Generalization isn’t always the best outcome for assets, and cryptocurrencies have proven that. While an increase in adoption has certainly brought legitimacy and capital to the market, it has also made it sensitive to macroeconomic changes.

Crypto is stocking up

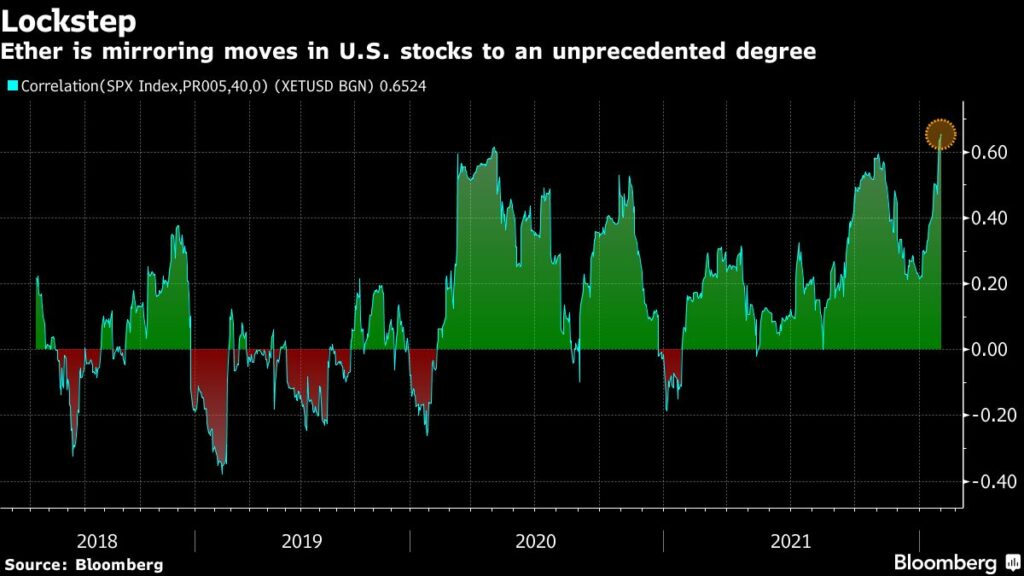

This has been highlighted in the rising correlation between cryptocurrency and U.S Stock market prices, which has been a worrying trend for analysts for quite a few years. This was accelerated last month when the U.S Federal Reserve’s hawkish stance and inflation reporting sent both markets tumbling down.

Now that both asset classes are entering a period of stability, these fears have been invoked again, especially as several announcements are expected to be made by the Fed in the coming week.

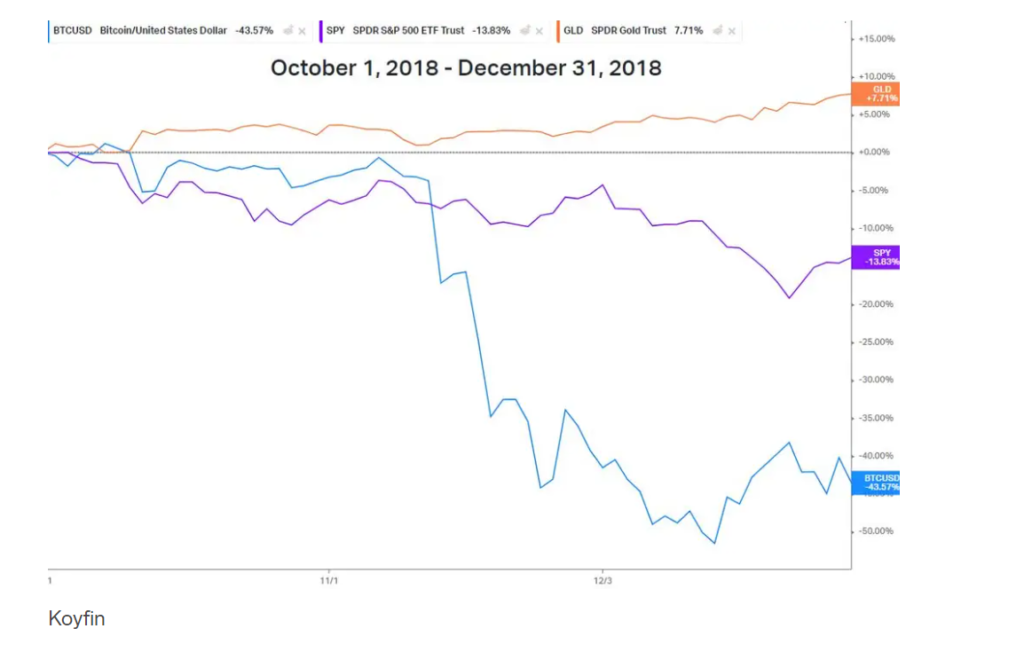

Historical data has shown that a positive correlation between stocks and crypto was first noted in 2018 when similar tapering by the Fed had crashed both markets. While stocks fell nearly 20% in the fourth quarter of 2018, Bitcoin fell as much as 50%.

But regarding the trend that may have preceded, its unprecedented acceleration since August 2021 has made many dizzy. Over the past month, Bitcoin has fallen 12% against the dollar, while the S&P has fallen 10%, indicating that the gap between the two is narrowing with each crash.

Martin Green, CEO of Cambrian Asset Management noted the same in a recent Forbes interview, highlighting that while the Bitcoin-Nasdaq correlation was 0.2 over the last three years, “in the last several weeks, it has doubled to around point four.” He added,

“There is a higher correlation today than six months ago…I would say that recently along both axes – up and down – Bitcoin and tech stocks are in tandem due to interest rates and inflation issues that have affected stocks and crypto.”

Safe haven no more

Crypto and tech stocks moving in tandem could cause many hurdles to global finance, as pointed out by the International Monetary Fund (IMF) recently. Among these include the risk of contagion that could cause investor sentiment to spillover between markets.

A spillover can also be noted between crypto assets, as a similar correlation between the second-largest cryptocurrency Ether and the S&P 500 hit record highs.

This has eaten into BTC’s narrative of being a safe haven asset akin to, or better than, Gold. This was behind much of its earlier popularity, argued ChangeNOW spokesperson Mike Ermolaev in the same interview.

He said that if macroeconomic trends were a contributing factor to BTC’s economic evolution, its widespread adoption by institutional investors could also have played its part. As outflows of BTC investment products have hit an all-time high of late, the largest investment cohort has been growing bullish on the nascent asset.

Even as this has brought legitimacy to the industry, it could also lead to money managers’ treating the asset similar to traditional tech stocks, thus adding to the correlation.

“There has been a lot of money flowing into crypto from traditional markets over the past two years. During this time, traditional markets and cryptocurrency markets have converged. It is apparent from various indicators that tech stocks and Bitcoin are highly correlated right now.

Fortunately, a silver lining prevails amidst the chaos, as Bitcoin and Ether tracking the traditional stock market could mean a surge in these assets’ prices whenever the shares take an upturn.

Moreover, the growth in institutional interest and long-term holders is a signal that the market is maturing and eroding its risk factor. Bitcoin tracking the S&P or the NASDAQ could add to this narrative even further.