Despite the relatively long consolidation phase of the past few weeks, options traders, alongside on-chain metrics, are showing uncertainty. Large-scale fear is affecting both cryptocurrency and the stock market.

Options Market Analysis

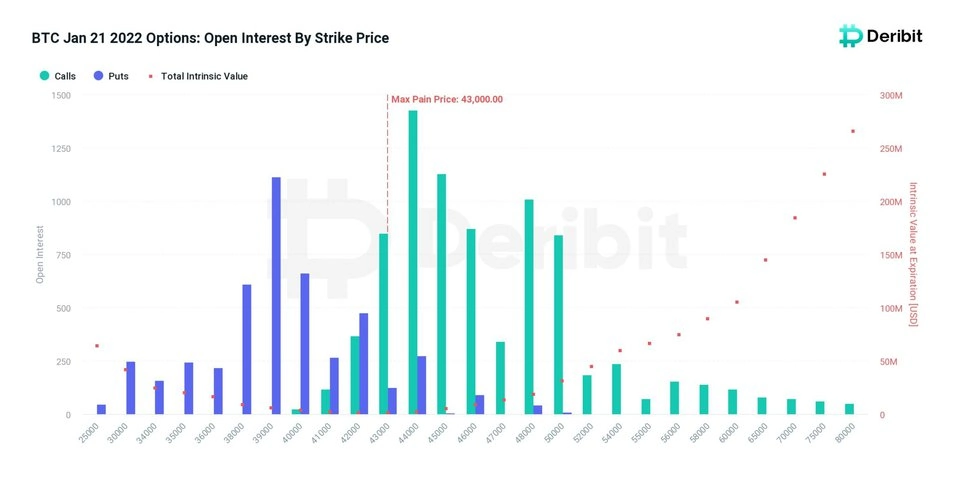

This Friday, January 21st, approximately $538 million worth of Bitcoin options contracts will expire on Deribit. The max pain scenario is for the price to be at $43K for this expiry. Calls for the $44K strike price have the highest open interest. Puts for the $39k strike price have the highest open interest among put options.

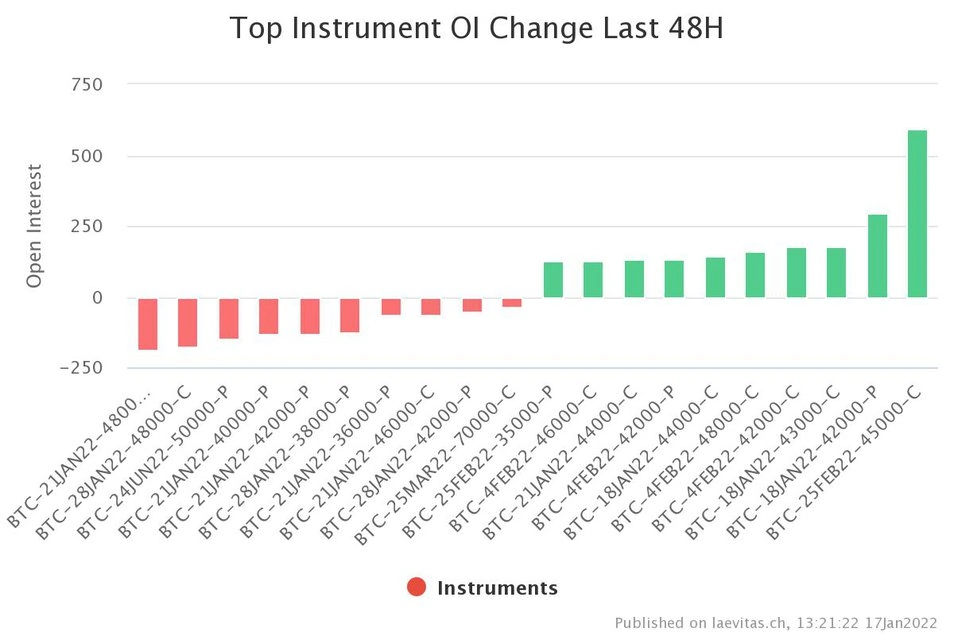

Open interest in 21Jan_44k_C has increased since January 11, and most of them are call buyers. The change in Top Instrument OI shows that perhaps call option traders with strike price orders of $48,000 were no longer optimistic about a price increase above that price. fiscal year ($48,000) for that expiration.

Technical Analysis

Due to the fear at the macro level, the cryptocurrency market is showing a great deal of uncertainty. While the BTC price remained above $40K, consolidation continues at the $40K-$43K range. Many of the participants believe that we are entering a bear market.

Meanwhile, others think the bull run is not over yet. We can use technical indicators to see past trends and then anticipate the most possible scenarios. One of these indicators is the Ichimoku cloud. Tenkan-sen (conversion line) crossed Kijun-sen (base line) in November on the daily time frame, indicating that the price is falling. According to the DMI indicator, by moving –DI above +DI, a bearish trend has been confirmed.

Then, the $40K-$42K zone acted as solid support for the past few weeks. For bitcoin to hit the higher prices, Tenkan-sen must come back above the Kijun-sen and +DI>-DI. Otherwise, the $40K-$42K level will be tested again.

Short-Term Analysis

Bitcoin was moving within a descending channel since December on the 8-hour time frame. It broke out the channel on 12 January for the second time. The chart shows that in this time frame, the pullback was completed where the green level acted as good support. Simultaneously, the RSI was supported by the lower band of the Bollinger band. For now, bitcoin is trying to test the red level resistance, which is $44K. Possible resistances are shown in the chart.

On-chain analysis

One of the well-known on-chain metrics that can map “fear” is net unrealized profit/loss, which shows the total amount of profit/loss as a ratio.

The value of this metric is interpreted through the ratio of investors who are in profit. An increasing trend in value means more investors are beginning to be in profit, and a down strand means the number of underwater participants is growing. At the moment, NUPL is approaching the same level (0.35) that the market was in July 2020. This is a perfect explanation for the obvious uncertainty among analysts.