During the last seven days, virtual lands sold in the metaverse have outpaced a great number of non-fungible token (NFT) sales. Moreover, metaverse native crypto tokens like axie infinity, sandbox and decentraland and play-to-earn digital assets in general have jumped significantly in value this year.

Metaverse properties exceed NFT collections – Increase in Play-to-Earn tokens

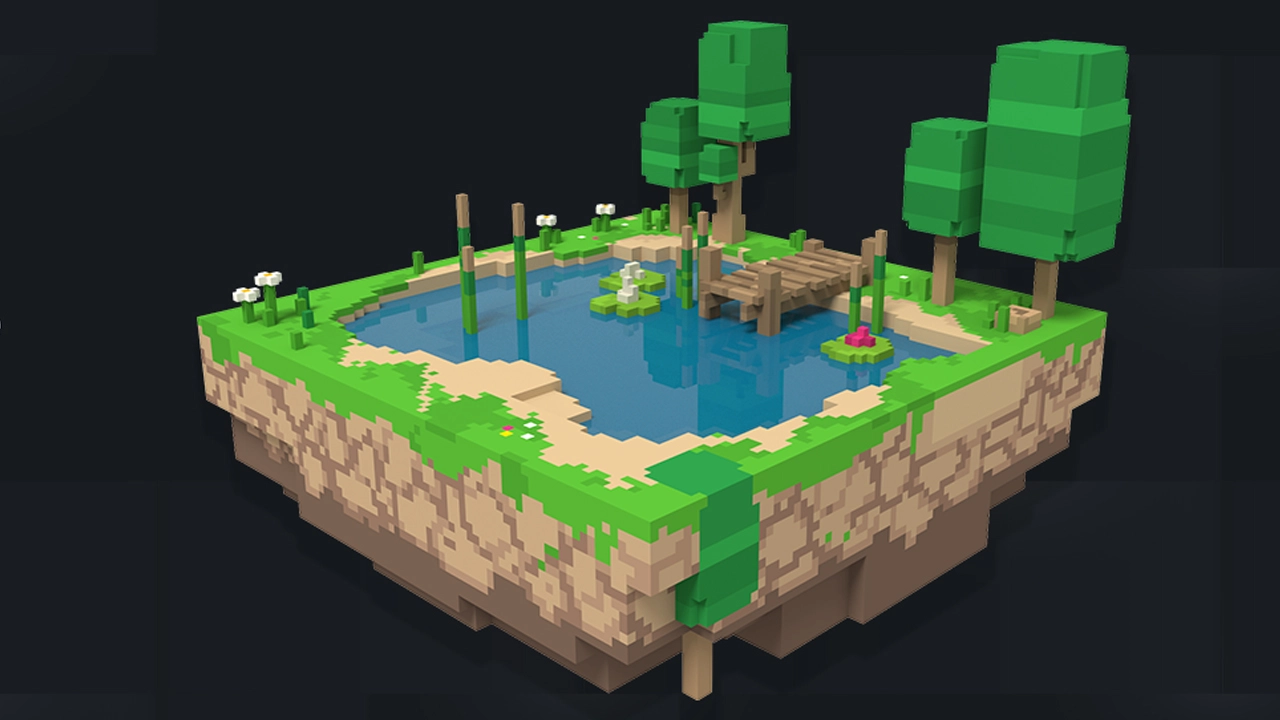

Following the meme-crypto hype, the decentralized finance trend (challenge), and the non-fungible token (NFT) craze, the metaverse has become a big deal. Essentially, a Metaverse is a different version of the Internet that supports virtual environments, items, collectibles, weapons, and sometimes in-game features to win. Virtual worlds like Second Life, Minecraft, and Roblox can be considered iterations of the metaverse, but lately blockchain technology has entered the field.

For instance, out of the $2.3 trillion crypto economy, $25 billion of it belongs to play-to-earn (P2E) digital assets. Axie infinity (AXS) is the largest P2E token in terms of market capitalization with a valuation of around $6.5 billion.

While AXS has lost 25% over the past week, AXS is up 20.824% year-to-date (YTD). The second largest P2E token is the Sandbox (SAND) with a market valuation of $ 4.6 billion. SAND lost 32% last week but gained 11.597% YTD.

The third-largest market valuation in terms of P2E assets is decentraland (MANA) with a market cap of around $4.4 billion. MANA has lost 32% this week as well but has gained 3,693% YTD in USD value. Other top P2E tokens in terms of market cap size include gala (GALA), wax (WAXP), illuvium (ILV), and mobox (MBOX).

Staking land in the Metaverse can be costly – Sandbox captures $ 70 million in weekly sales

In addition to the Metaverse and P2E tokens which have accumulated tremendous value over the past year, in recent times land in the Metaverse has been a highly prized commodity. Nonfungible.com’s metrics indicate that the NFT market history over the past seven days shows The Sandbox to be the main competitor. Sales from the metaverse The Sandbox have seen more than $ 70 million in sales over the past seven days.

That’s about $10 million more than the sales produced by the Bored Ape Yacht Club (BAYC) NFT collection which saw $59 million. Moreover, The Sandbox sales are much larger than the Cryptopunks NFT collection sales which captured $17 million last week. The virtual reality platform powered by the Ethereum blockchain, Decentraland has seen the sixth largest number of weekly sales with $6.6 million last week.

The biggest sales on Decentraland were land and estates valued between $ 289,000 and $ 758,000. While The Sandbox topped Decentraland’s sales, the plots of land sold for much lower values as the lands traded hands last week for $ 44,000 to $ 68,000 per plot. However, a virtual land adjacent to Snoop Dogg’s Sandbox domain was recently sold for $ 450,000 in Ethereum. The average USD price of The Sandbox metaverse products over the past week was $ 15,000 out of over 4,400 sales.