Ethereum [ETH] crossed $1,500 on 19 July after it last crossed the mark on 12 June. This comes following the massive bull run from the level of $1,100 after the update related to the Merge came to the fore.

However, the crowd’s disbelief is evident on social media, as the latest on-chain data shows. Moreover, the average returns on Ethereum have also increased with rising prices. Traders’ average 30-day ETH return rose to 28%, the highest since August 2021.

No backing down now

Despite signals for a drawdown, a few metrics are suggesting encouraging signs across the ETH network.

The current relief rally during this bearish cycle has also contributed to Ethereum’s growth in recent days. So what does all of this mean for Ethereum now under these circumstances?

Recent Glassnode tweets provided data to analyze Ethereum’s current price trajectory.

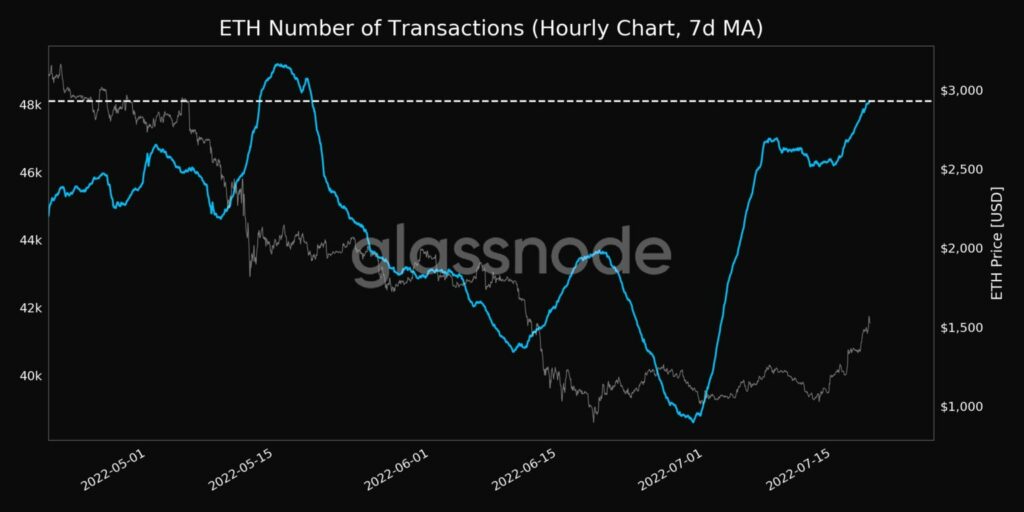

The number of transactions (7d MA) on Ethereum hit a one-month high of 48,100 on July 19, with traders participating in buying and selling to seek profit or cut losses.

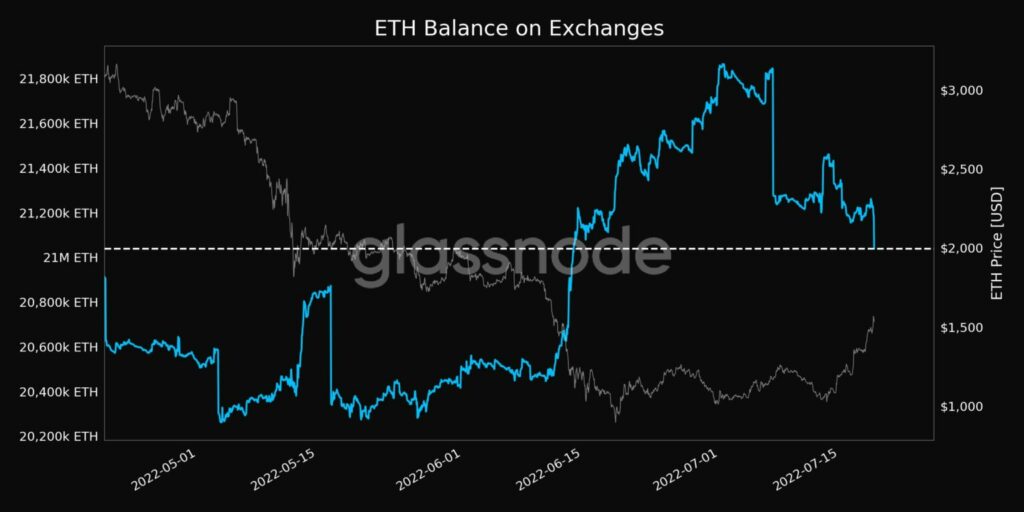

Furthermore, a bullish indicator was the decreasing balance on exchanges, which reached a one-month low of 21,039,062.196 ETH on 29 July.

This refers to the trend of pulling holdings from exchanges for long-term commitment to the network. The previous 1-month low of 21,155,053.268 ETH was seen three days ago on July 16.

Mixed signals now, is it?

Ethereum finds itself in a similar position again. With conflicting indicators, there is now growing confusion about whether the Ethereum bubble will burst or not.

Ethereum whales are also starting to show interest in the recent gathering with over 131 whales returning to the network recently.

ETH could see a near-term slowdown before picking itself up again.

Finally, investors/traders should pay attention to the movement of Bitcoin. Indeed, ETH shares a whopping 81% 30-day correlation with the king coin.