Crypto winter is temporary. Uses of the blockchain are steaming ahead, says Johannes Schweifer, CEO and Co-Founder of CoreLedger.

With financial markets in disarray and gloomy sentiment, crypto and blockchain hype and speculation have stalled. Gone are the days when NFTs could easily fetch millions of dollars. Today, digital images of cute animals or meme culture are increasingly branded as scams amid the backlash of declining crypto markets.

Thankfully, there is a silver lining to every dark cloud. Bear markets signify the start of building season. A new generation of builders can surface. Companies buckle down and focus on continuing to build practical innovations that will bring about utility and greater efficiency. They can overcome some of the biggest challenges we face today.

NFTs are just one small application of tokenization. Many different objects apart from art can be turned into digital tokens. This allows any asset to become accessible and tradable on the blockchain.

So where exactly are these practical innovations being developed? Here are some examples of how blockchain for enterprise is steadily becoming a critical aspect of our lives.

What is Crypto Winter? Agriculture in emerging economies

As we generally recover from the pandemic, farmers are grappling with a plummeting peso amid financial uncertainties in Argentina. Inflation is over 50%. Over 40% of soybean oil and meal production comes from Argentina. This puts pressure on farmers to liquefy their real and physical assets. This also makes them vulnerable to undercutting by intermediaries.

This is a prevalent issue for agriculture and livestock particularly in emerging economies. Their fiat currency is constantly being devalued. By tokenizing agricultural assets, farmers can potentially hedge against inflation.

Blockchain technology also allows them to access capital provided by domestic and international investors via blockchain. This is a solution that has been used on cattle ranches in Bolivia. Investors around the world can participate through a tokenized revenue participation model. This is where each token represents a percentage of revenue or a digital barter.

Crypto Winter? Digital Swap is Surging Forward

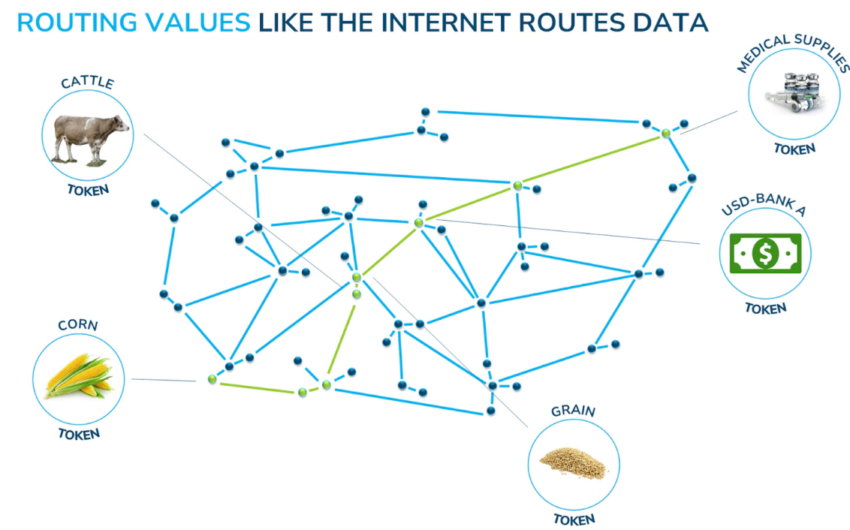

So how can this be possible? All that is required is a digital swap technology to increase liquidity in a token economy by enabling instantaneous value-conversion. This facilitates a peer-to-peer (P2P) exchange of contracts that allows parties to trade tokens of different values. It chains together any number of swaps and payments and picks the optimal path through thousands of available trades based on set criteria, as shown in the diagram below.

Essentially, it makes anything transactional to anything else. While this development is exciting, much more needs to be done to develop an awareness of the technology to realize its full potential. The more possible professions, the more useful it becomes.

More efforts between companies, regulatory bodies and institutions are also needed to facilitate this. There needs to be a change in the perception of the technology – from fearing the unknown, to an understanding of its benefits to establish suitable guidelines.

Although still relatively experimental, the total market for tokenized assets is estimated at less than $20 billion. The total size of the digital asset market can be as high as $350 billion, highlighting the huge room for growth that can be achieved.

Crypto Winter and Combating Climate Change

Another critical area currently witnessing successful experimentation with tokenization is in combating climate change. Carbon credits are measurable, verifiable emission reductions from certified climate action projects. Companies can reduce, remove or avoid greenhouse gas (GHG) emissions using them.

They are transferable instruments certified by governments or independent certification bodies to represent an emission reduction of one metric ton of CO2, or an equivalent amount of other GHGs. The owner of a credit can thus use a credit to offset his own GHG reduction objectives.

Tokenizing carbon credits aims to overcome issues of poor credit quality, operational transparency and project measurements and evaluation. By tokenizing credits, blockchain enables greater transparency and integrity across markets. Data is stored in a way that eliminates double counting while making them tradable and accessible globally.

There are up to 22 million credits withdrawn already on the blockchain. The introduction of decentralized protocols integrating with carbon credit markets has sparked new ideas on how to create greater transparency and accountability. This while providing ways to meet the growing demand that will attract more capital to climate-positive projects.

This is where regulatory bodies and companies need to work together to eliminate opacity to achieve a net positive to the environment.

Protection of intellectual property (IP)

Legal documents and other forms of agreements or contracts are often shared in printed form to ensure confidentiality and immutability.

Tokenization allows any asset to become accessible and tradeable on the blockchain. Documents and other forms of data allow businesses to instead utilize tokenization for stronger digital security and safe transferring of data.

Records on the blockchain are immutable (they cannot be modified and only added). This offers proof in a validatable way without the need for an intermediary or notary, whether in the form of digital claims, certificates or proof of ownership.

This levels the playing field for managing copyrights and Ips. Legal fees to establish proof of ownership in lengthy lawsuits can be prohibitively expensive. Singers looking to preserve the originality of their work and scientists looking to patent their technology may have an additional means of doing so, in addition to traditional methods.

This has been experimented with since 2019. Various countries and regions have different policies governing digital records on being legally binding. This is steadily changing as the complex underlying technology is being converted into easy-to-use apps which provide a seamless user experience.

Even traditionally conservative jurisdictions such as China have started to embrace blockchain to help courts deal with piracy and copyright infringement cases. Blockchain applications in business go beyond the mentioned agriculture in emerging economies. Environmental and IP protection is a great taste of the benefits it can bring.

Blockchain companies need to work together with governments and regulatory bodies to find the most effective and practical ways to implement the technology. This is in order to dispel skewed perceptions and provide suitable guidelines. Only then will we have a secure and sustainable environment to help stakeholders utilize the applications in meaningful ways.