After the Tether (USDT) collapsed below $1 recently, all focus has been shifted towards USDC as the investors are reassessing their preference for stablceoin due to USDC’s increased market cap.

Here are two metrics that are evidence of the increased demand for USDC.

Decreased Liquidity

According to the Glassnode data, on the Uniswap exchange, the USDC liquidity has been finding its bottom to the level which was last seen 16 months ago.

Therefore, this decrease in liquidity on Uniswap indicates that demand is increasing and also indicates that investors are moving towards stablecoins.

Increased Supply

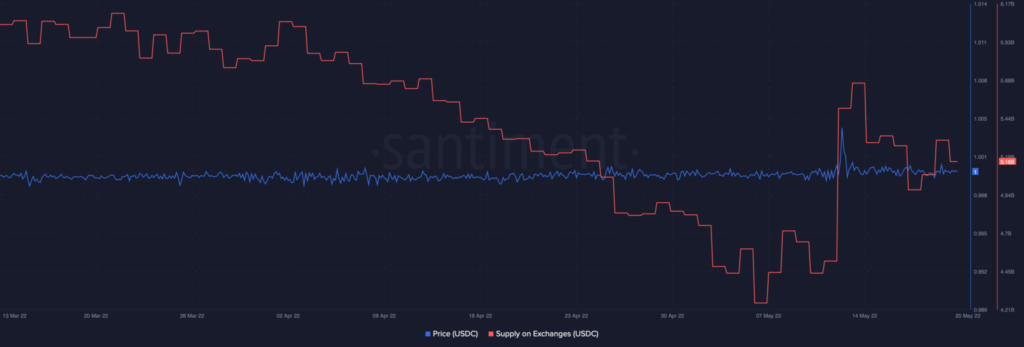

It’s just not the decreased liquidity that is signifying the increased demand for USDC. The Santiment data suggests that the exchanges are witnessing an increase in the USDC supply since the 17th of May, even though the USDC price was back to its normal range.

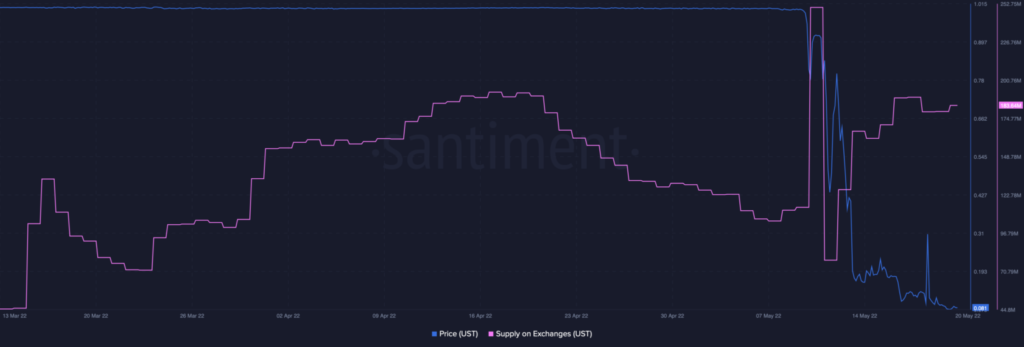

When the UST supply is compared, since the time it experienced the unpeg, the UST supply on the exchanges has bottomed out. Although the data shows that the UST supply is about to reach its all-time high, the supply has just increased to the level last seen in April.

USDC’s Increasing Role In Crypto Space

USDC velocity was dropping at the time of publication, suggesting that less USDC stablecoins were traveling between addresses. This does not, however, guarantee that nothing will change for investors.

Meanwhile, according to Glassnode stats, the top 1% of addresses only held about 91.226% of the USDC supply. While that may seem like a lot, it’s only a 13-month low.

Another report by Glassnode published on May 16 points out that USDC has reversed the supply trend which was in contraction since late Feb that has expanded by $2.639 Billion.