Ethereum, the world’s largest altcoin, has been busy prepping for the much-anticipated Merge as it showcased significant signs. However, the main question is the timeline. The Ethereum mainnet is slated to merge with the Beacon Chain, but the delay has fueled a lot of questions too.

Opportunity cost

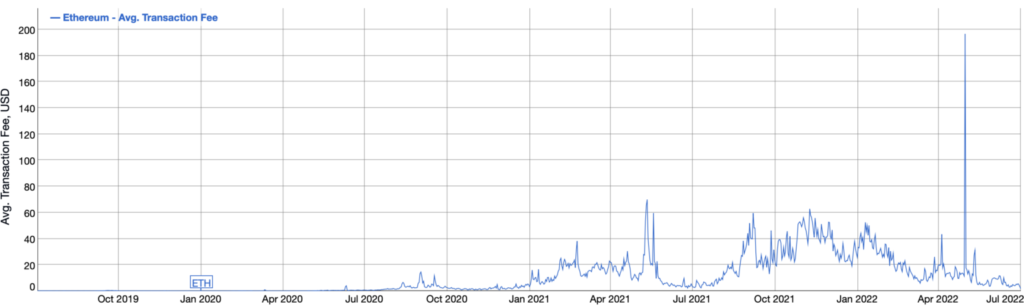

Ethereum’s popularity has grown over the years. The same goes for the cost of doing business on the network – the gas fee, the amount of gwei charged per transaction. Gas charges have been rising steadily, despite declining trends from time to time.

However, this scenario changed as Ethereum’s average gas fees came down to 0.0015 ETH. The average gas fee tapped a new low on 2 July – A level unseen in 19 months or since November 2020.

The aforementioned chart marks a significant drop in transaction fees for the altcoin. Consider This – As of January 2021, Ethereum gas fees have increased due to the hype around non-fungible tokens (NFTs) and decentralized finance (DeFi). This is no longer the case.

Such a decline in the fee structure injects two possible scenarios. The obvious one – It would bring some relief to investors/traders/ETH holders who have faced or rather incurred immense fees.

On the contrary, here is another bereavement scenario – According to DeFi Llama, the DeFi dominance of the ETH blockchain is in decline.

Another reason could be the decline in NFT sales. The NFT ecosystem recorded its worst performance of the year in June 2022 as the total number of daily sales fell down to roughly 19,000 with an estimated value of $13.8 million — A number which was recorded back in June 2021. Moreover, ETH’s network difficulty painted the same picture as well.

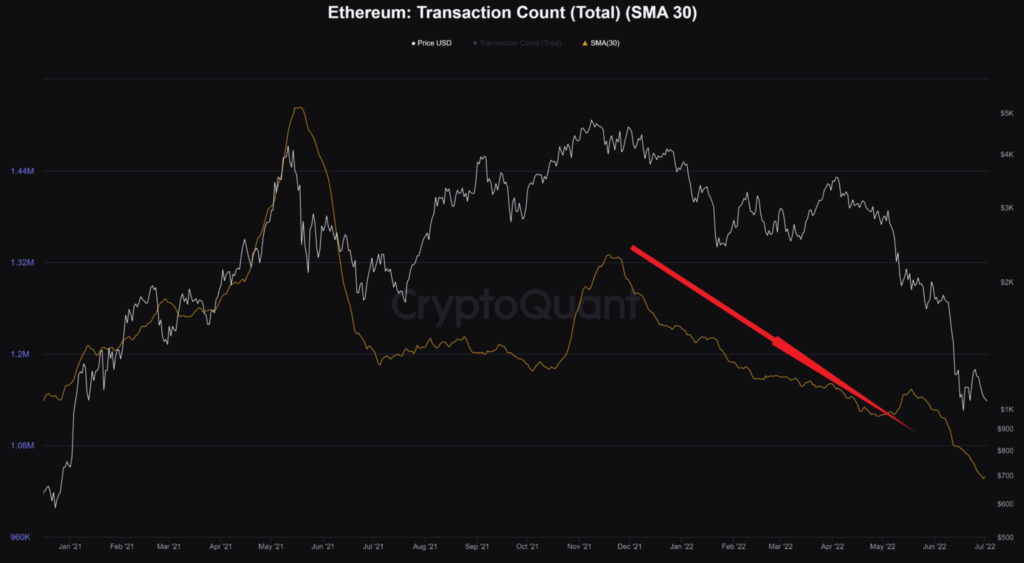

Moreover, the number of ETH transactions also fell sharply and reached its lowest level in the past year.

After hitting an all-time high in November 2021, the metric has barely seen any sunshine. As can be evidenced from the past, price uptrends remain associated with an increasing number of transactions. Unfortunately, this isn’t the case here.

From south to north

The next merge could be the saving grace here. The total value locked in the ETH 2.0 deposit contract continues to register new all-time highs. As of July 3, the latest statistics had recorded an impressive figure.

The number of staking ETH 2.0 deposit contract addresses reached 12,992,901. Furthermore, the staking rate surpassed the 11% mark.

This means that more than 11% of the ETH currently in circulation is deposited in ETH2.

Overall, ETH has incorporated or shown signs of the upcoming Merge. That being said, the delay here has fueled some significant bearish narratives.

Top of Form