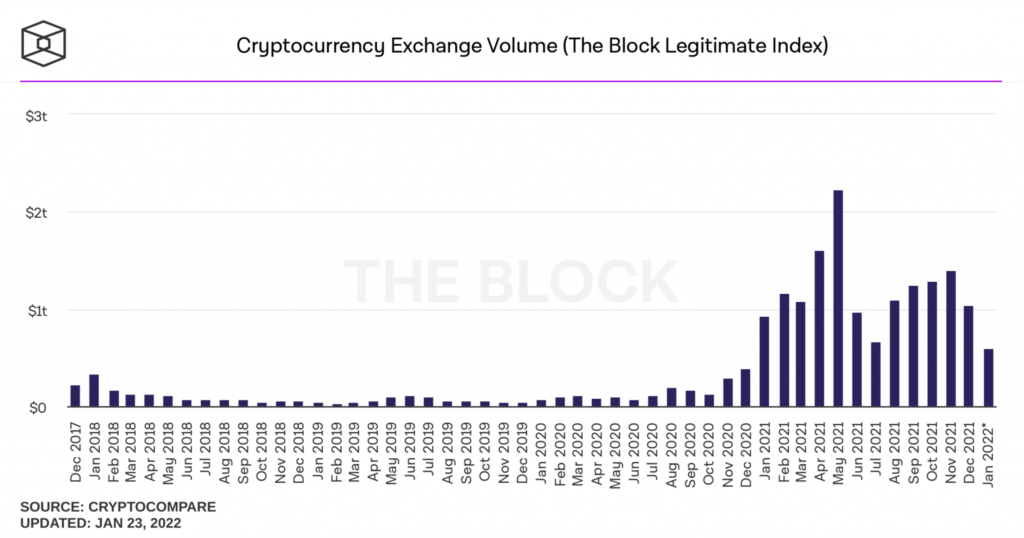

Digital currency markets have slipped significantly in value during the last two weeks and the lower prices have not sparked higher trade volumes. Data shows cryptocurrency spot market volume has slipped from $1.4 trillion in November 2021, to this month’s $593 billion in volume. Bitcoin futures open interest and volumes have dropped considerably over the last two months as well.

Crypto volumes have been slipping month-on-month since November

When crypto markets lose significant value, traders typically look to see if trading volume is increasing in order to support current prices. Since a number of coins hit all-time highs in the second week of November, the crypto spot market volume has continued to decline.

Data from theblockcrypto.com’s exchange volume dashboard, which sources data from cryptocompare.com metrics, indicates spot market volume has fallen month-over-month since November.

While November saw $1.4 trillion, December saw a record high of $1.04 trillion. Although data is incomplete for the month of January 2022, so far $593 billion in volume has been settled.

Even though November’s spot market volume was larger than December’s and the three weeks of January, the $2.23 trillion in volume recorded in May 2021 was double the size. Daily exchange volume has followed the same pattern as daily crypto trade volumes are lower than they were two months ago.

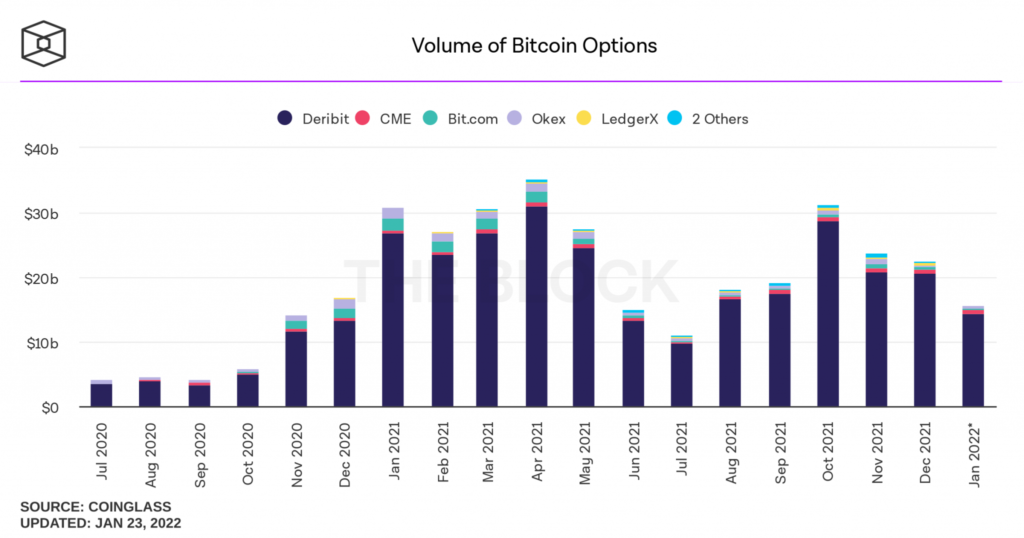

On November 2, 2021, $53.27 billion was settled that day, while data for January 22, 2022 shows $24.65 billion. As monthly and daily cryptoasset spot market volumes have fallen, so have derivatives markets like futures and options.

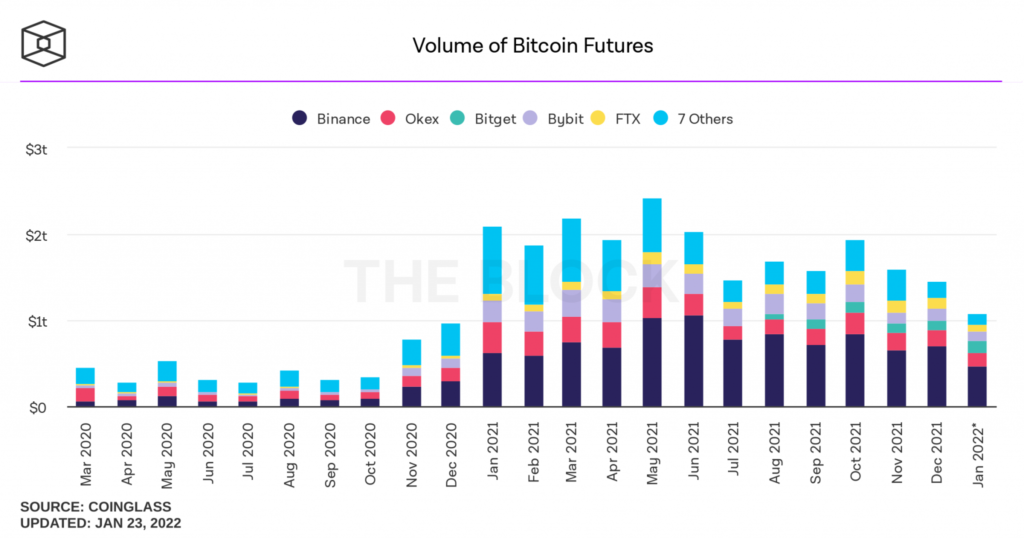

When BTC tapped an all-time price high on November 10, 2021, the following day $28 billion in bitcoin futures open interest was recorded. January 22 metrics indicate $14.64 billion in open interest was recorded across a slew of bitcoin futures exchanges.

As for bitcoin futures volumes, they were higher in October than they were in November. $1.94 trillion was recorded last October and this month there has only been $1.08 trillion recorded so far. Aggregate open interest and volumes related to bitcoin options also fell month-over-month over the past two months.

For the most part, the low volumes across crypto spot markets and derivatives have affected the crypto economy negatively. Up volume typically indicates bullish trading, but that hasn’t been the case in recent times.