While the larger market appeared to be heading for a recovery with Bitcoin above the $ 48.5,000 mark, some altcoins and their double-digit gains over the past week have still kept traders on their guard. One of those altcoins that saw a massive increase in prices and social attention was the ANT token from Aragon.

Aragon, an Ethereum network-based protocol that supports DAOs, developing governance structures to encourage community engagement saw over 75% rise in volumes and over 15% rise in market cap over the last 24-hours. As ANT’s price spiked by over 88% in a week the market seemed to eye ANT for further gains but before that, it was crucial to see what triggered the rally and whether the gains would sustain.

What led to the push?

The ANT token has risen by around 75% in the past four days after its price rebounded on December 12. The surge in prices also resulted in high trading volumes for the asset in the spot market as the coin has seen very active trading for four consecutive days. . Trade volumes were multiplied by 6 compared to the volumes at the beginning of December.

The price gains came alongside the DAO global hackathon which aims to attract developers to the Aragon ecosystem. In fact, there were rumors that the DAOpunks NFT project could conduct an airdrop to ANT holders further aiding the coin’s rally.

And then ?

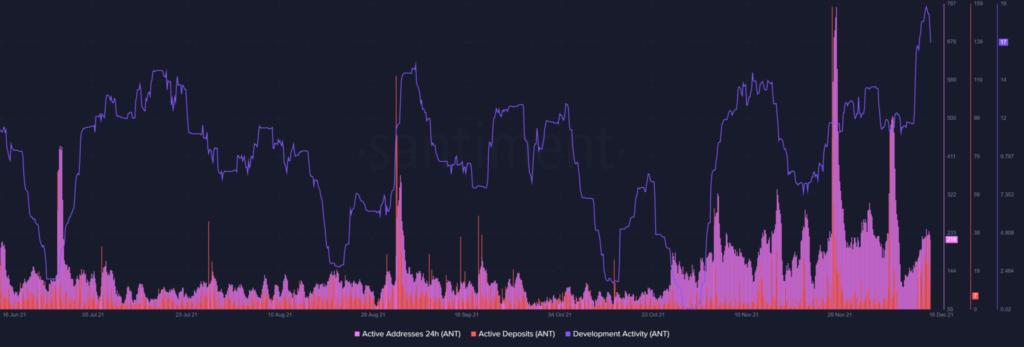

While on the price front things seemed to shine, a look at Aragon’s chain activity presented a puzzling scenario. Active addresses for ANT did not see a major increase, although they increased from the lows seen on December 11, being more than 70% lower than the ATH seen at the end of November. Active fields also saw an increase and development activity showed healthy growth.

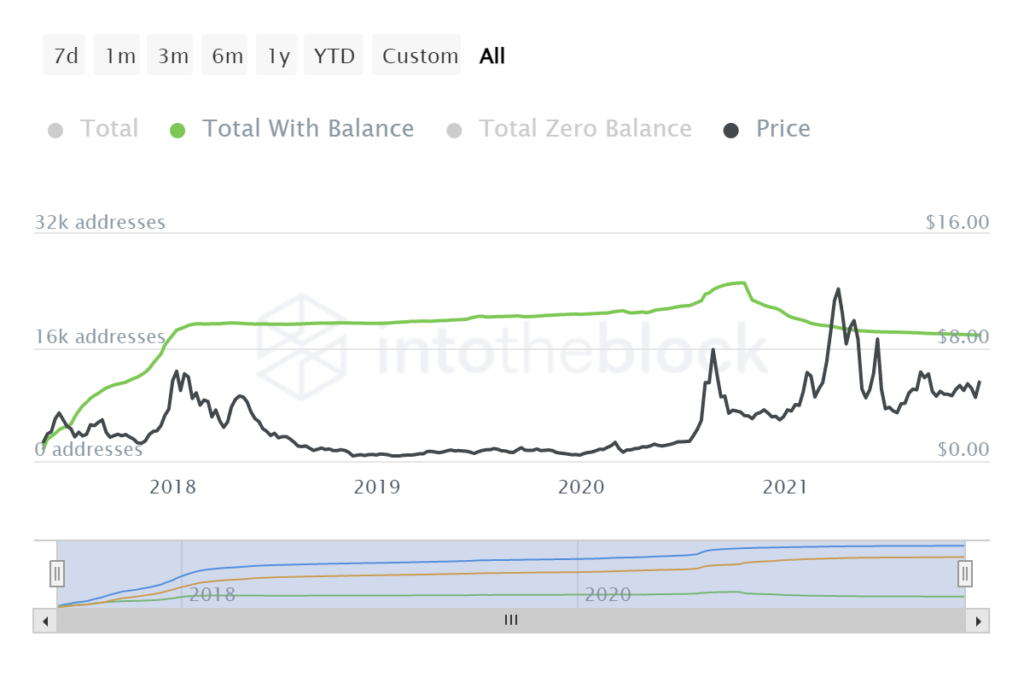

Further, the constant number of total addresses with balance was indicative of a lack of participation on the network. In fact, the 7-day change in new addresses as per data from Into The Block was -60.00%, and active addresses saw an 18.75% decline over the same period.

Institutional interest in the asset also did not look very good and the low number of large transactions in the network and large transaction volumes were indicative of the absence of large players on the scene.

Additionally, whales and HODLers dominated ANT’s ownership statistics, and a lack of investors and retail crowd could be behind the alt’s volatile price action of late.

That being said, the price structure has been quite volatile and the coin has seen some major ups and downs over the past month. Plus, despite recent gains of over 70%, the alt was still almost 50% down from its all-time high price tag. Overall, ANT has remained a high risk, largely speculative asset with a still budding ecosystem.

While increasing adoption for the Aragon application could help drive its token price significantly higher in the long term, in the short term it would be better to do your own research before making a move.