Till today, 2022 has been an exceptionally difficult year for the financial market, with stocks, bonds, and virtual currencies all failing in the face of restrictive financial conditions. Inflation and restricting liquidity in the economy has put enormous strain on the excessively bought crypto industry.

Almost all of the current pain comes from overvalued funds, as well as security rehypothecation coming into effect, both on and off chain.

During this period, Bitcoin and Ethereum also have dropped beneath their prior cycle ATHs, the first in the record. As a result, a large chunk of the market has experienced unrecognized damage, with all 2021-22 investors being submerged. Since this financial crisis worsens, an increasing number of buyers are abandoning their investments, resulting in historic actual damages.

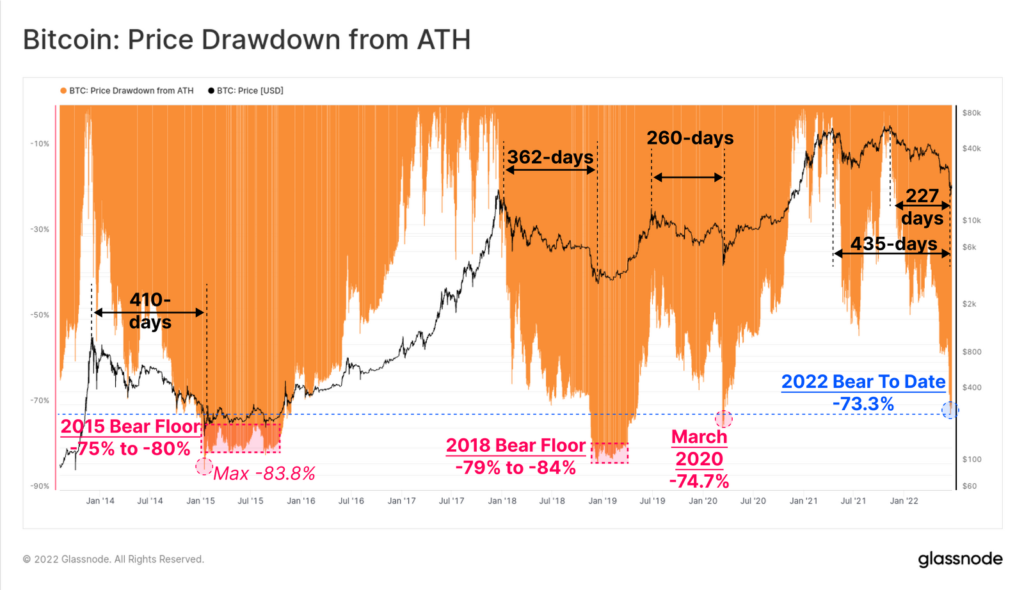

Bears of historic proportion

June 25 research titled “A Bear of Historic Proportions” by blockchain analytics firm Glassnode shows how Bitcoin’s recent drop below the 200-day moving average (MA), negative divergence from the realized price, and net realized deficits helped make 2022 the worst year in Bitcoin history.

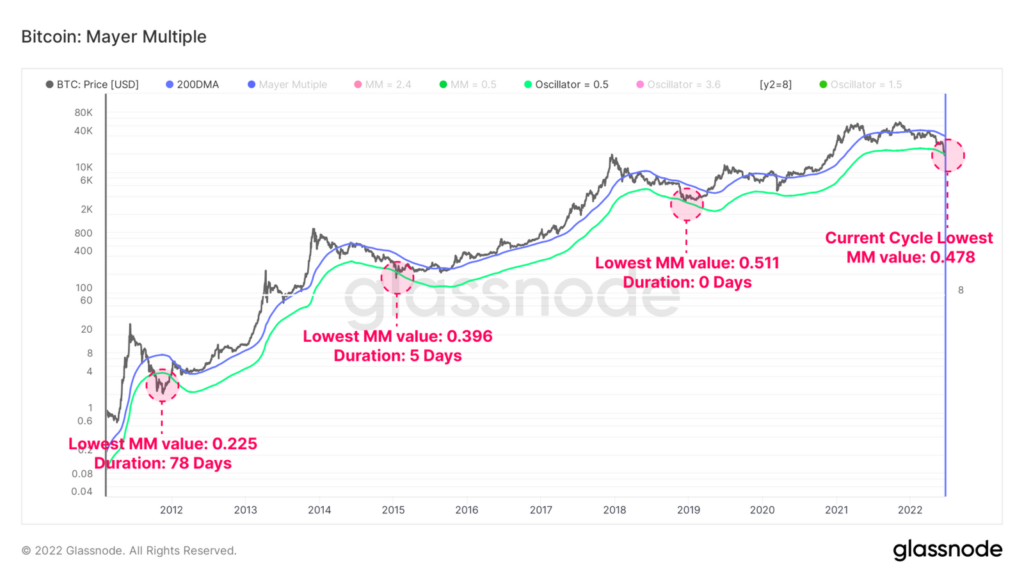

The first indication that the firm talks about is the Mayer Multiple, a statistic generated from the 200-day simple moving average. This is among the most frequently used indicators in Technical Analysis. The 200d MA is widely used to signify a technical bull/bear cycle breakdown.

This approach has held true for Bitcoin’s large-scale price behavior over the years. Using the 200-day MA as a long-term benchmark, the Mayer multiple (MA) measures price deviations on each 200-day MA to indicate overvalued or oversold circumstances.

Perhaps for the first time in history, the 2021-22 cycle’s MM value (0.487) was lesser than the earlier cycle’s bottom (0.511). Only 84 out of 4160 days of trading (2%) had a closing MM value less than 0.5. The figure below depicts a target price in green equal to an MM value of 0.5, as well as the number of days that stayed below it throughout history.

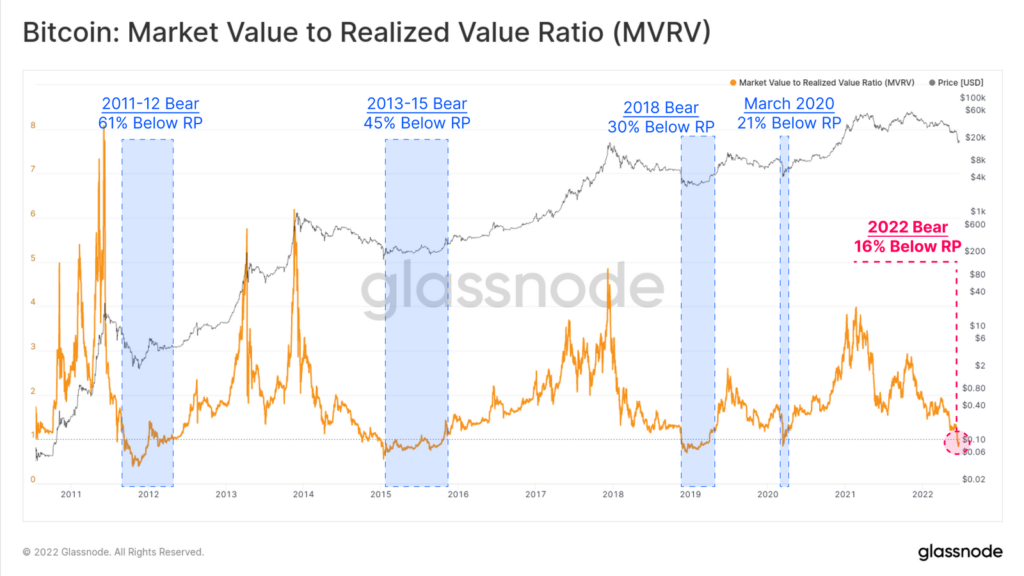

The company examines improvements to bitcoin’s core value concepts using on-chain searches based on current bitcoin ownership and spending habits. Spot prices are currently trading 11.3% below realized cost, indicating that the valued investor in the market is now deep in the red.

Next is the MVRV Ratio, an instrument that compares the Market Value to the Realized Value in a ratio. This enables everyone to see big differences from the average.

The chart below illustrates blue areas when spot prices were lower than realized prices. These occurrences represent 604 of the 4160 daily closings or 13.9% of trading days.

These situations are intensified by investors who have locked in their deficits on the largest cryptocurrency by market capitalization. After Bitcoin plummeted under $20,000 in June 2022, Glassnode reported that BTC traders had suffered “the greatest day USD denominated realized drop in historical past:”

After taking into account all the adverse measures, Glassnode concludes that the economy is now in the midst of a crisis phase.