Numerous Ethereum indicators show bullish data, but the price does not seem to react positively

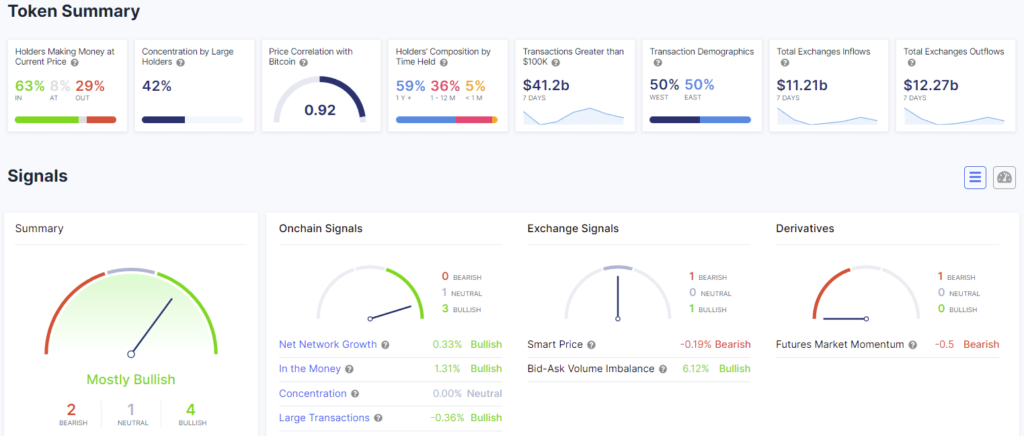

Most on-chain and market metrics for Ethereum turned “bullish,” including asset profitability, network net growth, bid-ask volume imbalance, and number of large on-chain transactions.

In/Out of the money indicator

One of the most profitable on-chain indicators for Ethereum is a metric that shows the percentage of ETH holders currently remaining in profit, loss or breaking even. The second-largest cryptocurrency still remains one of the most profitable assets on the market, with over 60% of all holders trading in profit.

The profitability of an asset greater than 50% but less than 75% is “sound” since the number of holders in profit does not reach values suggesting an oversaturation of the market. As soon as the profitability of an asset approaches 90%, the market is faced with a downside risk due to the appearance of strong selling pressure.

Bid/Ask Volume Imbalance

The balance of Sell and Buy orders on the market may also reflect the current sentiment of traders on the market. According to IntoTheBlock’s data, the majority of the orders on the market are bids. Currently, the imbalance remains at 3.69% in favor of bulls.

As for the price performance, it does not seem to back up the data given as Ethereum has lost more than 4% of its value in the last 24 hours. Previously, ETH hit the first strong resistance of the 50-day moving average but unfortunately failed to break through. The third failed test could indicate that the asset is still not ready for another long-term bullrun.

Besides four bullish Ethereum indicators, exchange inflows for the coin have also decreased at the same time as exchange outflows, suggesting that fear on the market still prevails over positive sentiment.