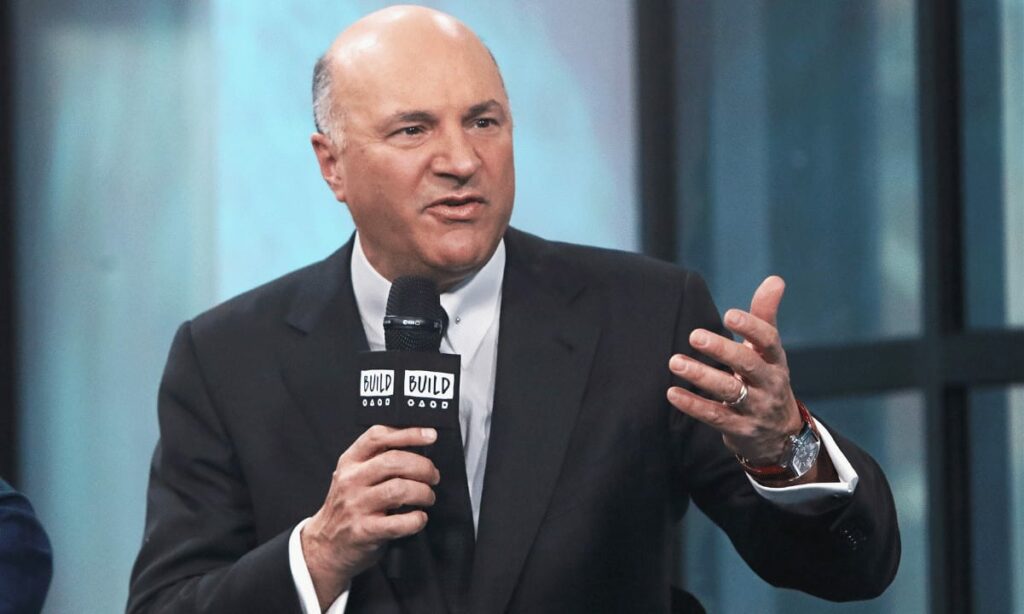

Kevin O’Leary said he has allocated millions of dollars in crypto. The former critic of Bitcoin now said investing in it is like investing in giant corporations such as Google and Microsoft.

20% of his portfolio in crypto

In 2019, the Canadian businessman and TV personality was among the crypto industry’s biggest critics. At the time, he described bitcoin as “worthless”, “useless currency”, and even “garbage because you can’t get in and out of it in large quantities”.

He started softening his stance at the beginning of 2021, saying he’s not against BTC and that he even respects the asset. Shortly after, he entered the ecosystem by allocating 3% of his portfolio to it.

In a recent interview for CNBC, Mr. Wonderful revealed that his exposure to digital assets equals 20% of his total wealth:

“I have millions of dollars in crypto. 20% of my portfolio is in cryptocurrencies and blockchain.”

Talking about the leading cryptocurrency, he argued that investing in it is equivalent to buying shares of top tech companies such as Microsoft, Google and many others. Besides Bitcoin (BTC), he admitted to owning Ethereum (ETH), Solana (SOL) and Avalanche (AVAX):

“You have to be diversified. I own 32 different positions, including equity and FTX itself: I’m backing their initiatives. You don’t know who’s going to win: is Ethereum going to win, is Solana, is Avalanche? I own them all.”

Afterwards, the Canadian said he also sees potential in non-fungible tokens. Earlier this year, O’Leary envisioned that NFTs could emerge as a “much bigger and more fluid market” than bitcoin.

“You’re going to see a lot of movement in terms of doing authentication and insurance policies and real estate transfer taxes all online over the next few years, making NFTs a much bigger, more fluid market potentially than just bitcoin alone,” he stated back then.

Dogecoin is the one he doesn’t like

O’Leary may be interested in many digital assets, but Dogecoin is definitely not one of them. Last summer, he said investing in memecoin was like betting your money on red or black at a casino. He went further, arguing that DOGE has no intrinsic value and should be classified as pure speculation:

“When you speculate on something like Dogecoin – that’s no different than going to Las Vegas and putting your money on red or black – it’s a pure speculation.”