As macro-economic uncertainties fueled market-wide corrections, the crypto-market’s capitalization plunged below $900 billion.

During the week, Ethereum [ETH] fell into high volatility after losing its $1,700 support. The recent bearish engulfment has significantly tarnished the ability to buy under the current market momentum.

The fall below the $ 1,000-support level pulled ETH to its January 2021 lows. Any near-term bullish comebacks after the recent rejection of lower prices can help ETH test its immediate supply zone.

At press time, ETH was trading at $1,035.8, up 4.11% in the past 24 hours.

ETH 12-hour Chart

Over this timeframe, ETH saw an evening star setup from the recent rejection of lower prices from the $1,000-support. A sustained close beyond the $$1,093-level could aid near-term buying efforts to test the bounds of its immediate supply zone.

In this case, the targets would be between $1,173 and $1,129. However, the current candlestick should close green to reaffirm the strength of the Morning Star candlesticks. Any close below the $1,000 support would invalidate the buying trends while the sellers could aim to retest the $930 area.

ETH Daily Chart

From a rather long-term outlook, the price action was quite below its 20 EMA. Historically, such a gap has warranted a revival. But, with the current macroeconomic factors in play, ETH truly walked on thin ice.

The sellers were visibly in check as price action continued to test the lower Bollinger Bands (BB) over the past week.

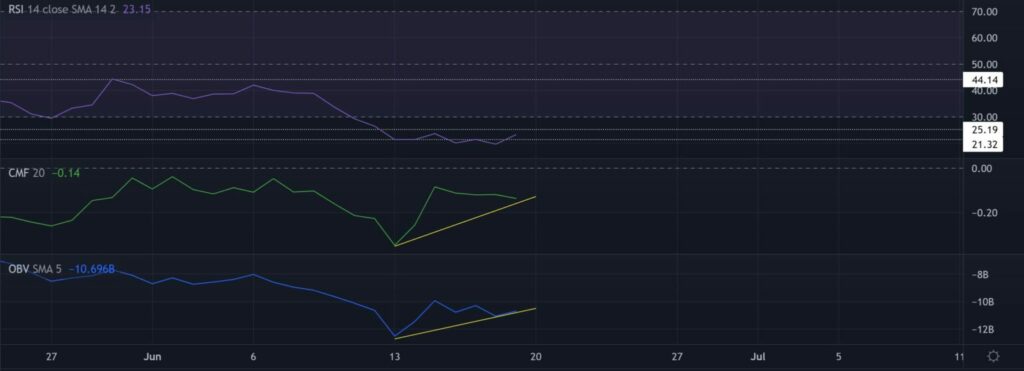

The Relative Strength Index (RSI) coincided with the price action for the most part and affirmed a one-sided bearish market. While the index swayed deep into the oversold region, the buyers would now aim to test the sturdiness of the 25-resistance.

With relatively higher lows, OBV and CMF have diverged higher with the price action over the past six days.

Conclusion

Given the bullish candlestick pattern on the H12 alongside the oversold readings and bullish divergences on the daily timeframe, ETH could test its immediate supply zone. The targets would remain the same as mentioned above.

With fear sentiment driving the current trend, any close below the $1000 support could lead to a retest of the $913-$930 range before a rebound. Investors/traders need to consider Bitcoin’s movement and its impact on the broader market perception to make a profitable move.