As the market capitalization of the stablecoin tether nears $80 billion, with its current $77.9 billion valuation, data from onchain researchers at Santiment indicates that tether addresses valued at $1 million own more than 80% of the entire supply.

Tether whales command over 80% of supply

The US dollar-pegged stablecoin has grown exponentially over the past few years, and by current metrics, there are 77.9 billion tether (USDT) in circulation today. Tether is the most dominant stablecoin of all existing stablecoins in terms of market capitalization.

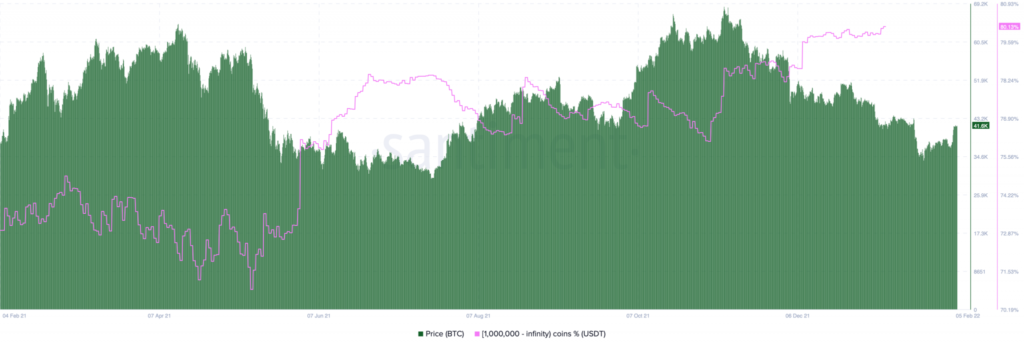

USDT’s market capitalization of $77.9 billion further represents 3.79% of the $2 trillion crypto economy. Furthermore, recent data from Santiment shows that USDT’s concentration of larger holders valued at $1 own more than 80% of the entire supply.

“Tether addresses valued at $1M are poised to reclaim 80%+ of $USDT supply for the first time in 3 weeks,” Santiment tweeted. “Generally, Whale Stablecoin addresses increasing their buying power are a good prospect for the long-term future of crypto.”

At the time of writing, Santiment’s metrics show USDT addresses valued at $1 million command 80.13% of the 77,922,851,073 tether supply in circulation. Into the Block indicates that the concentration of large tether (USDT) holders today is 46%.

The Ethereum-based USDT rich list from coincarp.com shows that there are 4.4 million ETH addresses holding tether. The top ten USDT holders hold 28.4% of all ERC20 tethers in circulation, while the top 100 hold 47.71%.

Stablecoins USDC and UST Have a Significant Concentration of Large Holders

While Santiment’s USDT data shows that USDT addresses valued at $1 million command 80.13%, USDC statistics indicate that USDC addresses valued at $1 million command 86.8% of the stablecoin’s supply.

USDC has approximately 51,570,858,520 USD pegged tokens in circulation today. The concentration of large USDC holders in the block also shows the metric to be higher than USDT at 63%.

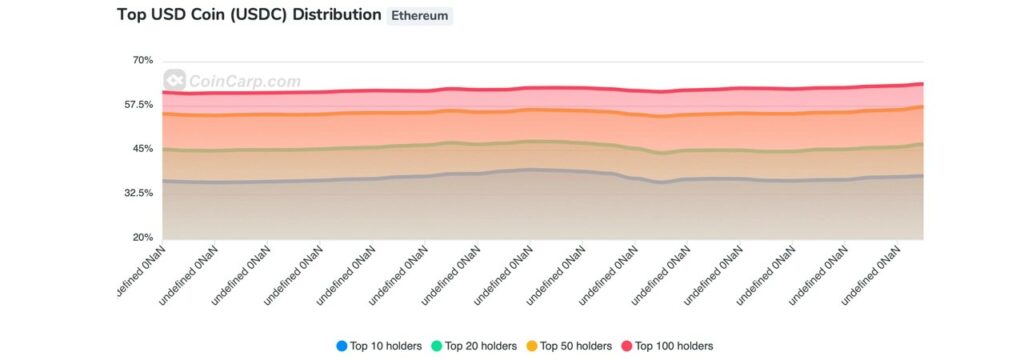

Coincarp.com’s USDC rich list metrics show the concentration of holders leveraging USDC on the Ethereum network. Currently, there are 1.35 million ETH addresses holding USDC and the top ten addresses holding the most USDC command 38.11% of the circulating supply.

Additionally, the top 100 USDC ETH-based addresses own 63.79% of the stablecoins on that specific chain. Terra’s UST also has a large concentration of holders according to Santiment’s UST data.

Data concerning Terra’s UST stablecoin (UST issuance on Ethereum) recorded by coincarp.com indicates that ten ethereum-based addresses hold 73.77% of the UST supply. Of course, this data is based on EVM-based UST and the 28,737 holders.

The top 100 UST stable addresses on Terra hold 97.70% of the coins in circulation. Data from Coingecko.com shows that there were approximately 11,256,872,859 USTs in circulation on February 8, 2022. Meanwhile, EVM-based USTs stand at 947.5 million in circulation today.

While there is $179 billion worth of fiat-pegged tokens in existence today, stablecoins are not as liquid as circulation metrics suggest, especially when it comes to the concentration of large holders.

With the advent of stablecoin pools, many owners simply hold stablecoins because they are less volatile and can accrue an annual percentage return (APY) of up to 18% or more.