Despite the relatively positive short-term technical structure and early signs of bullish sentiment in the futures market, macro factors remain a source of uncertainty.

Technical Analysis

Long-Term

Bitcoin’s price is still consolidating above the $40k mark. Last week, it was rejected by the $46k area, making a pullback towards the broken 50-day moving average.

The 50-day MA successfully supported the price, pushing it back towards the $46,000 level, which is the first significant static resistance. The next key resistance would be the 100-day MA, which could hold the price down and trigger a short-term correction. The 50-day MA and the $39,000-$40,000 area remain critical supports and could be bullish turning points in the event of a price correction.

Short-Term

On the 4-hour timeframe, the price is currently testing the lower trendline of the pattern for the third time. If this area holds, a rally towards the $45k zone would be expected. However, if the pattern fails, a drop to $38k or even lower would be the most probable scenario. Additionally, RSI is entering the oversold area, indicating that a local bottom or consolidation could be near.

Futures Sentiment Analysis

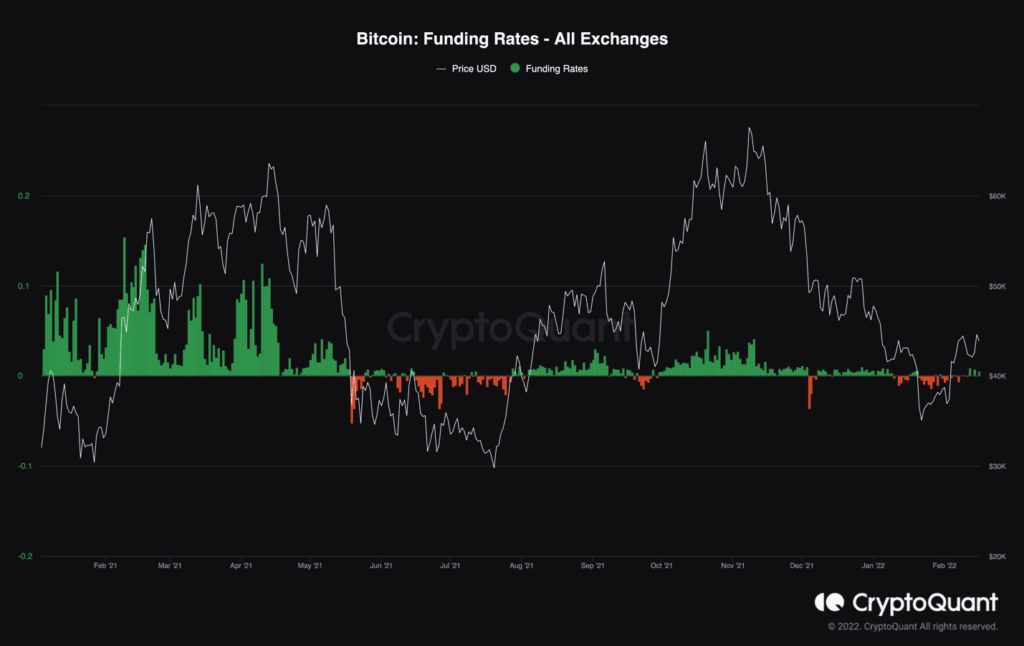

Funding rates have turned positive again in recent days, after a period of negative values. This optimism seems irrational as a potential war simmers between Russia and Ukraine, and rumors of the Fed taking a rate hike of 50 basis points instead of 25.

Additionally, many bears getting liquidated in the current rally also played a considerable part in painting the funding rates green. However, comparing the current state of the market to that of June 2021, there may be another drop in the short term to liquidate the impatient bulls and overleveraged speculators.