Crypto and Bitcoin critic believes major crypto fund was main reason behind BTC’s rally in 2021

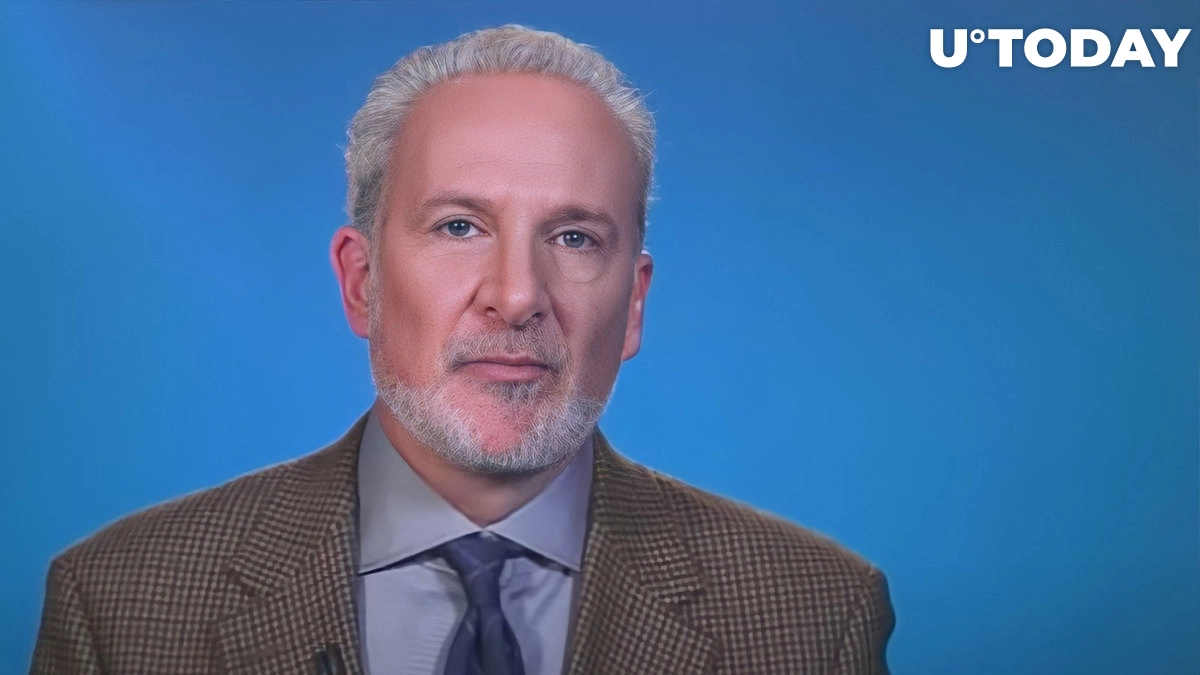

Renowned bitcoin critic and gold advocate hits back at his authority Twitter The account is now saying that the Grayscale Bitcoin Trust was one of the main reasons the first cryptocurrency stalled at around $70,000. He also described a special scheme used by institutional investors.

According to Schiff, Grayscale was actively advertised on CNBC to get the attention of retail investors, who were ready to pay “huge” premiums to the trust’s net asset value. After attracting retail funds, Grayscale issued more shares to institutions and used the proceeds to buy Bitcoin, which directly pushed the price to new highs.

Technically, the Economist is not correct; By issuing more shares, Grayscale was able to raise more capital, which it successfully used to buy up as many bitcoins as possible on the market. Unfortunately, this has played a cruel joke with GBTC holders.

Due to the imbalance between the total number of shares and the net asset value of the trust, GBTC tumbled to sell at a discount and started to underperform drastically against the spot asset, making Grayscale’s fund a questionable way of exposing oneself to the cryptocurrency market.

According to market data, Grayscale’s discount to NAV has reached recently unseen values, reaching as low as 43%. While such a large discount should have attracted institutional traders, the limits the fund imposes on its investors are driving most away, who opt for alternative options such as futures, ETFs or spot exposure.

Recently, rumors around Digital Currency Group suggested that the company is looking for ways to realize their GBTC shares on the open market to cover a $1 billion hole on their balance sheet due to the Genesis liquidity crisis.