The Bitcoin market is far from being overheated, according to CryptoQuant analyst Ki Young Ju

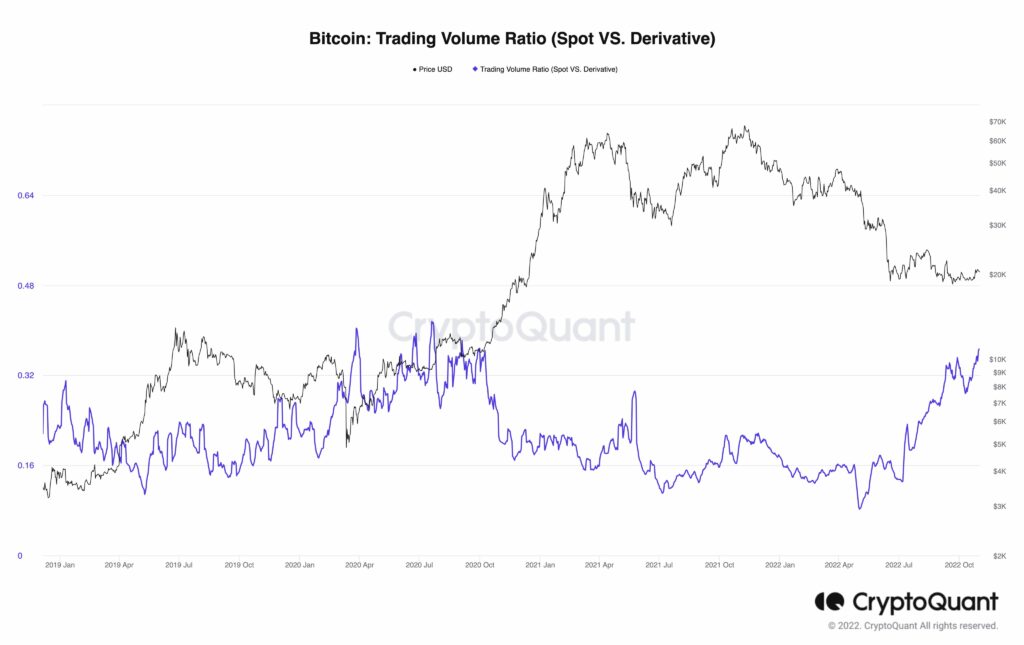

Ki Young Joo, co-founder of cryptocurrency analytics firm Cryptoquant, claims that spot trading volumes for derivatives have reached their highest level in two years.

This indicates that the market is actually overcold, according to Ju.

as Reported by U.TodayBitcoin futures are now mostly traded by whales, which suggests that the largest cryptocurrency is currently in the midst of another accumulation cycle.

Retail investors have now mostly abandoned the futures market following the recent price crash.

As Xu mentioned, when the crypto market heats up, people trade futures with high leverage.

Last month, Bitcoin-denominated futures open interest managed to reach a new peak even though volatility remains low. In fact, for the first time since 2020, the world’s largest cryptocurrency is now less volatile than the S&P 500 stock market index.

The fact that trading volumes remain consistently high sets this bearish cycle apart from the 2018 crypto winter.

In late October, Arcane Research analyst Vetle Lunde suggested that the cryptocurrency market was likely to see “explosive” volatility due to growing futures open interest.

Bitcoin managed to finish last month in green After two red monthly candles in a row. At press time, the largest cryptocurrency is trading at $20,440 on the Bitstamp exchange.