Ethereum survived one of worst weeks in its history and is now looking for reversal opportunity

The second largest cryptocurrency in the market has found a base for a reversal, according to a report from Bloomberg. Ether plunged to $880, causing a series of massive sell-offs in the market, which created even more pressure on the asset’s performance.

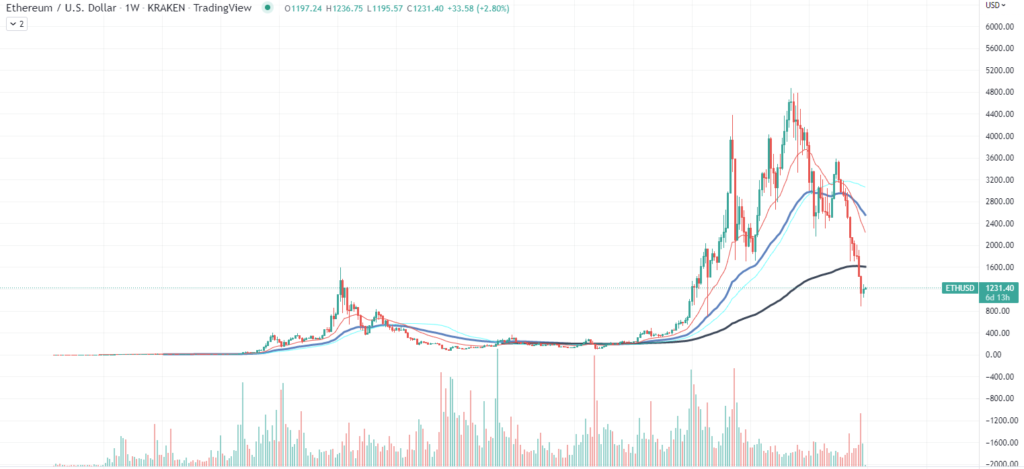

On June 19, Ether successfully rallied to $1,279 on Sunday and then retraced to $1,200, which still remains the key support zone for ETH. Conveniently, the 200 WMA sits exactly at the aforementioned price, which is why the second biggest cryptocurrency has consolidated for the last 4 days.

As the article suggests, the tokens are “off their worst levels” that we saw only a week ago and are now showing signs of stabilizing. U.Today has previously mentioned the success of Dogecoin in the cryptocurrency market, as the meme has managed to earn a spot as the most profitable asset in the top 100 cryptocurrencies by market capitalization in the past. over the past 24 hours.

But while the asset is comfortably sitting at the support level, there is not enough buying power on the cryptocurrency market to push above the first and usually weak 21-day moving average.

The volume indicator also suggests that Ether is not doing well enough in the market as entries into the asset remain at a low level, creating a decreasing volume trend which is the first signal of an upcoming bearish reversal. .

Unfortunately, Ethereum has a long way to go to be considered a reversed or even consolidating asset, as it remains in a sharp downtrend since April and needs to gain a foothold above the 200-WMA.

At press time, Ethereum is trading at $1,231, gaining around 3% in value over the past 24 hours.