Following the collapse of FTX and the exchange filing bankruptcy on Nov. 11, the trading platform’s exchange token called ftx (FTT) has shed 91.6% in value during the last seven days. While the FTT token’s utility is based entirely on the backing of the now-bankrupt FTX and Alameda Research, the token is still trading for $1.85 per unit. Moreover, FTT’s deployer contract surprisingly unlocked 192 million FTX tokens on Nov. 12, 2022. While a few crypto exchanges have halted FTT deposits, crypto coin aggregation sites like coingecko.com have flagged the number of coins in circulation.

A Suspicious FTT Unlocking Event Puts the Crypto Community on High Alert

One Touch After 9:00 PM (ET), The Crypto Community noticed that the ftx (FTT) Deployer Contract transferred 192 million new FTT tokens. No one knows why this happened, but it added 192 million already locked tokens to the supply of 133,618,094 FTT that was circulating before the transfer last night.

Coingecko.com’s website notes that the “FTX token Contract Deployer has transferred out the entirety of supposedly locked FTT tokens into circulation.” In a now-deleted tweet, Binance CEO Changpeng Zhao (CZ) tweeted that Binance has halted FTT deposits. CZ said:

Binance has turned off FTT [deposits]in order to stop [the] Suspected excess supply likely to affect the market. We will monitor the situation.

Similar to the Terra fiasco, the FTX implosion took place in a matter of six days after Alameda Research’s balance sheet was made public, and Binance CEO Changpeng Zhao told the public his exchange would be dumping all of its FTT tokens.

On November 5th, 2022, ftx (FTT) was trading at $25 per FTT and as of November 8th, it was below $5 per coin. FTT, a token launched shortly after FTX was formed, was privately launched in July 2019 by the FTX and Alameda teams.

FTX White Paper Claims FTT Is Backed by an ‘All-Star Team’

FTT was made to give owners FTX-based rebates when they traded on the exchange or leveraged FTX OTC. Anyone holding between $1 million to $5 million worth of FTT could get automatically upgraded to a VIP status if they used both services.

Of the initial 350 million FTT tokens, 175 million were designated as “company tokens that unlock over a three-year period”. According to FTX’s transparency page archived at archive.org, 73,461,920 FTT tokens were sold and staked as of “July 21, 2019”.

While ftx (FTT) tokens offered rebates for FTX users and VIP perks for large holders, FTT’s white paper highlights that most of FTT’s value stems from an “all-star team.” The FTT white paper says that FTX is backed by Alameda Research, the quantitive crypto trading platform started by Sam Bankman-Fried (SBF).

“Almeida trades $600 million to $1 billion a day, roughly 5% of global volume, and ranks second on the BitMEX leaderboard,” the white paper claimed.

Following the drop below $5 per coin on Nov. 8, 2022, FTT’s token value is down to under $2 per token. While FTT is down 97.6% from the $84.18 per unit all-time high it reached on Sept. 09, 2021, it’s managed to stave off the extremely fast death spiral Terra’s LUNA (now LUNC) saw when it collapsed.

In fact, anyone who bought FTT before Sep 06, 2019 is still up 74% against the US Dollar. 50 million FTT tokens were sold during the Initial Exchange Offering (IEO) for a price range between $0.10-$0.20.

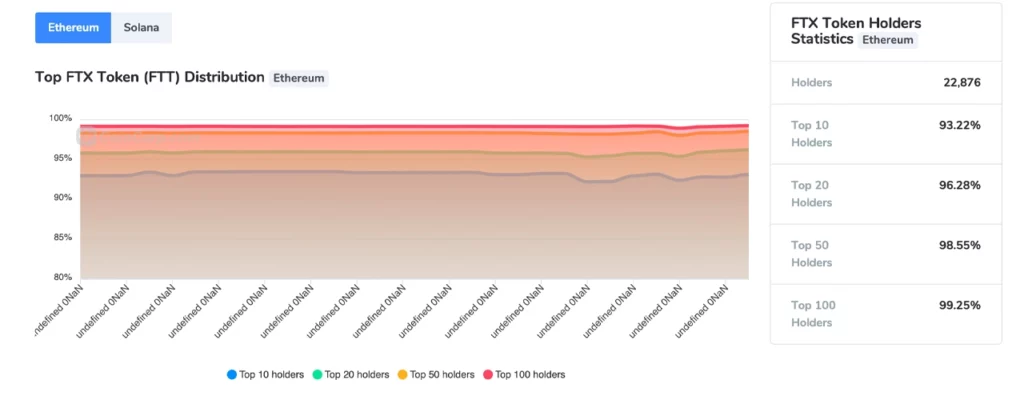

10 Addresses Hold 93% of the FTT Supply — Despite the Negative News, FTT Still Trades for Under $2 per Unit

Data recorded before the deployer unlock had shown FTT once had a circulating supply of around 133,618,094 FTT. The FTT tokens that were purchased in July 2019 unlocked after the listing, “at a rate of roughly 3% per day. FTX also did regular FTT repurchases and burns to bolster the coin’s tokenomics.

According to data from Coincarp.com Richlist, FTT is highly concentrated as 22,837 addresses hold ERC20 tokens and 10 addresses hold 93.22% of the FTT supply. Block data via Markets.bitcoin.com showed 96% of holders were in the red in terms of gains.

Into the Block’s concentration of large holders metrics for FTT is 97% and FTT’s price correlation with bitcoin (BTC) is around 0.9%. In the last seven days, in terms of transactions greater than $100K in FTT tokens, $2.4 billion worth of FTT has been settled this past week.

FTT saw a weekly high of 520 large transactions on Nov 8, 2022 and roughly 21 large transactions in the last 24 hours. The average FTT transaction during the last week was $55,266.27 worth of FTT tokens.

Most of FTT’s trade volume during the last 24 hours derived from exchanges like Binance, Gate.io, Hitbtc, Huobi, and Kucoin respectively. Over 60% of FTT trades are against tether (USDT) which is followed by BUSD, BTC, BNB, and ETH respectively.

Despite all the bad news surrounding the collapse of FTX and the excessive concentration of FTT holders, unlike LUNC, the coin has not dropped below zero. FTT is down over 7% against the US Dollar after news broke about the FTT Deployer contract unlocking the remainder of the locked FTT tokens. During the last 24 hours, FTT was exchanging for $1.79 to $2.20 per unit.