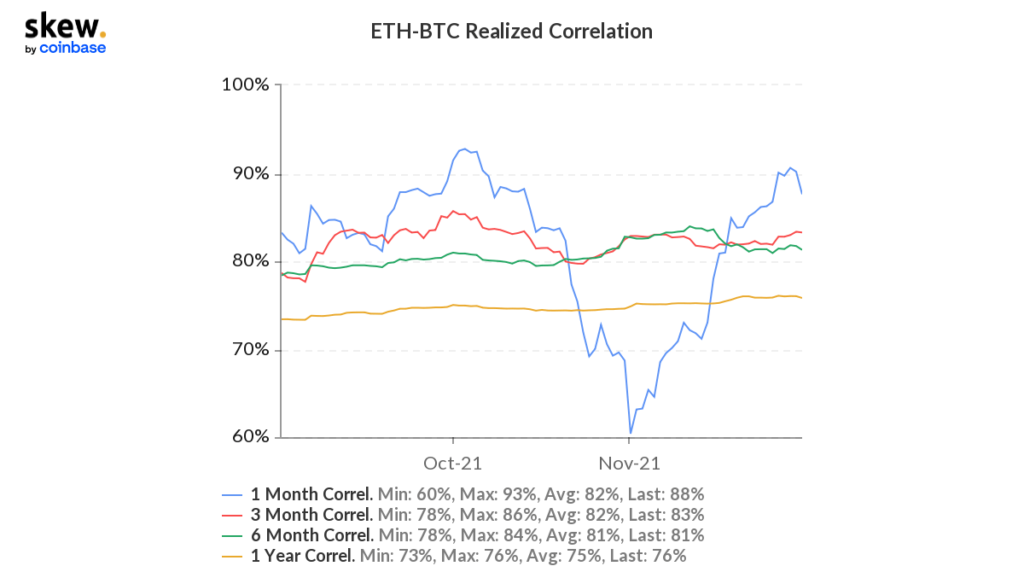

Interestingly, Ethereum, at the time of writing, was outperforming BTC as the ETH / BTC ratio was the highest since mid-May at 0.082 BTC per ETH. That being said, the correlation achieved by BTC-ETH (1 month) saw a sharp drop on November 29, showcasing the dissociation of ETH from the wider market.

Further ETH’s price as % of BTC’s price was at an all-time high of 8%, at the time of writing. The same trend was notable in early October when ETH’s price rallied by over 50% during the time period.

Nonetheless, there is still skepticism in the market – long traders place short bets, and data shows retail traders have been mostly neutral since November 4. In fact, the last break above 0.07% in the finance rate occurred on October 21, meaning the market was largely neutral.

The futures market’s open interest and estimated leverage ratio seem to be going parabolic. So, massive liquidations can be spotted when the market is overheated, this could be one reason why traders could be cautious at the time.

Additionally, with BTC’s dominance falling for over a month now, this reflects the recent outperformance of altcoins. It also meant that the market now had a greater appetite for risk. All in all, an Ethereum breakout could pave the way for an alternative rally soon enough.