On October 25, the bitcoin mining operation Cleanspark announced that the firm’s hashrate now exceeds 5 exahash per second (EH/s), a milestone achieved more than two months ahead of the company’s original year-end goals. Cleanspark says it now aims to surpass 5.5 EH/s by the year’s end by increasing the miner’s hashrate goal by 10%.

Cleanspark aims to achieve 5.5 EH/s by the end of 2022 after raising the target by 10%

CleanSpark (Nasdaq: CLSK) announced on Tuesday that the bitcoin miner has exceeded its year-end goal of maintaining 5,000 petash per second (pH/s), which is equivalent to 5 EH/s. The company intended to meet the 5 EH/s target by the end of 2022, and now plans to add an additional 10% hashrate to year-end guidance. The news follows the company completing the acquisition of Mawson Infrastructure Group’s Georgia-based bitcoin mining facility, a data center that came with 6,500 mining rigs.

Cleanspark is one miner that’s managed to weather the crypto winter and further used the downturn to the company’s advantage when it obtained miners at a “discounted price” in July. Other bitcoin mining firms in 2022 have not fared as well, as liquidations and bankruptcies have shaken the mining industry.

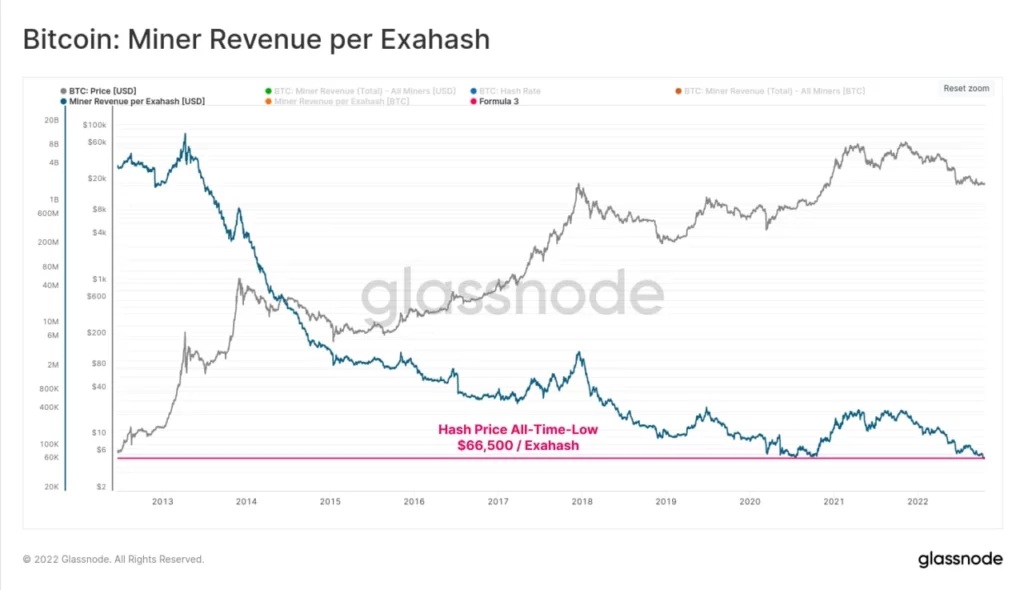

Furthermore, crypto analytics and onchain market intelligence company Glassnode explained via the firm’s Telegram channel on October 25 that bitcoin mining profits have diminished over a lifetime. Glassnode said:

The Bitcoin Hash Price has reached an all-time-low of $66,500 per Exahash. This means that [bitcoin] miners are earning the smallest reward relative to hashpower applied in history, and likely puts the industry under extreme income stress.

CleanSpark CEO Zach Bradford explained on Tuesday that his company has managed to buck the cryptocurrency winter trend that has wreaked havoc on participants in the bitcoin mining industry. “The acquisitions of the Washington and Sandersville facilities, as well as our hash rate growth over the past few months, have helped, but that’s only part of the story,” Bradford said in a statement on Tuesday.

“This milestone reflects operational prowess and efficiency gains that I believe are unmatched in our industry. In a period where the sector is experiencing reversals in forward-looking expectations, we are bucking that trend,” the Cleanspark executive added.

Meanwhile, shares associated with publicly listed mining companies such as CLSK have risen against the US Dollar as Bitcoin (BTC) crossed the $20K area again on Tuesday afternoon. The 30-day data shows CLSK is up 10.54% from the previous month, however, six-month metrics show that CLSK is down 50.85% against the greenback.

A variety of other mining company stocks such as MARA, RIOT, DMGGF, ARBKF, and CORZ have all seen 24 hour percentage increases against the U.S. dollar thanks to BTC’s rise on Tuesday. Bitcoin’s total hashrate on Tuesday, October 25, is around 240 EH/s following the network’s recent 3.44% difficulty rise two days ago.