The cryptocurrency economy has shed a lot of value during the last six months dropping 48.70% from $3.08 trillion to today’s $1.58 trillion. While crypto markets looks extremely bearish these days, a few crypto advocates have theorized the bear market will be less harsh this time around. Furthermore, there’s also the rare scenario that bitcoin’s price could reverse and see a triple top even though it’s commonly said in the finance world “there is no such thing as a triple top.”

Chances of Bitcoin experiencing a triple top scenario are rare, but could happen

Five days ago, Bitcoin.com News reported on a theory describing bitcoin (BTC) prices experiencing a milder bear market than the major crypto asset’s past 80%+ declines. the reasoning behind the theory is due to past peaks in bitcoin prices and the most recent peaks recorded in May and November 2021.

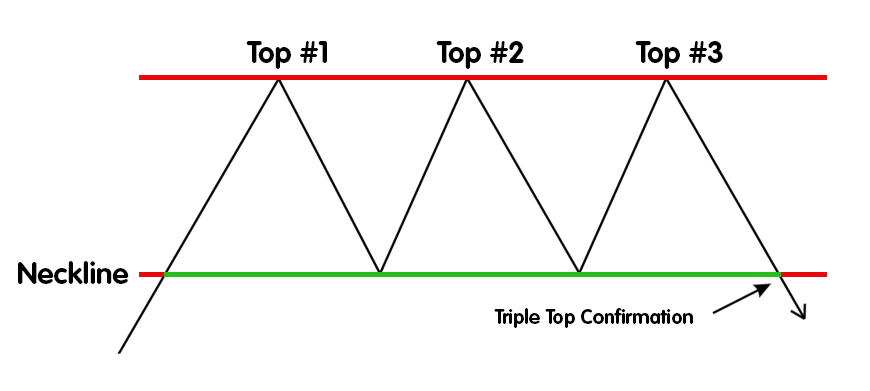

While BTC hit $64K in May and $69K in November, the two peaks were much smaller than previous bull run gains. From the looks of things it seems, BTC’s price experienced what’s called a double top. Now, coinciding with the theory the current market downturn will be a softer bear run, there’s also the rare possibility of a triple top scenario.

Basically, if a triple top scenario occurs, the fiat value of BTC will touch the same resistance it touched during the last downturn. For example, after BTC hit a high of $64,000 in mid-May 2021, the value fell to a low of $31,000 on June 21, 2021. From there, the price skyrocketed again and reached $69,000 on November 10, 2021.

If a triple-top happens to occur, then the upcoming bottom would be somewhat in the range of the $31K mark, when it starts another reversal. In order for this to happen, BTC will have to see a complete reversal from the same resistance levels and the third top could be equal to and just above or just below the $69K region.

Reversal theories considered “Hopium” because many won’t bet on such a risky game

Of course, many will assume that triple summit theories are based on pure faith and “hopium.” In the world of trading, triple tops are very rare and quad tops are seemingly non-existent. In 2019, JC, an analyst at allstarcharts.com, said, “We rarely see triple tops, and I can’t even tell you if I’ve ever seen a quadruple top. Betting on these outcomes never seems to pay off.

Which means betting on bitcoin (BTC) experiencing a triple top is a very risky bet in comparison to betting on a double top formation. Moreover, its a common message in the trading world to state:

There is no triple top.

Although it is common to say the statement, saying “there is no triple top”, the comment is not entirely accurate. They have surely occurred in financial market scenarios in the past, and traders who have risked betting on them have reaped the rewards. However, when a triple top runs and ends, the “party is officially over”. When a triple top is executed, the price begins a bearish descent until the next price cycle regains bullish strength.

While many are likely still willing to bet on a triple top formation as far as bitcoin’s price is concerned, its even more likely they are not willing to bet on a seemingly non-existent quad top. Moreover, triple tops being as rare as they are, means a great deal of traders are not willing to bet a third peak is in the cards. The chance of a BTC triple top coming to fruition is not impossible, and no one can safely say the scenario will not come into play.