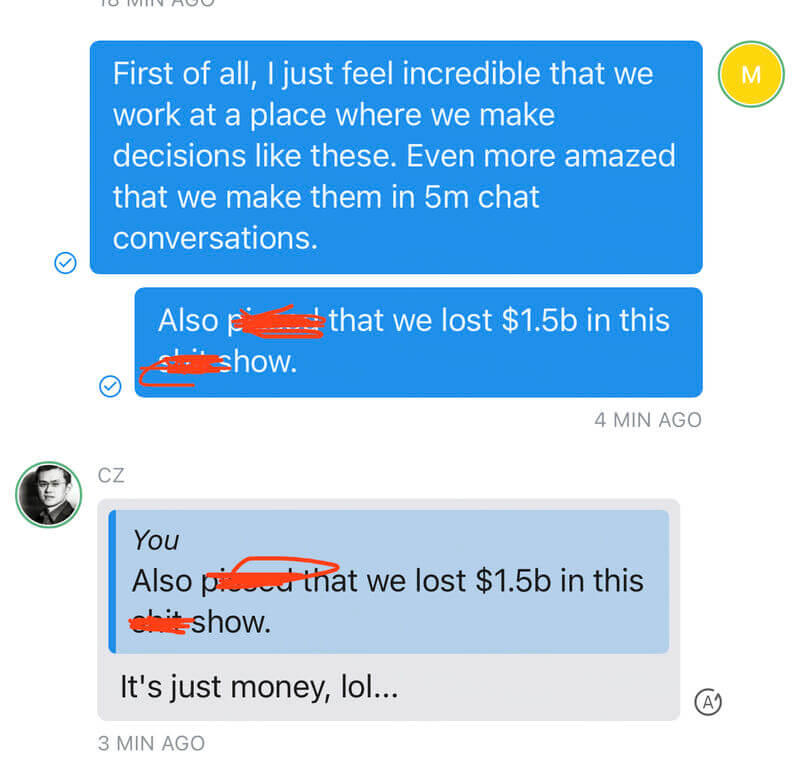

The conversation records of Binance’s internal leadership team during the Terra issue have been revealed by CEO Changpeng ‘CZ’ Zhao.

CZ and Mayur Kamat, Binance’s chief product officer, discussed what to do with Binance’s 15,000,000 LUNAs, which were previously worth $1.6 billion, according to records. The coins were part of the company’s original $3 million investment in Terra, but they’re now worth just $2,700.

CZ on May 16, posted a tweet that said Binance will let go of Tether but in return, it will ask the Tether team to compensate the retail users first and then the Binance.

Binance Product Manager Mayur Kamat further claimed that it only took Binance five minutes to make this decision.

For Binance Its Always Customers First

Traditional financial markets have never had the option to decide to sacrifice billions of dollars in order to prioritize its consumers. A CEO’s fiduciary responsibility is to make decisions that benefit the firm rather than its consumers.

Despite the fact that the interests of both parties are often aligned, Binance could have saved hundreds of millions of dollars by selling its LUNA tokens during the crisis. If you don’t, Terra LUNA will remove 15,000,000 LUNA parts from the new LUNA fork, possibly making the problem worse.

As Kamat was reviewing the Terra crash event, he quotes that there are a few signs which confirm that you are working for an extraordinary company and this will be in the decisions that are made when things get hard.

Then he claims that he has never worked in a company where decisions were made so quickly and says that money is fungible, but user trust is much harder to earn and easier to lose.

Is This Genuine Or Just A PR Move ?

However, even if Binance had wanted to, it’s likely that it couldn’t have done anything about the $1.6 billion LUNA coins. This might all be a public relations stunt, with the screenshots being released as part of a larger push to boost the company’s favorable image.

LUNA plummeted 98% to just $1 per coin in less than 48 hours from May 9. Do Kwon and the LFG team started selling tens of thousands of Bitcoins to restore the peg while UST traded around $0.21. The UST had hit $0.79 on May 11 and was showing signs of recovery. The algorithmic link between UST and LUNA, on the other hand, caused the latter to drop to $0.00000136 on May 13.

Binance’s LUNA tokens were only valued at $20.40 at the time. On May 16, CZ sent out a tweet stating that Binance will not be relocating or selling its 15 million LUNA. As a result, unless Binance elected not to sell the LUNA coins before May 10, the coins were worthless.