Bitcoin (BTC) price has retracted from trading above $21k, but on-chain data suggest further upside remains at play.

The instrument was trading around $20,730 hands during early Asian and London trading sessions, down about 2.2 percent over the past 24 hours.

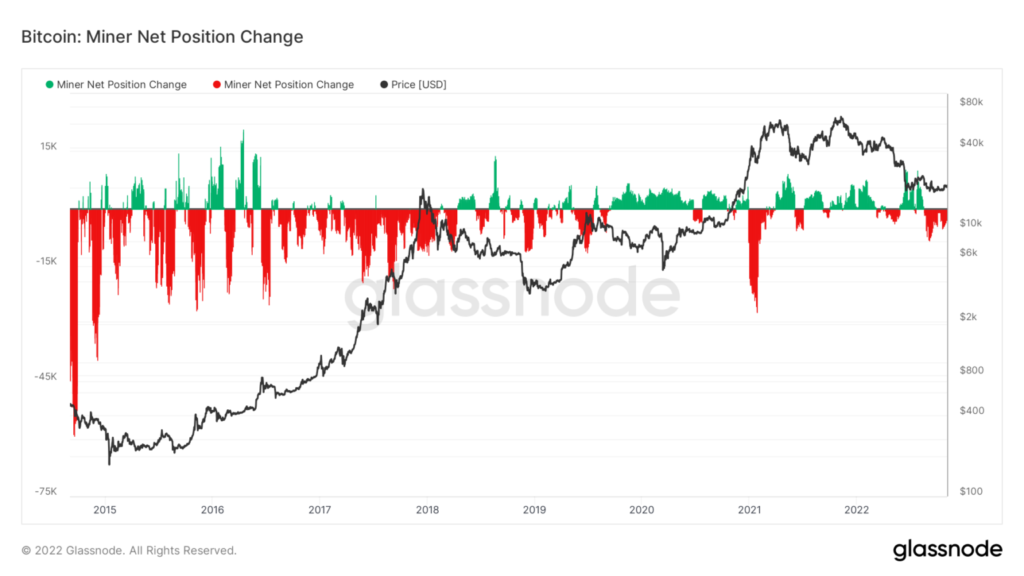

However, statistical data provided by Glassnode shows Bitcoin miners have been selling at unprecedented rates not recorded before 2021.

Historically, data from Glassnode has shown that whenever there is sustained high selling pressure from bitcoin miners, the underlying asset price reacts with a bull case.

For instance, there was a prolonged sustained Bitcoin selling pressure from miners during the 2017 bull market.

Furthermore, bitcoin miners sold more coins in 2021, when bitcoin hit its all-time high of around $69k. Glassnode data, on the other hand, shows that the price of bitcoin drops whenever miners hoard assets for a longer period of time.

For instance, in 2020, Bitcoin miners were invoked in a long phase of the positive net position change. Consequently, Bitcoin price reacted with a dip which has come to be referred to as Black Thursday.

The immediate and persistent question is whether the bitcoin price will continue with the bullish scenario of the past two weeks. Most importantly, the price of bitcoin could invalidate historical data and could fall further in the coming weeks, as seen in 2015.

Bitcoin and Crypto Market Outlook

Bitcoin has remained in the top position since its inception despite the increasing competition in the altcoins market. Arguably, the store of value has made Bitcoin more popular with retail, institutional investors and, recently, global nations.

As such, miners have more options to sell their assets with minimal volatility. Furthermore, as the bitcoin market matures, less volatility is recorded as compared to low-cap crypto assets.

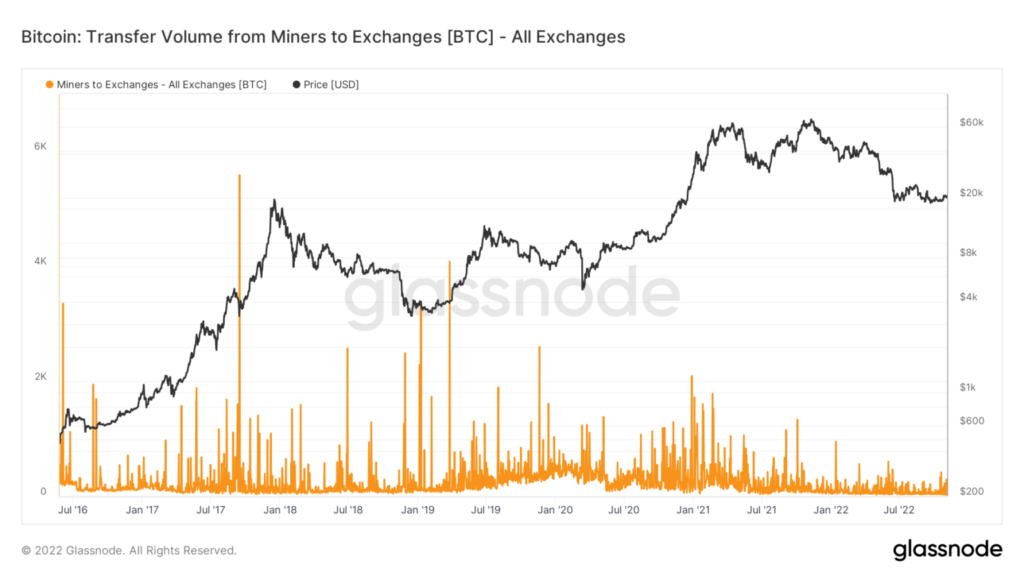

Notably, Glassnode data indicates that transfer volume from Bitcoin miners to all cryptocurrency exchanges has declined in 2022 compared to prior years.

While the volume of bitcoin transfers from miners to all cryptocurrency exchanges has declined over the past year, the underlying asset value has fallen. Nonetheless, the number of active bitcoin addresses has grown exponentially over the past few years.

According to on-chain statistical data from Tokenview, the total number of active Bitcoin addresses currently stands at 49,873,427.

Thereby increasing the aggregate demand for bitcoin while the miners ease their usual selling pressure and become long-term holders.

Meanwhile, the Bitcoin mining hashrate currently stands at 264.12 (EH/s), with the total difficulty at around 36.77 (T).