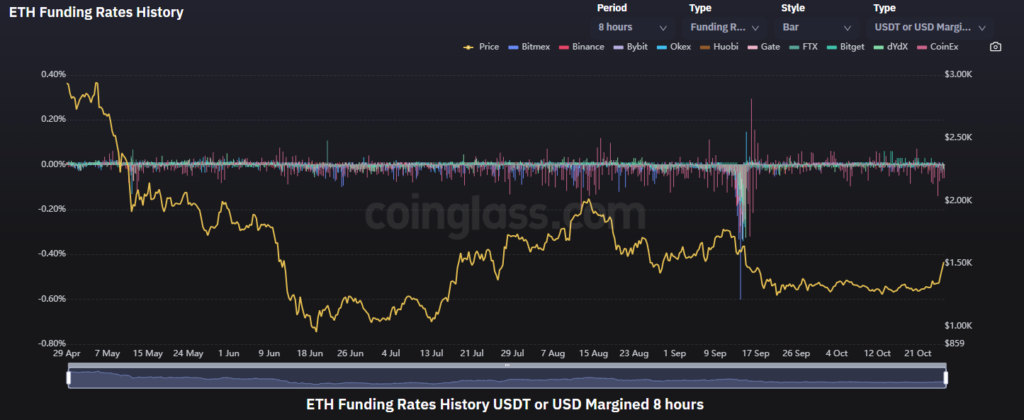

Shorting volume is rising despite positive price performance

Ethereum is being heavily undervalued by most market participants following the rapid change in cryptocurrency funding rates. In the past 24 hours, adding more bears to the second largest cryptocurrency by market has become even more expensive.

Ethereum’s price performance in the last two days and the composition of orders on the market might cause a bit of confusion, as the most recent breakout should have caused a surge in the number of long orders on the market.

Unfortunately, most market participants decided to short the second largest cryptocurrency on the market instead of opening longer ones to support the rally. However, this could lead to a small squeeze which will act as fuel for volatility and a possible continuation of the rally.

To cause forced liquidations on the market, Ethereum needs massive inflows from institutional investors, preferably as whales and large retail investors will not be able to provide as much buying support as may be needed to push ETH to new local highs.

As per the volume profile, Ethereum saw a large increase in positive trading volume, which has been the underlying reason behind the unexpected breakout. However, indicators such as the Relative Strength Index suggest that ETH is already overbought, which shows why some traders are so actively shorting it.

Buterin’s cryptocurrency previously showed a similar dynamic on the market when it broke through the same resistance level on Sept. 11. The behavior of investors was somewhat similar to what we are seeing today, and bears’ activity has also increased drastically, causing a reversal shortly after the breakthrough.

At press time, Ethereum is trading at $1,510, up 3.45% over the past 24 hours.