All markets are going through a rough patch during Monday’s trading session and Bitcoin is no exception. Cryptocurrency has fallen just under 2% in the past 24 hours, while altcoins are mostly red.

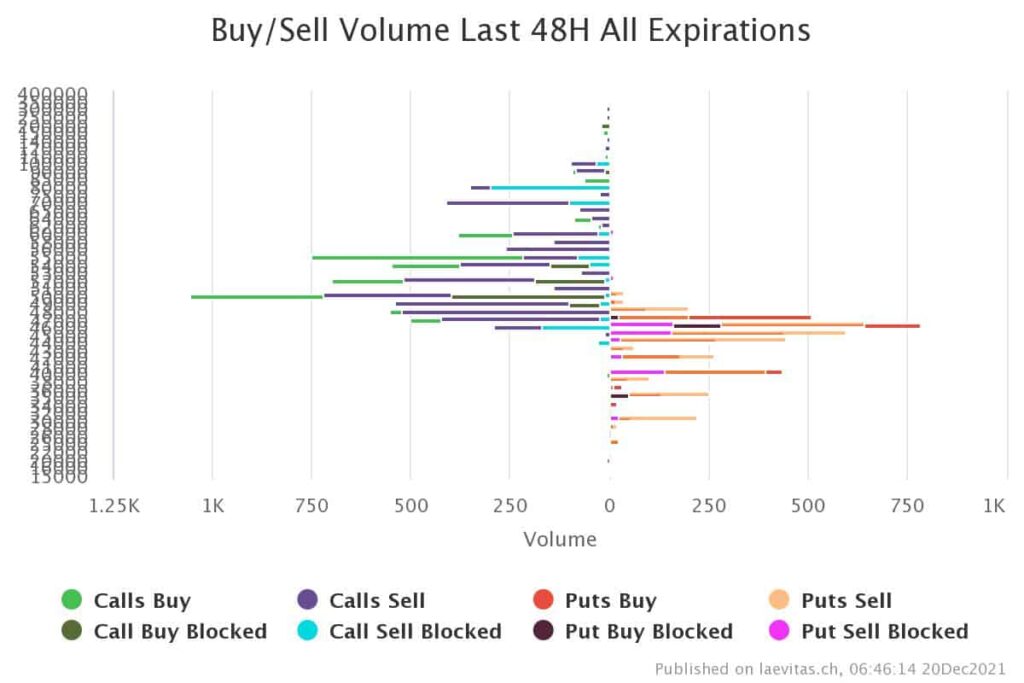

Option Market Analysis

The rising cases of the highly transmissible Omicron caused fear in all markets. Investors are worried about lockdowns which may have negative effects on the economy. In the options market, Short-dated implied volatility also increased accordingly to fear.

Bitcoin has fallen below $ 46,000. Traders hedged their portfolios by selling calls and buying puts. During the previous two days, options traders bought call options for $ 50,000, $ 55,000 and $ 60,000 exercise for the following year’s expiration. It seems they are still optimistic for the months to come.

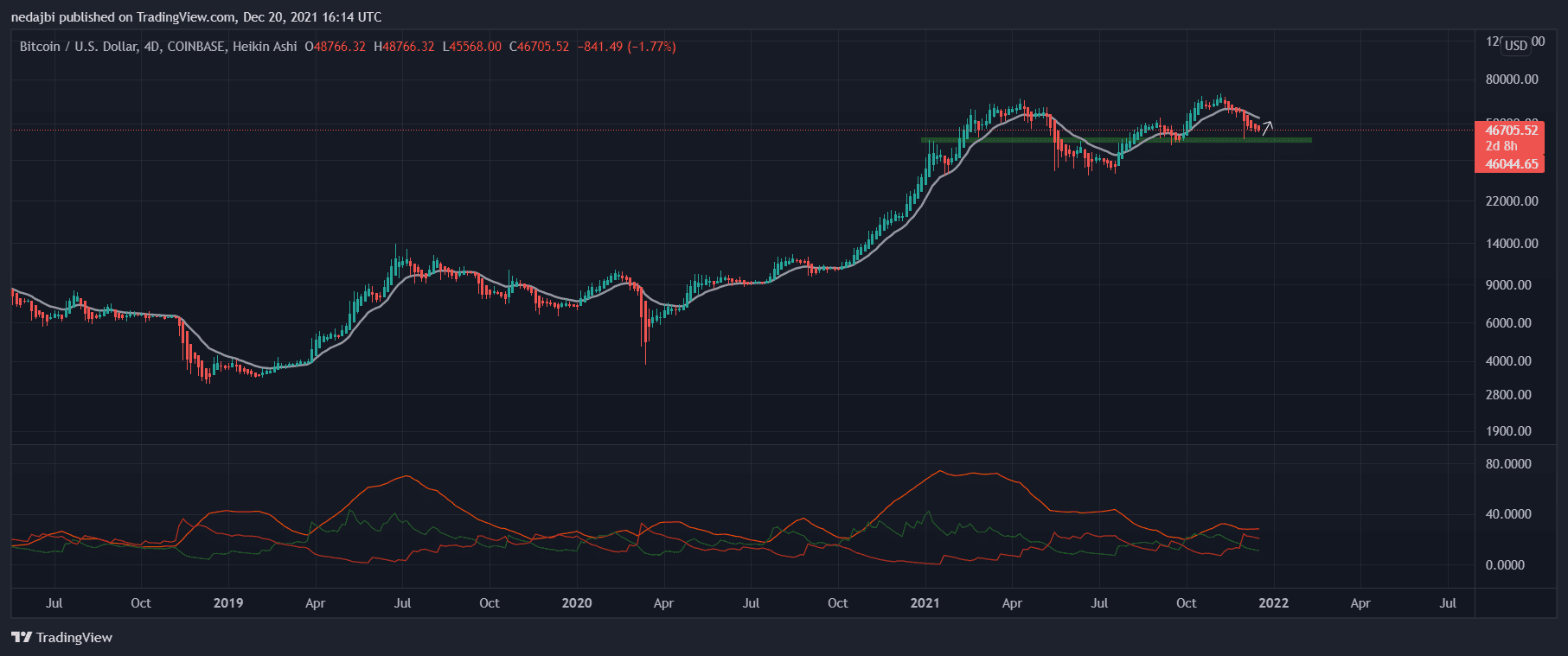

Technical Analysis (short-term)

After testing the lower Bollinger band on an 18-hour time frame, it seems the price might react to this formed support level. A Bollinger band squeeze can be seen in lower time frames. Therefore, a bullish divergence is forming on the 18-hour chart but is not confirmed yet. It will be confirmed by closing a candle above $49k.

Technical analysis (short term)

After testing the lower Bollinger Band over an 18 hour period, it looks like price may be reacting to this formed support level. Bollinger band compression can be seen in shorter time frames. As a result, a bullish divergence is forming on the 6pm chart but is not yet confirmed. This will be confirmed by closing a candle above $ 49,000.

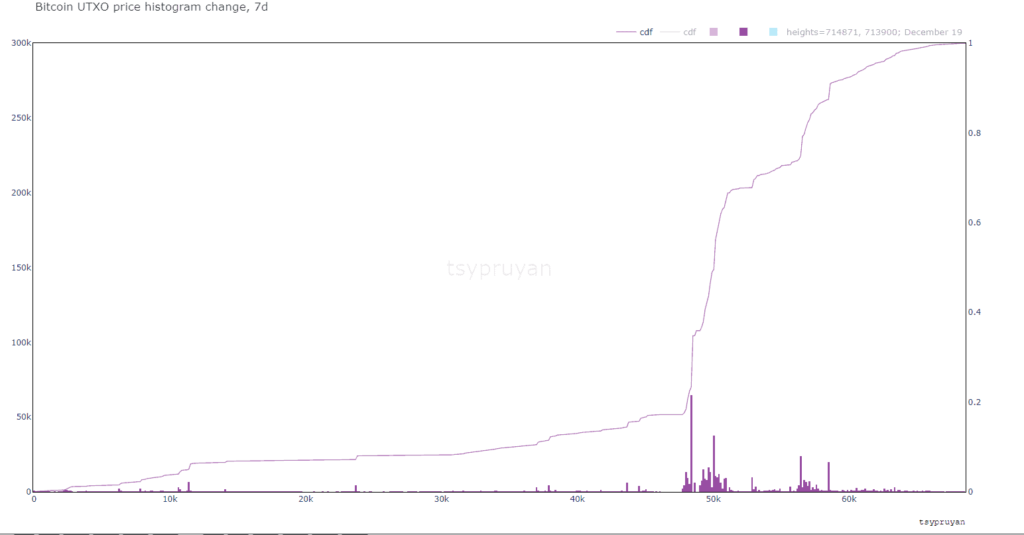

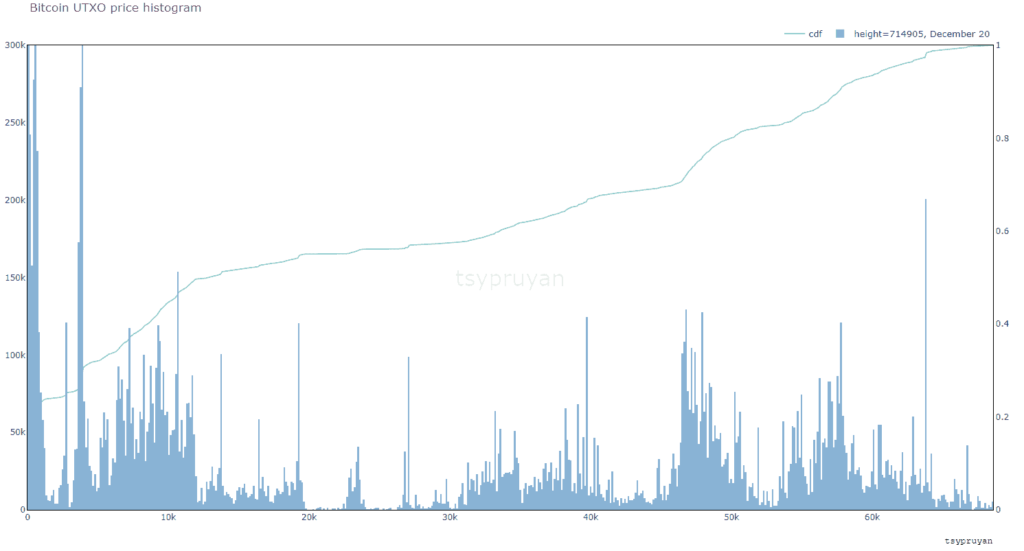

Onchain Analysis

Interestingly, the main sell-pressure (~83%) in the last 7D were the coins last moved (bought) at >$45K Purple square aka “Top Buyers.”

These first buyers have almost 31% of the offer in their possession (blue square). This means that we have not seen significant selling pressure from the former coin holders.