Since mid-November the total value locked (TVL) in decentralized finance (defi) has slid from $257 billion to $250.55 billion and during the last 24 hours it lost a touch more than 5%. Over the last seven days, defi tokens like uniswap, pancakeswap, curve dao token, 1inch and sushi have lost anywhere between 15% to 23.9% in value.

TVL Drops Challenge – Curve, Makerdao and Convex Finance dominate

At the time of writing, the TVL in the challenge protocols on a myriad of blockchains is $ 250.55 billion, according to metrics from defillama.com. The overall locked-in challenge value has lost 5.08% in the last day and the protocol curve dominates most of the listed TVLs with a dominance of 8.07%.

The automated market maker (AMM) Curve commands $20.23 billion TVL which is up 1.13% this past week. Makerdao is the second-largest defi protocol TVL with $18.56 billion at the time of writing. The third-largest defi protocol TVL belongs to Convex Finance with $15.14 billion today.

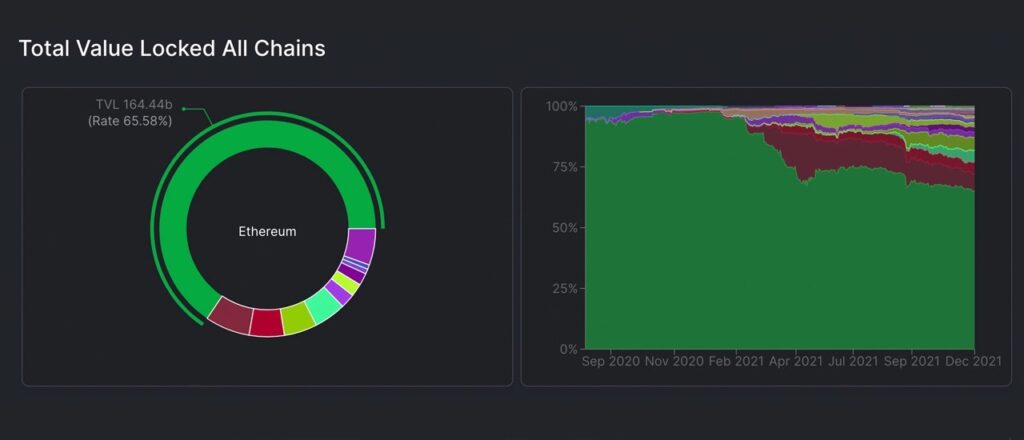

Ethereum Defi TVL Dominance 65%, Binance Smart Chain 6%, Terra 5%

TVL via blockchain shows Ethereum orders $ 164.36 billion of the $ 250.55 billion challenge on Sunday. Binance Smart Chain (BSC) captures $ 16.61 billion and the chain is the second largest chain in terms of TVL challenge protocol.

Following BSC is Terra ($13.29B), Avalanche ($12.03B), Solana ($12.46B), and Tron ($5.48B). At the time of writing, Ethereum commands 65.58% of the $250.55 billion of value locked in defi. While BSC commands 6.62% dominance, the TVL in Terra captures 5.30%.

Rebase and AMM Defi Tokens Slide —Crosschain Bridge TVL slips 26% in 30 days

Statistics from coingecko.com show that the total market capitalization of major Automated Market Maker (AMM) Challenge Tokens has fallen 13.6% to $ 17.2 billion. Additionally, metrics show rebase tokens fell 5.1% to a low of $ 6.09 billion on Sunday.

The top AMM crypto asset uniswap (UNI) has shed 15% during the last seven days. Uniswap is followed by pancakeswap (16.7%), curve dao token (27.2), 1inch (26.3%), sushi (23.9%), and bancor token (10.1%).

Rebase tokens such as olympus (OHM) lost 17.1% last week while Wonderland (TIME) lost 18.5%. Klima dao (KLIMA) is down 50.6% in the past seven days and ampleforth (AMPL) is down 17.7%.

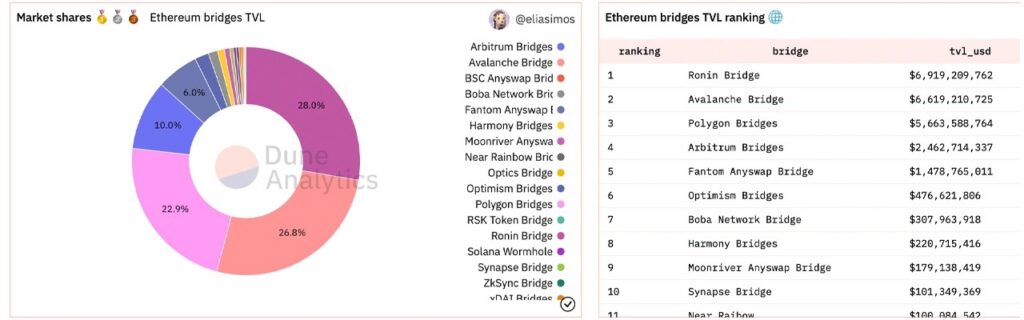

Monthly stats show cross-chain bridge TVLs have slipped 26.9% and today there’s $24.40 billion TVL in bridges to Ethereum, according to Dune Analytics. The leader is the Ronin bridge with $6.9 billion and Avalanche has $6.6 billion and Polygon has $5.6 billion.