Several digital assets, including Bitcoin and Ethereum, have been affected by the recent crypto crash that has captured the attention of the entire globe. Ethereum almost reached its 2017 lows at $880 during the “crypto winter.” After reaching its all-time high in November of last year at $69,000, BTC lost about 50 percent of its value.

Currently, the market is recovering and BTC is strengthening above the $20,000 cap. Alternative cryptocurrencies are gaining momentum with fringe benefits as they follow in the footsteps of BTC. As of this writing, BTC is trading at $20,778 and is down more than one percent in the past 24 hours.

Price Declines Call for Liquidations

It’s possible that a sharp decline in market capitalization, together with a number of liquidations and margin calls received by businesses owning digital assets or maintaining open long positions, scared away institutional investors, causing the industry to lose close to $500 million.

The outflows began on June 17 but have only just been acknowledged, according to Coinshares, due to delayed reporting from institutional and corporate investors. The crash of the Bitcoin and cryptocurrency market is the main cause of this, as already indicated. The data indicates that Bitcoin was the main target for exits.

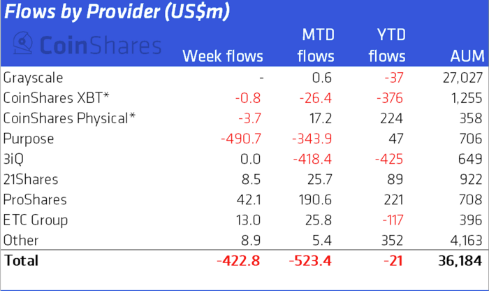

The Purpose Bitcoin ETF is the largest provider of outflows, with outflows totaling $490 million WTD and a negative $343 million month-to-date flow. Only the Short Bitcoin asset, which exposes investors to “Bitcoin short orders” and enables profiting from a declining asset, witnessed inflows.

In terms of geographic origin of outflows, Canadian exchanges, where there was significant outflow activity on June 17, are the main sources of negative volume. Fortunately, given that the market was already recovering, we shouldn’t expect to see such large pullbacks in the next report. We should rather anticipate neutral or positive dynamics on institutional addresses.