In the event you zoom out ETH’s chart, you’ll discover that its efficiency in July is similar with its efficiency in March. May this efficiency provide some insights into how ETH will carry out in August?

ETH’s latest rally started in mid-July and managed to propel the crypto up to 74%. More importantly, its price was trapped in a low-volatility range after its sharp crash from April to June.

Equally, ETH rallied by roughly 42% from round mid-March, after being caught in a low-volume vary. It was preceded by a pointy crash between November 2021 and January 2022.

If ETH follows the same pattern as it did in March, August should give a bearish performance. While this is entirely possible, most of the dynamics currently driving its price action are now different than they were in March.

The 2 sides of the coin

One of many primary variations is that ETH has virtually doubled its drop from the ATH. Ethereum plans to roll out the ultimate testnet known as Goerli in direction of the top of the primary week of August. The mainnet Merge is predicted to happen in September. This implies August is a vital month for the community and the altcoin.

The cryptocurrency often rallies weeks before going through a major upgrade to its core network. The merge is the largest network upgrade in the history of Ethereum. Based on this, we can expect ETH to attract a lot of buyers in the weeks leading up to the merger. Perhaps, this will encourage investors to hold on to their ETH rather than sell before the merger.

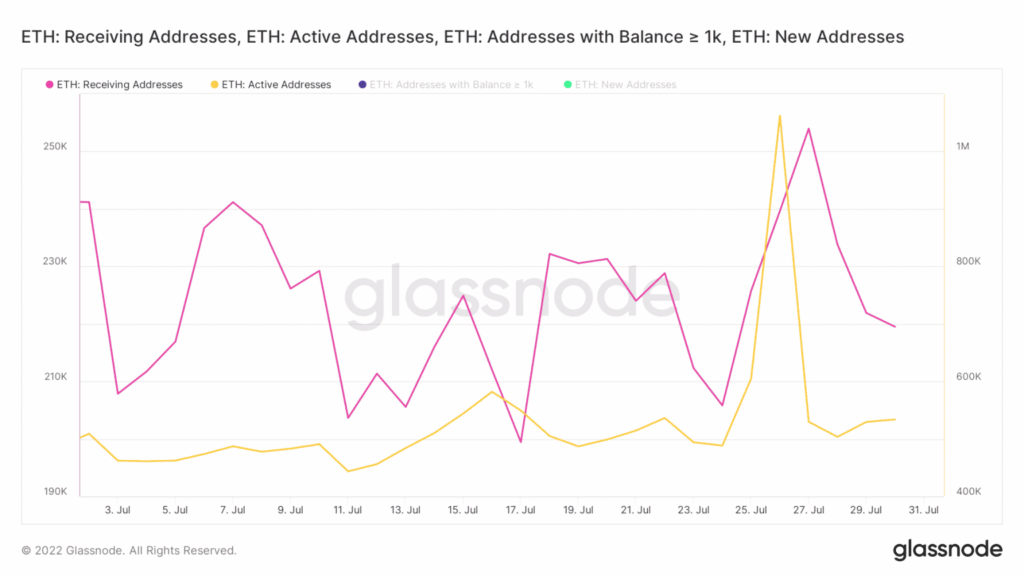

The aforementioned expectations are according to ETH flows, particularly over the previous couple of days. Regardless of its rally, nonetheless, the variety of energetic ETH addresses and receiving addresses fell barely within the final 4 days. That is doubtless as a result of traders anticipate some promote strain close to the present month-to-month high.

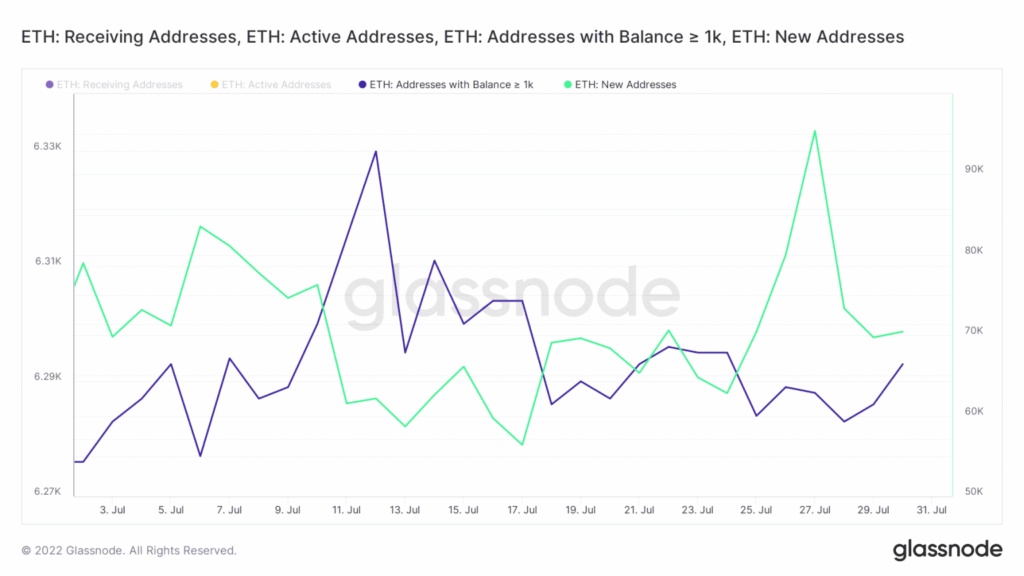

New addresses and addresses holding more than 1,000 ETH also fell, but they have already started to recover.

This confirms that the demand for ETH is robust, particularly now that the community is within the final stretch earlier than the Merge date.

conclusion

The impact of the merge on the price behavior of ETH cannot be overestimated. However, investors should note that ETH is still heavily tied to the rest of the market. Ergo, several pricing factors will affect its performance. However, a large drop would be seen as an opportunity for investors to raise ETH at a discount. Such a situation means that ETH can maintain a healthy floor price.