Nobel Prize-winning economist Paul Krugman sees parallels between the crypto market and the subprime mortgage crash. “There’s growing evidence that the risks of crypto are falling disproportionately on people who don’t know what they are getting into and are poorly positioned to handle the downside,” he stressed.

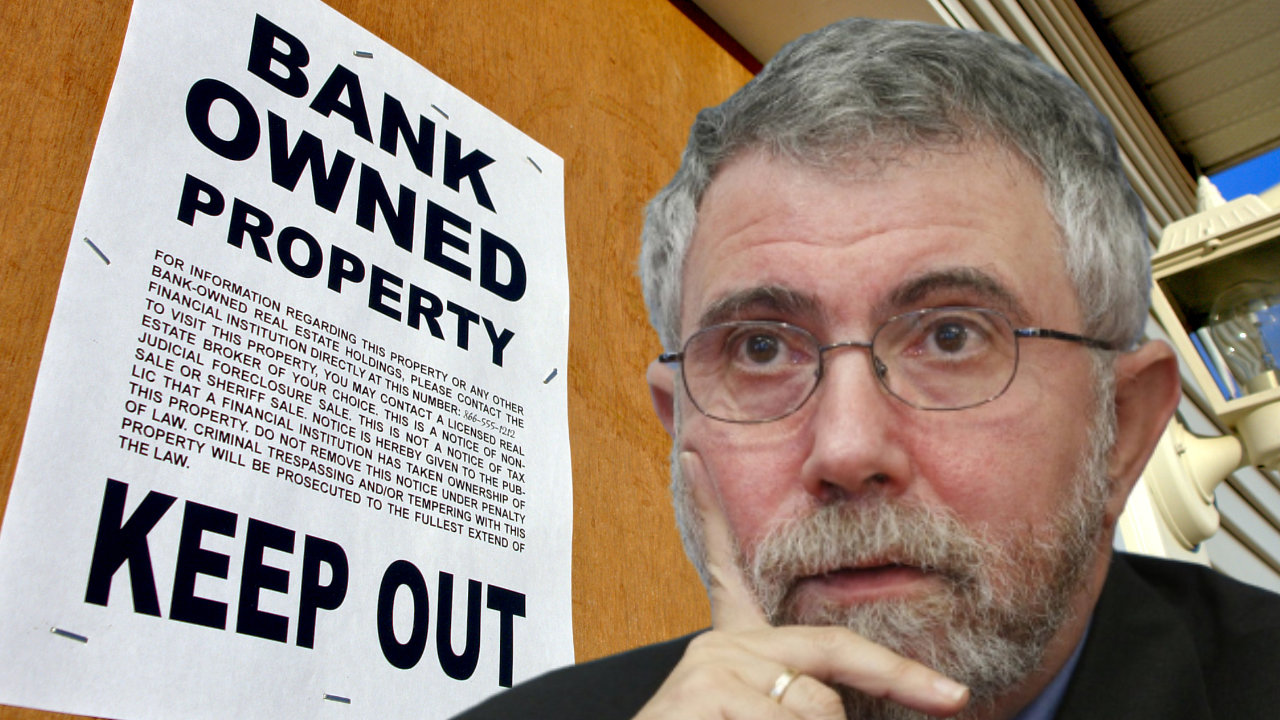

Nobel laureate Paul Krugman warns of crypto crash like subprime mortgages

Nobel laureate Paul Krugman warned against investing in cryptocurrency in an op-ed he wrote in The New York Times, published Thursday. Krugman won the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2008 “for his analysis of business patterns and the location of economic activity,” the Nobel Prize website says.

The Nobel Prize winner began by acknowledging that “crypto has become a pretty big asset class,” noting that the market value of all cryptocurrencies reached almost $3 trillion last fall. He added that the prices of cryptocurrencies have crashed, “wiping out around $1.3 trillion in market capitalization.”

However, Krugman believes that “crypto doesn’t threaten the financial system,” citing that “the numbers aren’t big enough to do that.”

Nonetheless, the economist warned that “There are disturbing echoes of the subprime crash 15 years ago,” elaborating:

I see uncomfortable parallels with the subprime mortgage crisis of the 2000s… There is growing evidence that crypto risks fall disproportionately on people who don’t know what they’re getting into and are misplaced to manage declines.

Krugman explained that “Investors in crypto seem to be different from investors in other risky assets, like stocks, who consist disproportionately of affluent, college-educated whites.” He cited a survey by the research organization NORC, stating that 44% of crypto investors are nonwhite and 55% don’t have a college degree.

While NORC asserts that “cryptocurrencies are opening up investment opportunities for more diverse investors,” Krugman pointed out that “sub-prime mortgages were also celebrated…they were hailed as a way to open up benefits. of home ownership to previously excluded groups.

Krugman continued: “cryptocurrencies, with their huge price fluctuations seemingly unrelated to fundamentals, are about as risky as an asset class can get.”

Noting that skeptics say cryptocurrencies are only good for “money laundering and tax evasion,” with some warnings that bitcoin is a bubble, he said “it’s OK for investors to bet against the skeptics”.

However, the Nobel laureate cautioned: “But these investors should be people who are both well equipped to make that judgment and financially secure enough to bear the losses if it turns out that the skeptics are right.” He concluded:

Unfortunately, this is not happening. And if you ask me, regulators made the same mistake they made on subprime: they failed to protect the public from financial products no one understood, and many vulnerable families could end up pay the price.