During the last month, the stablecoin economy’s market valuation dropped from $155.23 billion to $153.34 billion on July 20, sliding roughly 1.21%. The top two stablecoins by valuation, tether and usd coin, have seen their market caps slide over the last 30 days, while BUSD and DAI have seen increases.

Stablecoin Markets Lose Nearly $2 Billion, Stablecoin Token Dominance Equivalent to 14.16% of Entire Crypto Economy

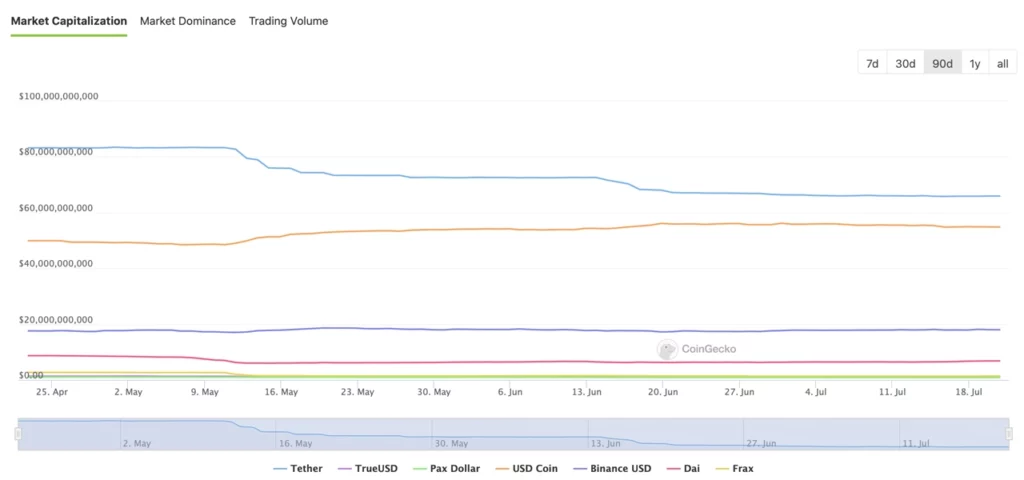

Statistics show that on June 23, 2022, the market capitalization of the entire stablecoin economy was around $155.23 billion. Since then, $1.89 billion has been cleared, as the Wednesday, July 20 stablecoin economy is around $153,349,982,002. Part of the 1.21% reduction stems from the 30-day reductions in Tether (USDT) and USD Coin (USDC).

For instance, USDT’s market valuation dipped by 3.1% last month, and USDC’s slid by 2.4%. The Waves network-based neutrino usd’s (USDN) market cap decreased by 5.7% during the last 30 days. Tether (USDT) is still the largest stablecoin market valuation, but USDC is getting closer to the same capitalization. USDT’s market cap this week is $65.78 billion while USDC’s is 16.84% less at $54.70 billion.

On July 20, the entire stablecoin economy recorded a global trade volume of $84.99 billion, while USDT captured $70.82 billion of that trade volume and USDC recorded a global trade volume of $7.53 billion. The two tokens dominate stablecoin trading volumes globally with 92.18% of global trading volume in the last 24 hours.

Meanwhile, the Binance-backed stablecoin BUSD saw its market capitalization increase by 3.5% to $17.95 billion. BUSD has seen more 24-hour trade volume than USDC as $8.65 billion in BUSD trade volume was recorded. Makerdao’s DAI saw an 8.8% market cap increase during the past month. At the time of writing, DAI has around a $6.81 billion market capitalization and roughly $330 million in global trade volume.

The stablecoin dola Inverse.finance (DOLA) saw its valuation inflate by 113.5% last month. The two stablecoins Synthetix.io susd (SUSD) and seur (SEUR) both recorded double-digit increases in the last 30 days. The valuation of the SUSD increased by 29.3% and the market capitalization of the Euro token Synthetix.io SEUR jumped by 23.5%.

Furthermore, Tron’s USDD has captured the ninth position in terms of stablecoins by market cap. Abracadabra’s stablecoin MIM was once a top ten contender but is now the 13th largest stablecoin by market valuation. While the size of the stablecoin and crypto economy, in general, has been reduced, stablecoins are very prevalent in the markets and industry today.

With USDT and USDC capturing 92.18% of the $84.99 billion in global trade volume, the overall global stablecoin trade volume accounts for 70.37% of the $120.76 billion in trade of the day. Additionally, USDT’s market dominance is 6.089% of the crypto’s net worth, while USDC’s valuation is equivalent to 5.09%. The entire stablecoin economy represents 14.16% of the $1,082,553,811,424 value recorded on July 20.