On May 13, Circle’s chief financial officer Jeremy Fox-Geen published a blog post called “How to Be Stable,” following the aftermath of Terra’s stablecoin implosion. Circle’s CFO explained that since usd coin’s inception, the stablecoin aims to be “the most transparent and trusted dollar digital currency.”

Terra’s Stablecoin Unpecking Incident Sheds Light on the Entire Stablecoin Economy

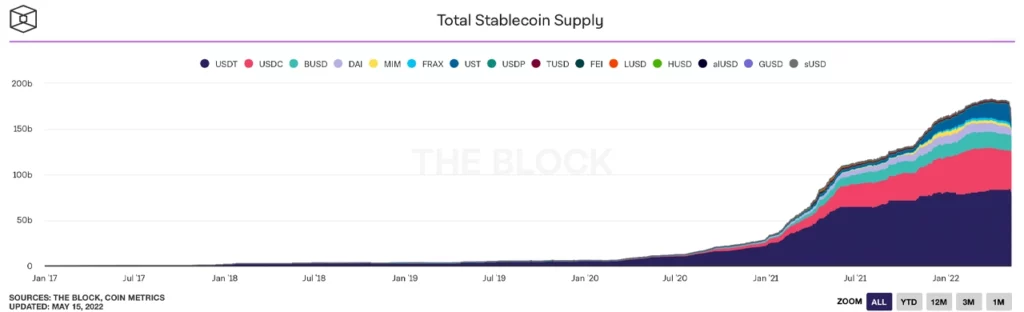

For a few years now, stablecoin assets have been a popular hedging vehicle among many participants within the cryptocurrency community. More recently, stablecoins are loaned out in large numbers in order to garner high interest and returns. In the beginning, stablecoins were centralized projects and nowadays there are a few decentralized and algorithmic stable tokens among the giants.

Tether (USDT) and usd coin (USDC) are the two largest stablecoin projects in terms of market valuation. Both of them are centralized, which means the company guarantees the stablecoins are redeemable for the $1 parity by holding reserves that cover the funds in circulation. Even before Terra’s stablecoin de-pegging event, more confidence has been placed in the top two stablecoins because they are centralized.

Three days ago, Bitcoin.com News reported on the stablecoin reshuffle after the recent editorial published by our news desk showed that for the first time in history, three stablecoins entered the crypto top ten. This is still the case today, except that terrausd (UST) was eliminated from the ten largest crypto market caps and the stablecoin BUSD replaced the token’s position. After the implosion of terrausd (UST), the CEO of Circle Financial Jeremy Allaire spoke to the press about what makes USDC different, and he thinks there needs to be “more regulatory framework around stablecoins.”

Circle CEO Says Company Is Ramping Up Trust and Transparency Efforts, Firm Says ‘USDC Is Always Redeemable 1:1 for US Dollars’

On Friday, Allaire tweeted that Circle was “ramping up our efforts” when it comes to USDC “trust and transparency.” Allaire also shared a blog post written by the firm’s CFO Jeremy Fox-Geen, who gives a summary of what Allaire means about transparency. Fox-Geen’s blog post explains “USDC has always been backed by the equivalent value of U.S. dollar-denominated assets.” The CFO further notes that the funds are held by America’s leading financial institutions such as Bank of New York Mellon and Blackrock. The Circle executive’s report adds:

The USDC reserve is held entirely in cash and short-term US government bonds, consisting of US Treasury bills with maturities of 3 months or less.

Circle’s CFO detailed that the company has been publishing monthly attestations from the leading accounting firm Grant Thornton International. “The USDC reserve is worth at least as much as the number of USDC in circulation, providing reputable third-party assurance of this fact to the USDC ecosystem,” Fox-Geen summarized in the blog post. “USDC is always redeemable 1:1 for U.S. dollars,” the Circle executive adds. The blog post concludes that there are thousands of projects and entities that support and facilitate the exchange of USDC in 190 countries.

While Terra’s Algorithmic Stablecoin Shakes, A Few Decentralized Tokens Pegged to Fiat Still Exist Many Crypto Proponents Believe They’re Needed

Meanwhile, there are a few decentralized and algorithmic stable assets today such as LUSD, DAI, FEI, MIM, USDV, and USDD. For example, the Ethereum-based Makerdao project leverages an oversizing method to support the DAI stablecoin. Tron recently introduced an algorithmic stablecoin token called USDD, and a blockchain project called Vader has a native algorithmic stablecoin called USDV. Another stablecoin asset, dubbed Magic Internet Money (MIM), is built on top of Avalanche (AVAX) and is issued by decentralized lending platform Abracadabra.

Decentralized and algorithmic stablecoin proponents believe they are needed among the centralized heavyweights like USDT and USDC. Supporters of such assets think that centralized stablecoins are subject to the same failure, and others believe decentralized and algorithmic stablecoins trump centralized models because they cannot be frozen by the issuer. Despite these benefits, centralized stablecoins have ruled the roost and crypto users, at least for now, have more confidence in them.