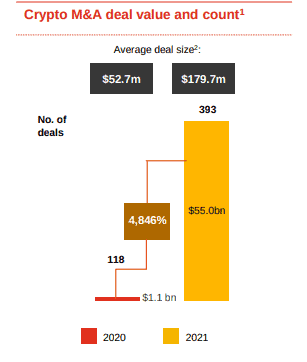

Crypto mergers and acquisitions (M&A) grew from $1.1 billion in value in 2020 to $55 billion, representing a massive increase of 4,846%, according to a PwC report.

The average size of an M&A increased threefold, from $52.7 million to $179.7 million. The report notes that a few mega-billion SPAC were behind this substantial jump.

Additionally, 2021 has seen activity shift to the Americas. The region increased its share of the total number of M&A deals from 41% to 51%.

In terms of the total value, Europe, the Middle East, and Africa are slightly ahead, with $25.5. The Asia-Pacific region trails far behind, with just $5 billion in merger deals.

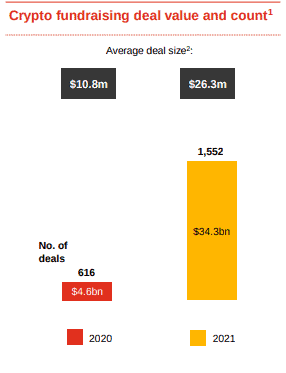

PwC, a multinational providing insurance, advisory and tax services, also reported on the crypto fundraising efforts. The total value of these transactions increased by 645%, from $4.5 billion to $26.3 billion. The average amount also increased by 143%.

It also noted that the number of venture capital firms that finance crypto and blockchain projects increased in 2021, with 49 new funds. The total number of such VCs is now just under 500.

Trends in 2022

The report expects momentum to continue in the industry, building on the significant upside over the past year. Moreover, the greater number of venture capital funds will likely fuel the growth of crypto transactions.

A key question is, the report suggests, whether crypto companies will continue to tap into SPAC’s as a funding opportunity. Special Purpose Acquisition Companies (SPACs) have exploded in 2021, as they offer a way for companies to avoid some of the regulatory scrutinies when going public.

The report also notes the continued growth trend of NFTs, DeFi (decentralized finance), Web 3, and the Metaverse. These segments of the blockchain space have seen exceptional growth in 2021. PwC expects this trend to continue, but likely more with fundraising deals rather than mergers and acquisitions, as the technology is still in its emerging phase.

The rest of the crypto space will continue to mature in 2022, with more institutional actors entering the scene. This will go hand in hand with more consolidation and expansion of the industry, the paper concluded.

The Crypto Industry Boom

The crypto industry has seen phenomenal growth in the past year, according to financial industry reports.

Just last week, a document by accounting giant KPMG revealed that investments in the digital asset space soared 450%. An earlier report by LinkedIn suggested that demand for crypto and blockchain jobs grew 395% during the same year.