Ethereum, the world’s largest altcoin, followed a bearish path below the $2,850-pivot level. In fact, ETH even traded below the $2,800-support level amidst the wider correction within the market. It traded as low as $2,718 before the bulls appeared on the horizon. Soon after, Ether’s price started an upside correction and climbed above the $2,750-level.

At press time, ETH, after rising 2%, was trading at $2.85k. That’s not all, however, as ETH also noted a spike in burning activity.

Too HOT to Handle

Ethereum is projected to become deflationary later this year. The much-anticipated ‘Merge‘ would decrease ETH’s issuance by 90%, leading to more ETH burned than “printed.” Ethereum has already recorded several days of deflation due to high fees resulting in more being burnt. Following the merge, ETH’s net issuance is likely to range between -1% and -2.5%, depending mostly on the network’s transaction fees.

Speaking of the burning mechanism, here’s the latest bulletin as it continues to hit new highs.

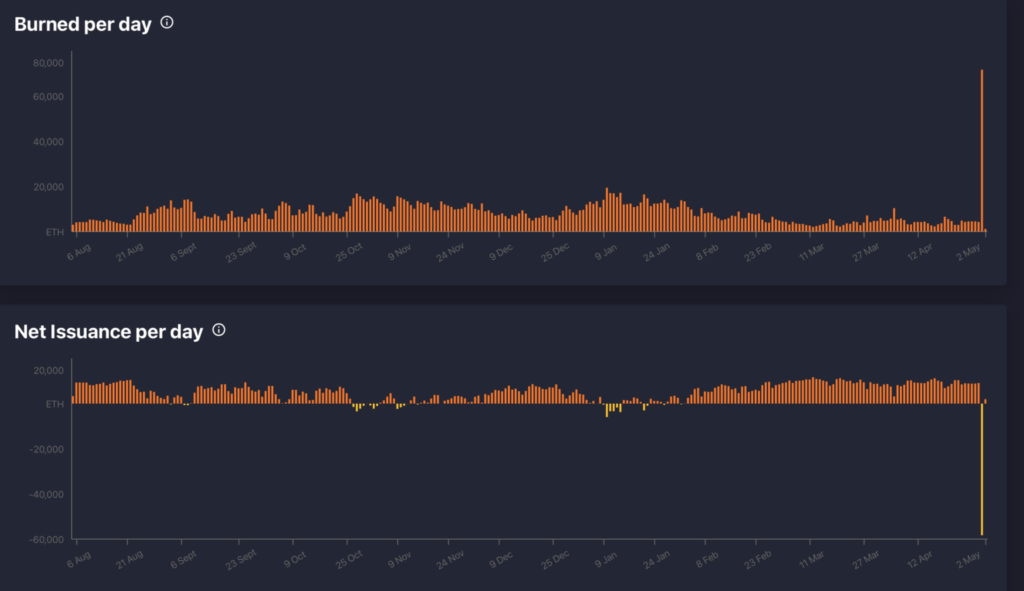

According to WatchTheBurn, ETH burned today exceeded 69,200 ETH, with the net issuance of ETH at -61,600. Both set new single-day historical records since EIP-1559 took effect.

The highly anticipated virtual land sale tied to Yuga Labs’ metaverse project went live a few days ago. The selloff affected much of the entire crypto market. The massive demand resulted in ETH fees worth nearly $200 million. In fact, data from Etherscan showed that users paid almost 64,000 ETH in fees, or more than $175 million, in the last 24 hours alone.

The aforementioned uptick on the graph best represents this unprecedented rise. At press time, 55,000 ETH burned from Otherdeed was the sixth-largest burn in history.

Thanks to EIP-1559, the base fee burned during each transaction steadily decreases the circulating supply of Ether. Since the implementation of the burning protocol, Ether’s supply has become 1.6% lower than it would have been without the hard fork. This is the sign of a significant drop in its circulating supply.

Similarly, ETH supply on cryptocurrency exchanges fell consistently over the past few months. This suggested that the digital asset’s price could see more positive price action in the coming months.

Doubts, Ponzi, etc.

The company behind the hugely popular Bored Ape Yacht Club NFT collection, Yuga Labs, has launched a new land title collection called Otherdeed for its Otherside Metaverse. The overwhelming demand drove the average cost of an Ethereum transaction to over $400 at the time, according to Etherscan.

Network fee tracker BitInfoCharts reported that average fees spiked to an all-time high of around $200 on 1 May. The hike in the gas fee, obviously, would anger a certain chunk of the crowd.

Following this event, ETH users paid a median fee of $4,830 per transaction over a one-hour window. Therefore, censorships such as “Ponzi” appeared soon after.