With the rise of DeFi, and the potential that cryptocurrency trading offers, it should be relatively easy to earn great amounts of money by trading cryptocurrencies — provided that the trader knows what they are doing, of course. However, even then, their wealth is facing considerable risk due to massive crypto volatility. The crypto industry remains highly volatile, and for a lot of people, that is a significant problem.

This is true for both, companies and individuals alike. After all, asset instability is one of the main reasons why so many companies are hesitating to move to crypto. Of course, there are other factors, such as the lack of regulations, and the fact that it is still a risk, as regulators could proclaim at any time that digital assets are illegal. However, there is a very low chance of this, and the biggest issue that many have with digital currencies is the fact that their prices might crash by a massive percentage and cost them a lot of money.

A project called Centrifuge, however, found a way to minimize this issue in a very interesting way, which is why we decided to look into it and see what exactly does it have to offer.

How Does Centrifuge (CFG) Work?

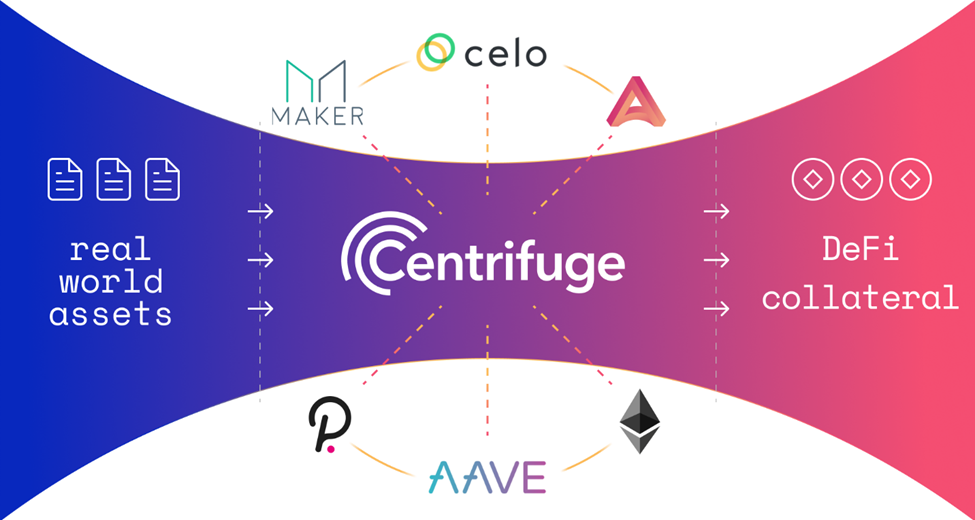

Centrifuge is a project that aims to unlock DeFi liquidity for real-world assets. The project offers a number of solutions and benefits, including the ability to bridge assets like invoices, real estate, and royalties to DeFi through the use of NFTs. It also allows borrowers to finance their real-world assets without the need for banks, and it offers liquidity that is open to everyone.

It claims that it can bring trillions from the real world to DeFi, and it can unlock economic opportunities for people by connecting them and allowing them to lend and borrow money transparently and with minimum cost. It completely bypasses all rent-seeking intermediaries, which is where a large portion of its potential lies.

In its essence, the protocol simply tokenizes real-world assets by converting them into NFTs, which are then granted entry to the world of blockchain. After that, the NFTs are funded via Tinlake, which is Centrifuge’s first dApp, which was made to access liquidity on Ethereum.

Centrifuge can also establish bridges to other chains, such as Ethereum, but also to other DeFi protocols, which allows its users to get liquidity with no slowdowns. Meanwhile, DeFi projects are protected from destabilizing events through the addition of uncorrelated collateral.

What Problems Does Centrifuge (CFG) Solve?

Centrifuge has several issues that it wishes to solve. These are the problems that have been on the company’s mind for a while, and its solution might be able to help anyone who worries about these same problems.

Connects DeFi with real-world assets

Centrifuge’s primary goal is to bridge decentralized finance with assets from the real world. In doing so, the project plans to achieve a number of things, such as lowering the cost of capital, which would be of immense importance for small and mid-sized enterprises. Furthermore, doing so would also provide investors with a more stable source of income.

Removes volatility from profits made through crypto

As mentioned earlier, the project aims to allow users to generate profits without exposing themselves to the risk of volatility. Since it cannot end volatility and make crypto prices stable, the best way to do this is to allow them to generate profits that are not tied to crypto assets themselves. In other words, its developers are seeking to transfer real monetary value from the fiat industry into the cryptocurrency sector.

Benefits of Centrifuge (CFG)

If you were wondering what kinds of benefits will Centrifuge’s approach bring to the users of the crypto industry, the answer is that there are many of them. For example:

Grants access to the liquidity of DeFi

One of the biggest benefits that you can expect from Centrifuge is gaining access to the liquidity that DeFi has to offer without relying on volatile cryptocurrencies. This can be extremely useful for the companies that wish to use crypto, but also don’t want to expose their funds to the risk of being devalued.

Removes third parties like the banks

Next, since Centrifuge can provide liquidity to everyone, it can also be used to link assets such as real estate, invoices, royalties, and more, with decentralized finance. In addition to that, it can also be used by borrowers who wish to take loans and allow them to finance their real assets without having to rely on banks and other financial institutions and intermediaries.

The procedures in the DeFi sector are mostly automatic thanks to smart contracts, they are much more affordable, more transparent, without hidden fees, and other issues that you are likely to encounter in your dealings with financial institutions.

Unlocks new economic opportunities

Finally, Centrifuge can also offer users the ability to profit by granting them regular income in the form of rewards for staking their assets. Staking has been a huge hit in the crypto industry for several years now, and it has existed as a possibility for much longer than that. It requires no effort or knowledge from stakers, and all that is required is for them to lock up their coins and don’t withdraw them. In return, they receive regular rewards for supporting the project.

Final Thought

Centrifuge is a project that has a lot of potentials when it comes to connecting the real world with DeFi. It has an interesting approach to bringing real-world assets to the crypto sector and ensuring the monetary stability of assets that it works with.

It views cryptocurrencies as unstable, and it believes that it can help remove risks for investors and empower them, as well as small and middle-sized companies. As a result of this, we believe that Centrifuge could easily become one of the crucial projects for strengthening ties between fiat and crypto, as well as between traditional and digital finance.