In the midst of yet another red weekend, Bitcoin faces its most critical medium-term support area. So far, despite the first day of 2022, the New Year has recorded seven consecutive daily red candles (keeping in mind that there are a few hours left until today’s candle closes).

Option Market Analysis

The sharp spike in omicron cases, US Federal Reserve’s announcement about raising interest rates due to a surge in the inflation rate, along with the events in Kazakhstan – are probably the fundamental reasons behind the recent selling pressure in the crypto markets.

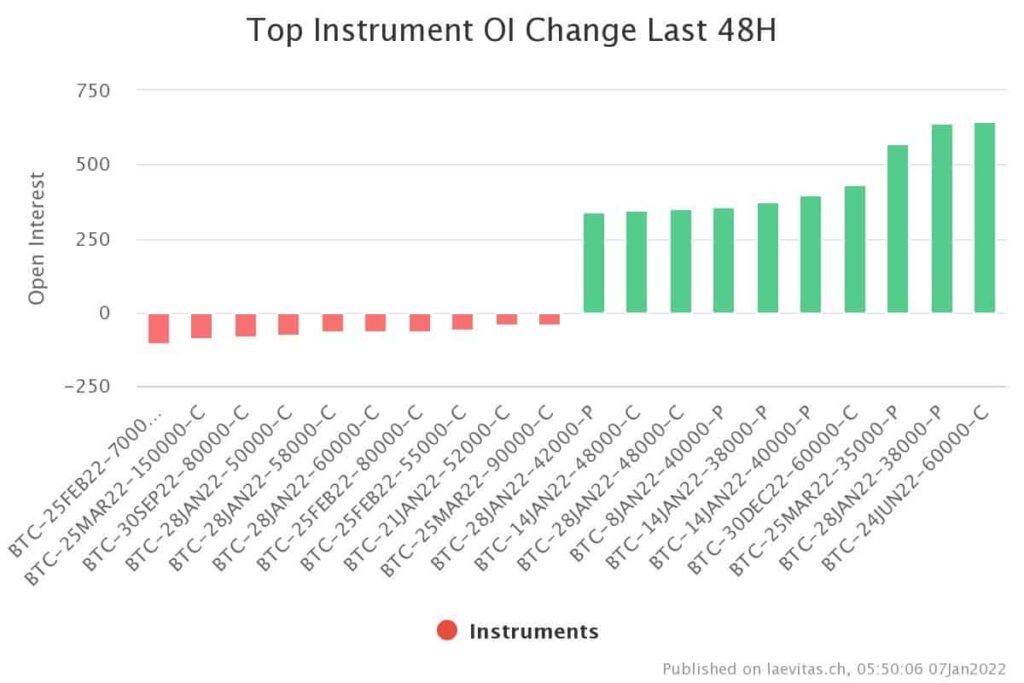

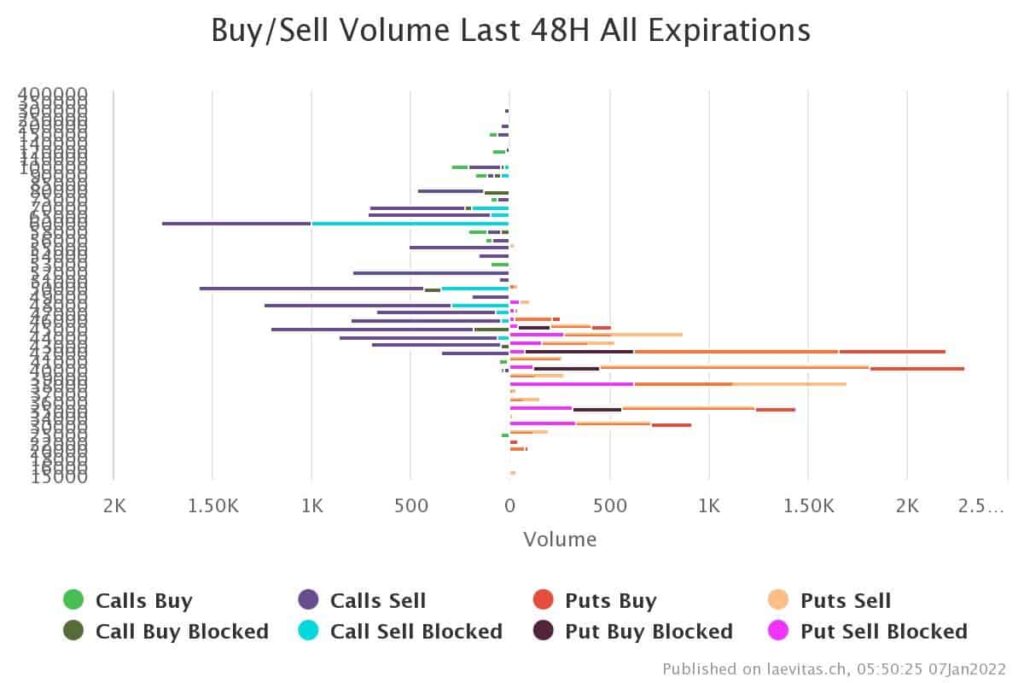

Fear is also pervasive in the options market. Options traders have hedged their portfolios by selling Calls and buying Puts over the past few days. The open interest changes over the last 48 hours of Top Instruments indicate the hedging strategies for short-term maturities.

Technical analysis

Looking at the macro indices, we see that the US10Y index has reached its highest level in a year. Bitcoin has experienced a major price correction whenever this index has reached high levels (marked by a red horizontal line at the bottom of the following chart).

Also, the DXY index has not shown any bearish signs so far, which historically correlates negatively with Bitcoin.

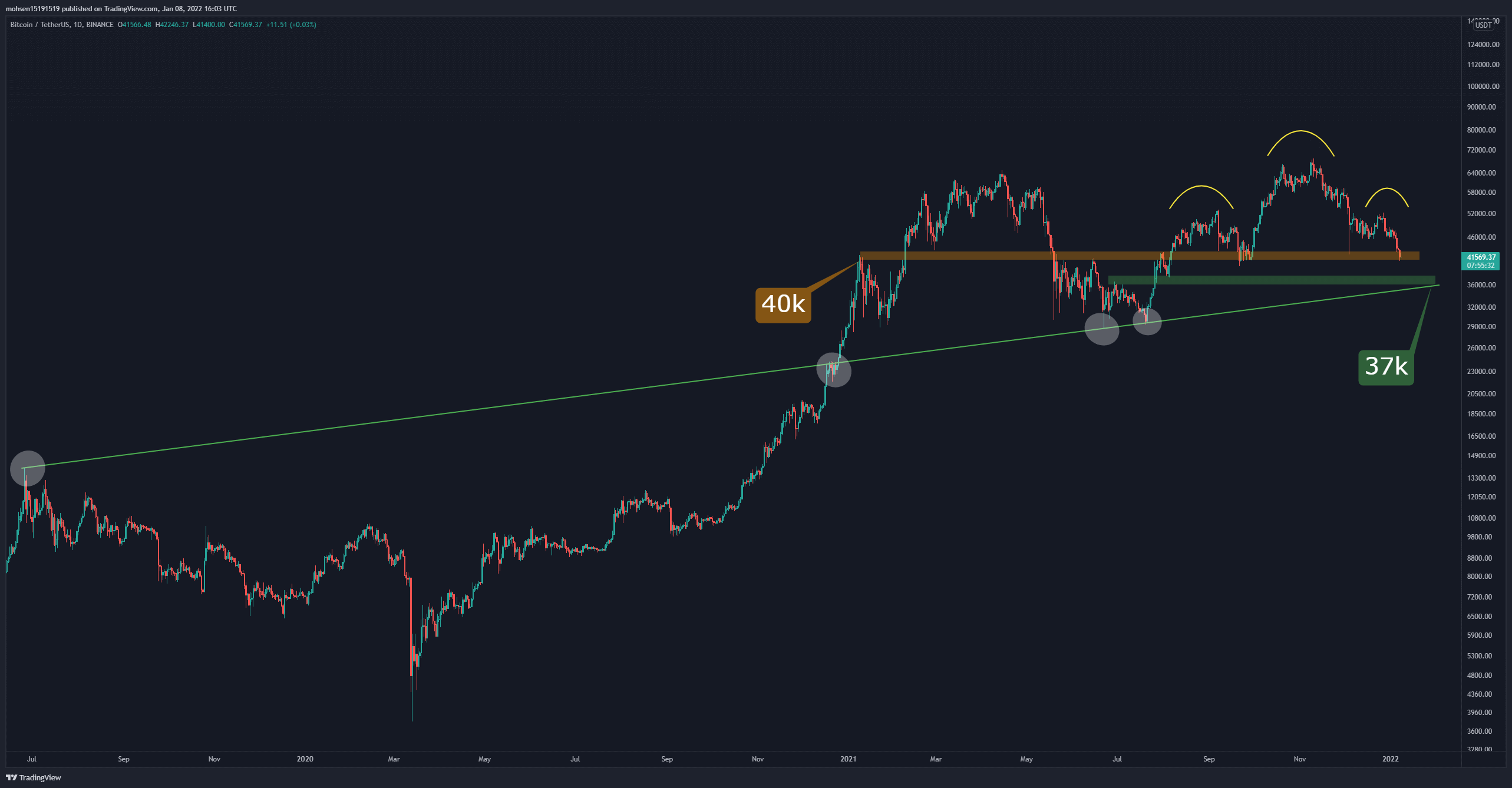

BTC faces the key price area of $ 40-42K on the daily chart, which has played a role of resistance and support over the past year.

Breaking down this level will likely lead to the intersection of static and dynamic support at $37K. The Head & Shoulders pattern, a bearish pattern on an uptrend, has convinced many analysts that bitcoin will retest lower levels.

Analysis of futures and spot markers

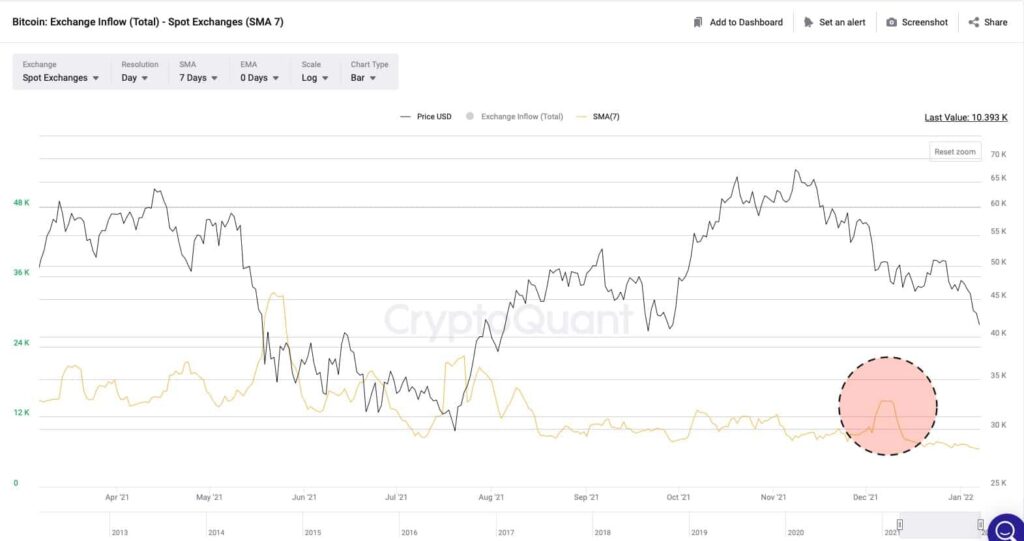

Over the past week, the 7-day moving average of the average value of inflows (average size of inbound transactions) to spot exchanges showed selling pressure in the spot market as price action increased. was trying to break through the resistance of $ 53,000.

Then, the market plunged towards $41K in the following days. Now, the spot market inflows have cooled down.

The worrying sign could be the high open interest in the futures market, mostly attributed to Binance. Even though the market has seen significant volatility over the past two weeks, open interest in Binance has yet to drop significantly.

Therefore, many analysts are fearful about an immediate shadow to lower levels that will flush the long positions. However, it’s hard to determine if the long positions are the majority, based on the funding rate and some other metrics.

One possible explanation could be that the big players are selling the market short to hedge against any potential bear market. Therefore, a rational strategy for traders might be to reduce their risk by staying away from highly leveraged positions until the futures market begins to experience open interest growth, as we do. saw it between May and July 2021.