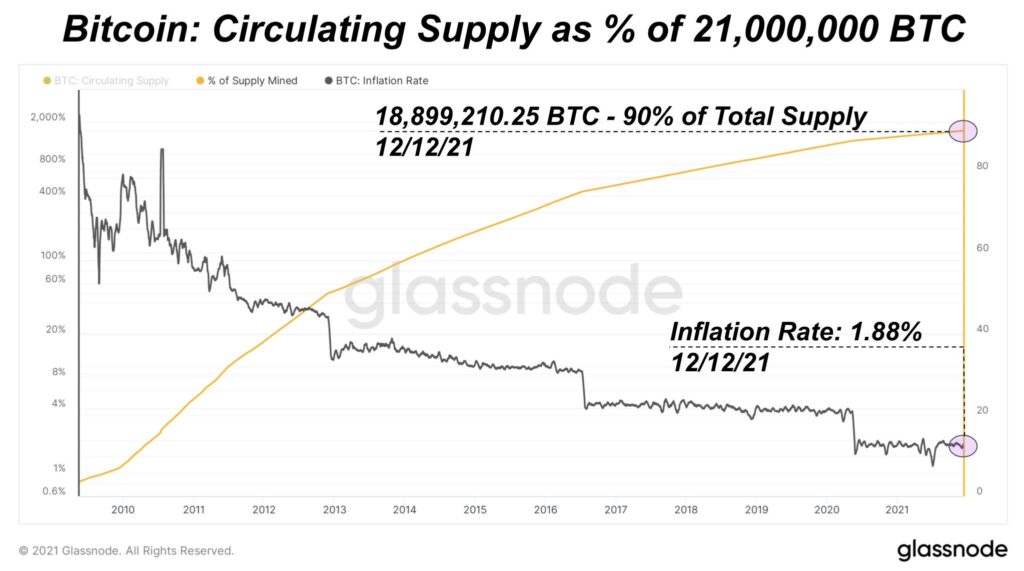

On December 12, crypto advocates celebrated the fact that 90% of the 21 million bitcoins that will ever exist have been mined into circulation. Currently, Bitcoin’s inflation rate per annum is around 1.88%, which is lower than the central banks’ traditional 2% target reference. Furthermore, in 875 days, the network’s inflation rate is expected to drop to 1.1% after 19.98 million bitcoins have been mined.

Programmatic scarcity

One of the advantages that people appreciate about the Bitcoin network is that it is mathematical and predictable, compared to monetary systems issued by central banks around the world, which are based on the whims of policymakers and are completely unpredictable. At the time of writing this article, 18,899,800 BTC have been put into circulation, which equates to roughly 90% of the 21 million BTC that will ever exist. Fans of digital currency recognized this milestone on Sunday, December 12, the same day as the 11th anniversary of Satoshi Nakamoto’s official departure.

The 90% statistic can be seen on data sites like coinmarketcap.com, and Glassnode’s percentage of the bitcoin supply currently mined. The 90% of bitcoins mined into existence discussion on Reddit also led to people asking how many bitcoins are lost and stuck in unrecoverable wallets. While Bitcoin.com News recently shared a Coin Metrics 2019 report on the state of lost bitcoins, which said at least 1.5 million BTC was assumed to be lost, some Redditors estimate the number to be a whole lot more.

“Estimates of 3 to 5 million [bitcoin] are over there, ”a Redditor explained on Sunday. “You can see onchain metrics showing how many bitcoins haven’t moved [in the] last decade, but it would be as high as possible and there are some who just haven’t budged even though they have the keys. I believe it is around 3 [million], but we will most likely never know and it will continue to rise slightly. We also have a lag factor in the data, as people within 10 years may have lost as well. It’s just assumed [for the] the first two years [the] the biggest losses have occurred, so we enter that data.

Bitcoin Inflation Rate per Annum Estimated to Be Around 0.4% in 2030

While we don’t have a hard number of how many bitcoins are officially unrecoverable or lost, it’s far different than the predictability of BTC issuance. Satoshi believed and many crypto advocates believe that lost coins simply add to the crypto asset’s scarcity. “Lost coins only make everyone else’s coins worth slightly more,” Bitcoin’s inventor said. “Think of it as a donation to everyone.” With 90% of the coins in existence circulating, and the current rate of 900 BTC per day, and 210,000 blocks every halving, the next reward halving is expected to happen on May 6, 2024.

Right now the block reward is 6.25 bitcoins per block and the rewards will decrease to 3.125 bitcoins per block after halving. With Bitcoin’s current inflation rate fluctuating between 1.75% and 1.88%, we can estimate that after halving, Bitcoin’s inflation rate will be around 1.1%. The Bitcoin protocol is continuously halved every 210,000 blocks until it hits 0, which is estimated around the year 2140. By then (the year 2140), it is expected to that miners continue to secure the network and process transactions on the basis of network transfer fees.

There’s a total of two more significantly sized bitcoin block reward halvings expected up until around 2030, and the halvings that follow after that year will be fractions of BTC. By 2028, Bitcoin’s inflation rate per annum is expected to be around 0.5% and by 2030 it will be around 0.4% with 20,585,442 million bitcoins in circulation. By 2030 estimates indicate that 98.02% of the 21 million bitcoins that will ever exist will be mined.

With Bitcoin’s hashrate reaching all-time highs, the exact time frames for which these changes will occur are pretty good approximations, but are not set in stone. Currently, network participants (minors) who dedicate the hashrate to the BTC network have sped up the time between halves, and the daily issue rate has been faster than previously assumed estimates.