As bitcoin dropped to fresh new lows on Monday, the price of terra (LUNA) slid by 33.3% during the last 24 hours. Moreover, the project’s stablecoin terrausd (UST) has lost stability, dropping to $0.932008 per token. Additionally, the Luna Foundation Guard’s bitcoin wallet and ethereum Gnosis safe address has been emptied.

LUNA Price Puts Intense Pressure on Terra’s Stablecoin UST

Over the past 24 hours, over $830 million has been liquidated from the crypto-economy and the price of bitcoin (BTC) has fallen to levels not seen since January 2022. Over the past seven days, BTC has lost 20.2% in value against the USD, and 11% of the value has been shaved off in the past 24 hours. Additionally, many crypto assets suffered larger losses as terra (LUNA) fell 33.3%.

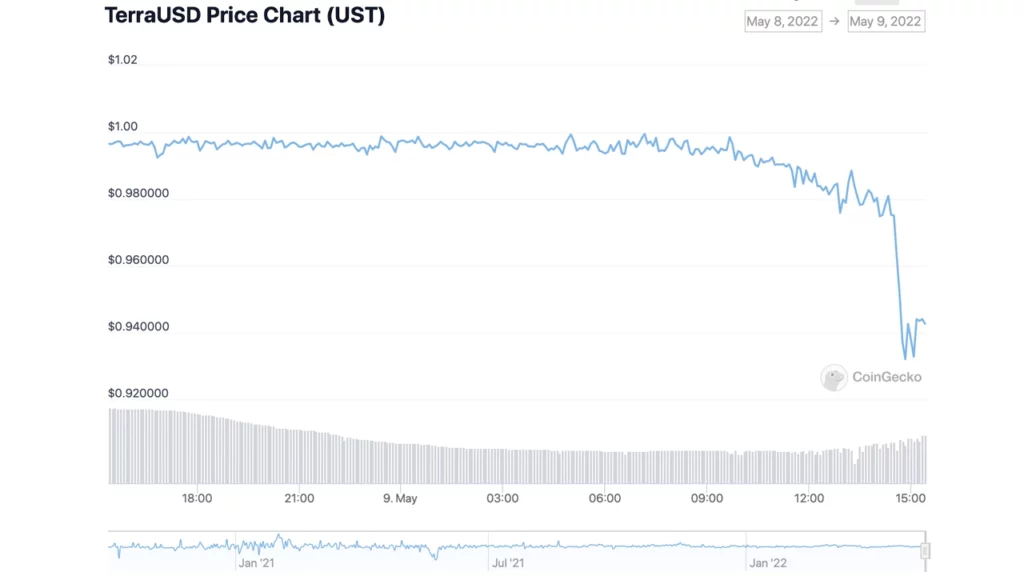

The stress has caused the project’s UST peg or $1 parity to slip beneath the dollar value. At its lowest point on Monday, terrausd (UST) dipped to $0.932008 per unit according to Coingecko.com statistics. UST’s 24-hour price range on Monday has been between $0.932008 to $0.999601 per unit.

Luna Foundation empties Bitcoin and Ethereum wallets

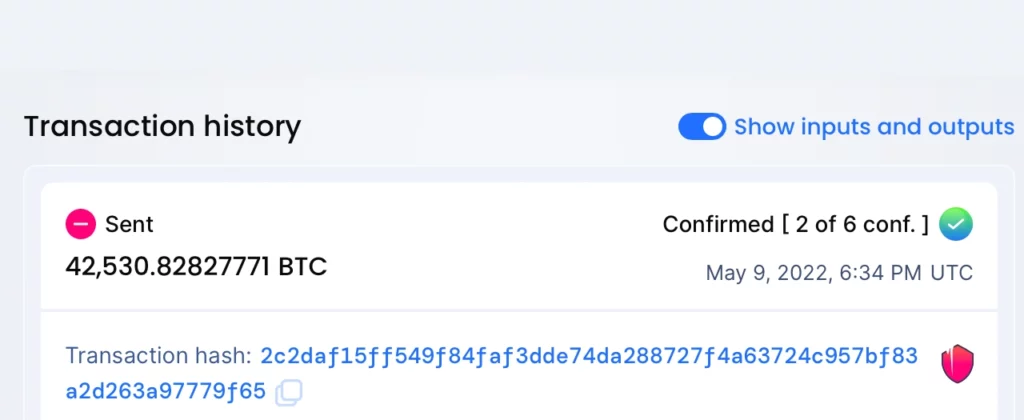

In addition to the losses, UST and LUNA suffered on Monday, after it was revealed that the Luna Foundation Guard (LFG) would lend $1.5 billion in BTC and UST, LFG’s public bitcoin and ethereum wallets were depleted. The LFG bitcoin wallet once held 42,530.82 BTC, but sent the entire reserve in a single transaction to another wallet. Additionally, LFG’s Gnosis secure address, which once held millions of dollars in USDC and USDT, was also emptied.

On May 3, the LFG Gnosis safe address held $143 million and today, it currently holds $195. At 2:36 p.m. (ET), Terra co-founder Do Kwon tweeted “Deploying more capital – steady lads.” UST’s price has seen some improvement on Monday after the deployment of capital, but has been down between 4.5 to 6.5% during the last few hours.

While other stablecoin assets like USDC and USDT felt pressure today seeing much smaller percentage losses, the two largest stablecoins by market cap held their pegs. Tether fell to $0.995691 per unit on Monday while the US dollar coin (USDC) fell to $0.994630 per unit.

Binance usd (BUSD) is exchanging hands for $0.996616 and DAI has been trading for $0.995420. Most USD pegged stablecoins besides UST remained trading for at least $0.975328 to $0.99 per token. Meanwhile, toward the end of writing this article at 4:00 p.m. (ET), UST has been trying to regain the $1 parity but has yet to accomplish the goal. At press time at 4:30 p.m., the stablecoin UST has managed to jump to $0.956017 per unit.