In light of the recent crypto market crash, Ethereum [ETH] can be considered one of the worst-hit tokens. Given the performance of the token in the past couple of days, it can be hard to imagine the token back above the $1,000 support line.

At the height of the crisis, ETH prices had fallen as low as $895, but recovered almost in a flash. Meanwhile, the broader crypto market has seen a revival over the past week after threats of a crypto winter have largely surfaced.

Finally free from bear shackles?

ETH has made quite a stunning recovery in the last four days. Investors were in grave pain after the latest crash that led to huge losses across the market.

However, the token is starting to gain momentum in daily trading. ETH is currently up 2.25% and stood at $1,217 at the time of writing. It has also seen a bullish resurgence of around 21% over the past week to get there. The recent phantom fork has rattled developers, but ETH 2.0 is still garnering huge interest.

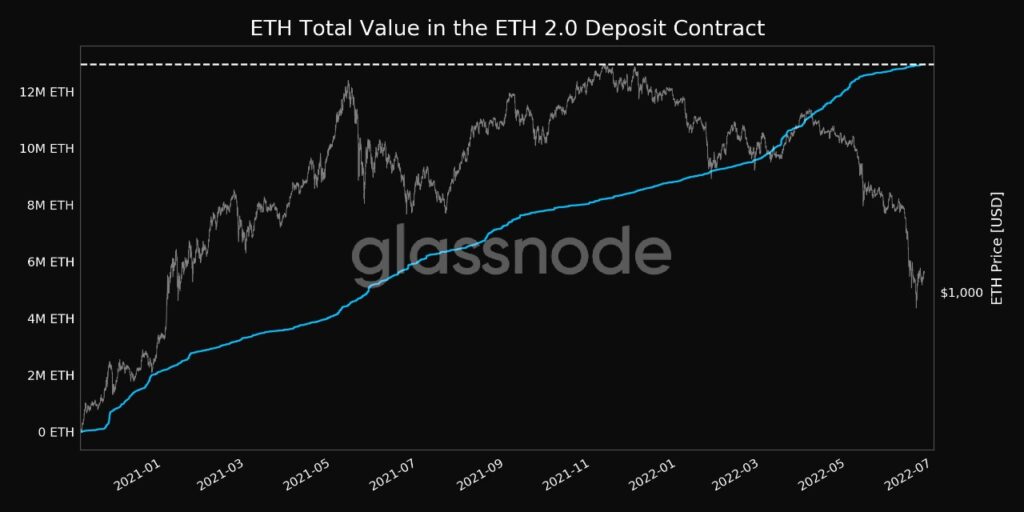

Glassnode reported a recent development on the subject in the latest tweet. As per the tweet, the total value in the ETH 2.0 deposit contract just reached an all-time high of 12,954,309 ETH as of 25 June.

This means that 11.5% of the total Ethereum supply at 121,297,250.87 is stored in ETH 2.0. It’s worth more than $25 billion at current exchange rates and will provide a welcome boost to investors after the start of June.

This looks like a good time to be an ETH investor, right? Maybe.

Ethereum’s network still has its share of lingering issues that have caused the volume to drop rather erratically. Currently down 7.5%, network volume is starting to become a stumbling block for Ethereum’s stability.

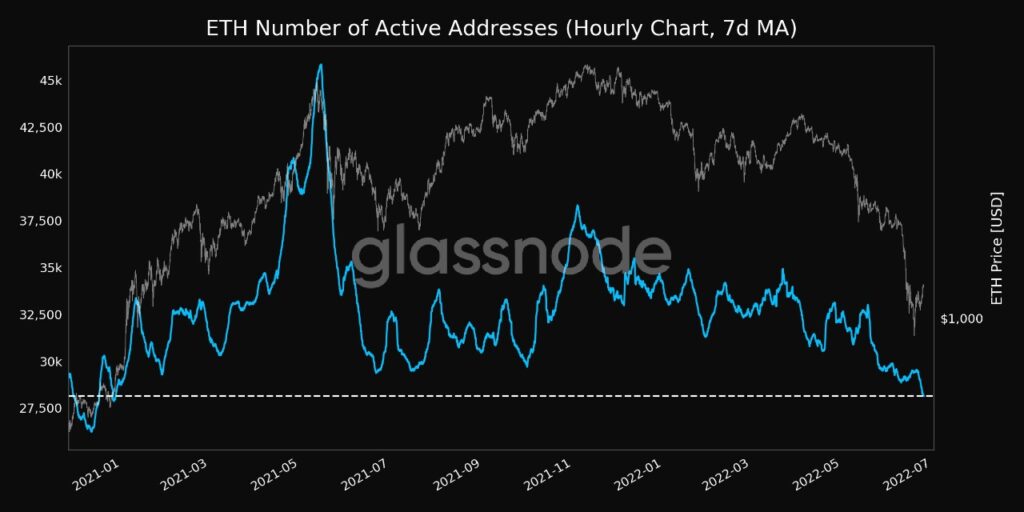

There has been a major drop in active addresses on Ethereum. In fact, the number of active addresses (7d MA) reached a whopping 17-month low at 28,149 on 25 June.

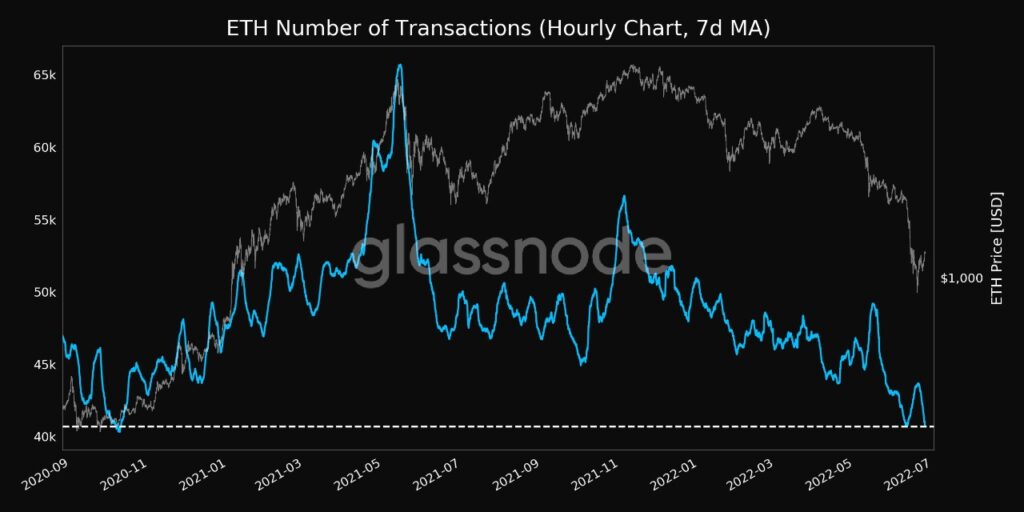

Additionally, the number of ETH transactions hit a 20-month low of 40,691. Such a previous low on the network was seen during the recent crypto crash in June itself, when liquidations were about to explode.

Well, the question still lingers- Will investors remain patient or will they flock to other scalable networks, the so-called Ethereum killers?