Ethereum, the largest altcoin might just be in for a bouncy ride despite the hype around the upcoming Merge. Well, Ethereum failed to settle above the $1,620 zone yet again.

Do you believe me?

The flagship coin took quite a trip on July 24, jumping above $1,640 before falling back down to $1,540.

In the anticipation of Merge, the crypto market was expecting ETH to break above its current resistance of $1,620. But at press time, ETH was back in the negative zone. Hence, the trading crowd abstained from believing the hype surrounding Merge.

In fact, the crowd expected prices to fall before the FOMC meeting as evidenced by the grim scenario in the table below. ETH weighted sentiment has fallen into “super” negative territory, at the time of writing.

In the current market structure, traders are pessimistic about ETH’s chances of showing a price rise.

For context, at the next meeting (FOMC of the Fed), 78% high interest rates of 75 basis points and 21% of 100 basis points are expected. In addition, this week the QoQ Adv Q2 US GDP Growth Rate and June Core PCE Price Index will also be announced.

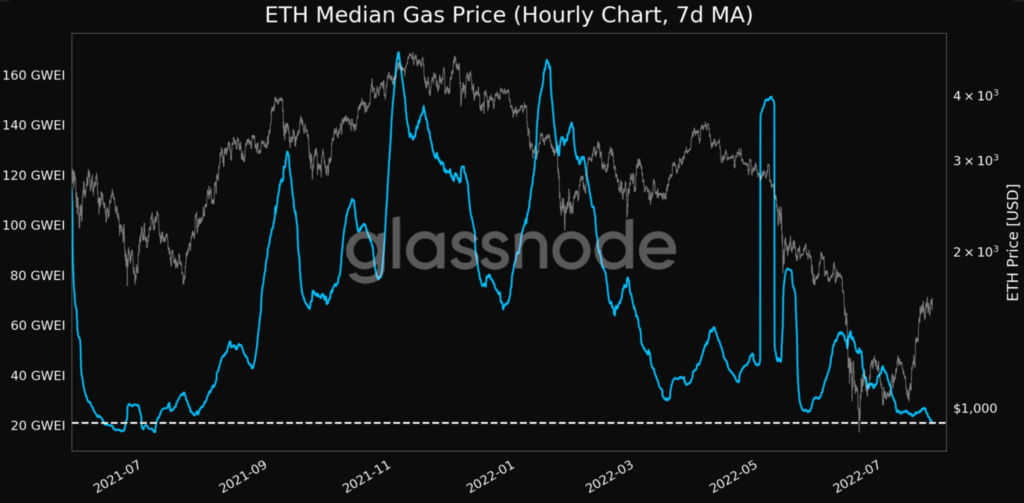

Meanwhile, on 25 July, Ethereum’s seven-day average gas fee reached 25.825 Gwei, a record low in a year.

On July 24, the minimum gas fee was reduced to 3 gwei, the press time gas fee was 4 gwei, while the ETH transfer cost was $0.51, and the ERC20 transfer cost was $0.51. $1.

This goes to showcase the declining demand for ETH.

Additionally, the total value locked in DeFi smart contracts fell from $98.4 billion to less than $50 billion. According to DeFiLlama, the DeFi dominance of the ETH blockchain is in decline.

Moreover, the decline in NFT sales raises a similar concern.

Nonetheless, ETH holders continue to exercise faith despite bearish market signals. In fact, at press time, the number of non-zero addresses achieved an all-time high (ATH) of 84,381,102 on Glassnode.