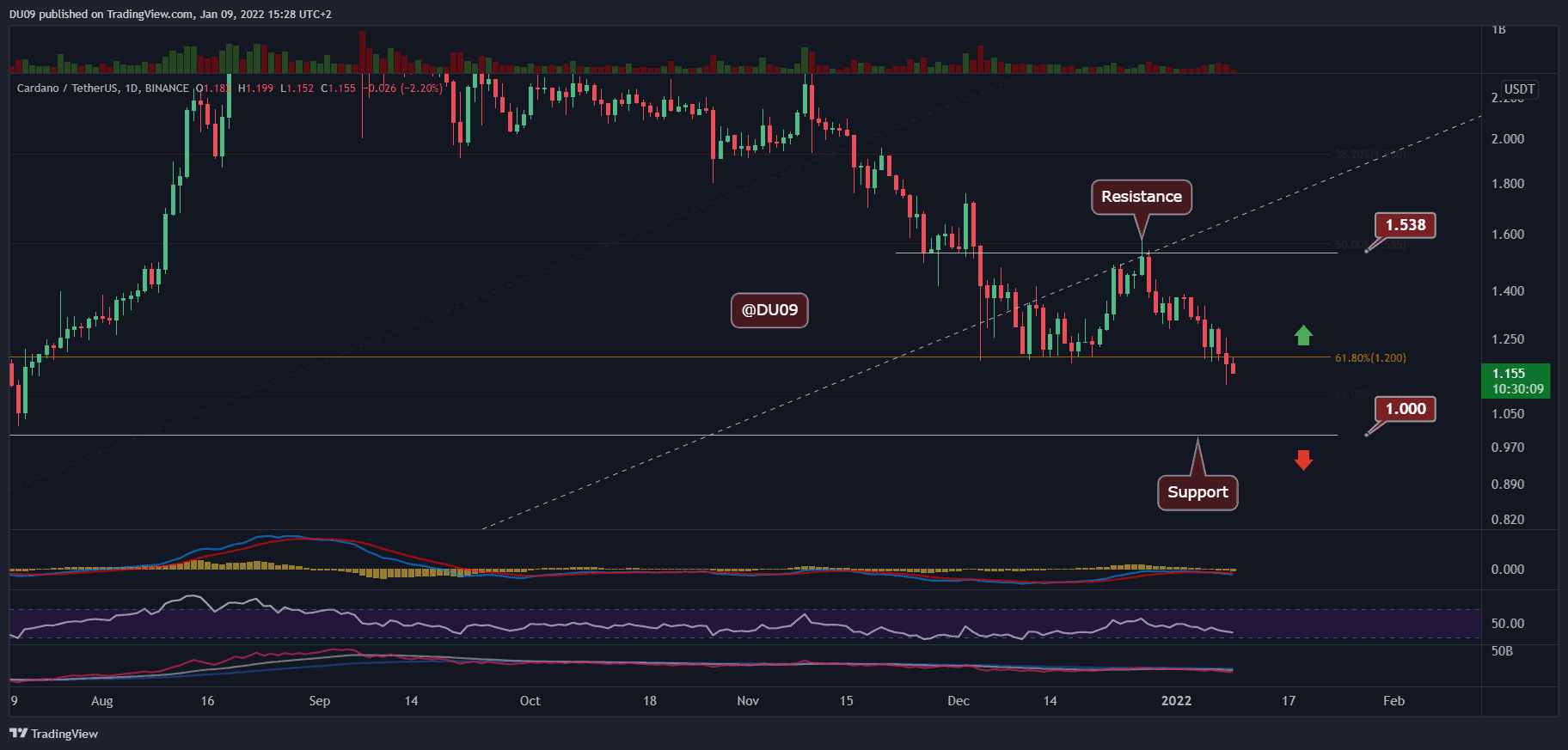

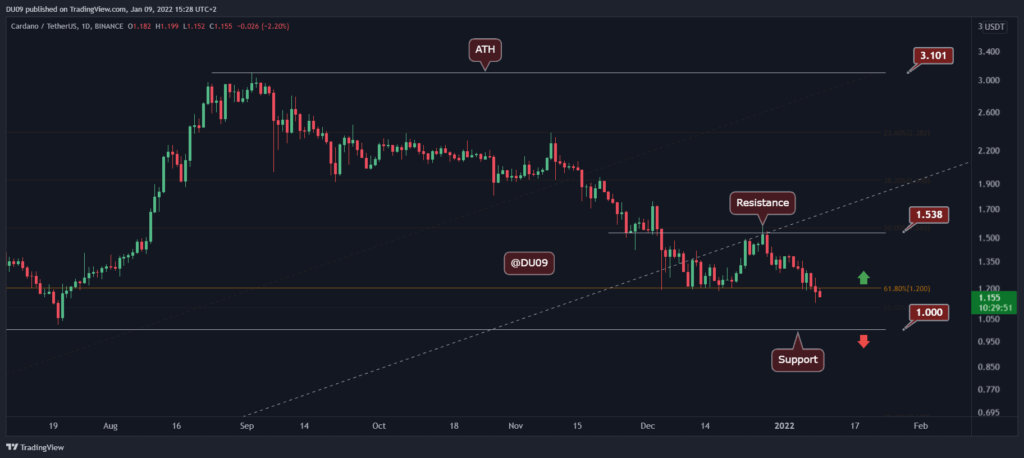

The first week of 2022 is poised to become one of crypto’s most bearish weeks in the past year. Much like general sentiment, ADA couldn’t resist the downtrend and is slowly descending towards the $ 1 mark.

Key support levels: $ 1, $ 0.8

Key resistance level: $ 1.2, $ 1.5

The support at $1.2 could not hold off the selling pressure as the price closed below this critical level on the daily timeframe yesterday. The latter becomes the first major level of resistance. On the other hand, the nearest support now lies at $1, and ADA appears on a clear path to test this critical area.

Technical indicators

Trade volume: The volume level was not significant when the price fell below $ 1.2, possibly because it happened over the weekend. This shows a certain lack of conviction on the sellers side and will need to be reassessed on Monday.

RSI: The daily RSI continues to slip after going through a lower high. The short-term trend is clearly bearish, however, the RSI has not reached the oversold area, sitting at 37 points at the time of this writing.

MACD: MACD is also bearish after the histogram and moving averages turned negative last Wednesday once the crypto market sell-off began. Since then, the bearish momentum has only intensified and there is no sign of a reversal yet. For this reason, ADA is likely to test the $ 1 level.

Bias

The current bias is bearish.

Short-term prediction for the ADA price

The support at $ 1.2 failed to end the negative momentum, which has only increased over the past few days. As mentioned above, ADA needs to hold the $ 1 mark because it is a key psychological support that buyers need to champion. If nothing major happens, we can expect the ADA to retest this critical level in the coming days.