About SundaeSwap

SundaeSwap is a decentralized exchange (DEX) built for the Cardano blockchain. Similar to how Uniswap was built for Ethereum and QuickSwap was built for Polygon, SundaeSwap is Cardano’s solution.

SundaeSwap is the first DEX in the Cardano ecosystem. It allows blockchain participants to provide liquidity and create a market for users to exchange their tokens. Similar to Uniswap, users who exchange tokens on the DEX pay a small fee that gets paid to liquidity providers as an incentive for providing liquidity.

SundaeSwap aims to be much more than a simple DEX where users can swap tokens. However, SundaeSwap also plans to feature staking, lending, borrowing, and more. The protocol is defined by a series of immutable, permissionless, and decentralized smart contracts which allow users to trade assets without a third-party intermediary.

The SundaeSwap protocol was released as a testnet in Q4 of 2021, which allowed users to test and play around with the platform. The fully-functional beta DEX was released on January 20th 2022. At the time of writing, the platform is a fully functional DEX. However, there are still improvements and “cherry on top”, exciting features in the pipeline yet to be released.

SundaeSwap Initial Stake Offering (ISO)

Rather than build and manage their own Cardano stake pools, SundaeSwap turned to trusted members in the stake pool community to run stake pools. These stake pools do the heavy lifting when it comes to processing transactions. There are 30 community elected stake pools referred to as “Scoopers,” keeping true to the ice cream theme.

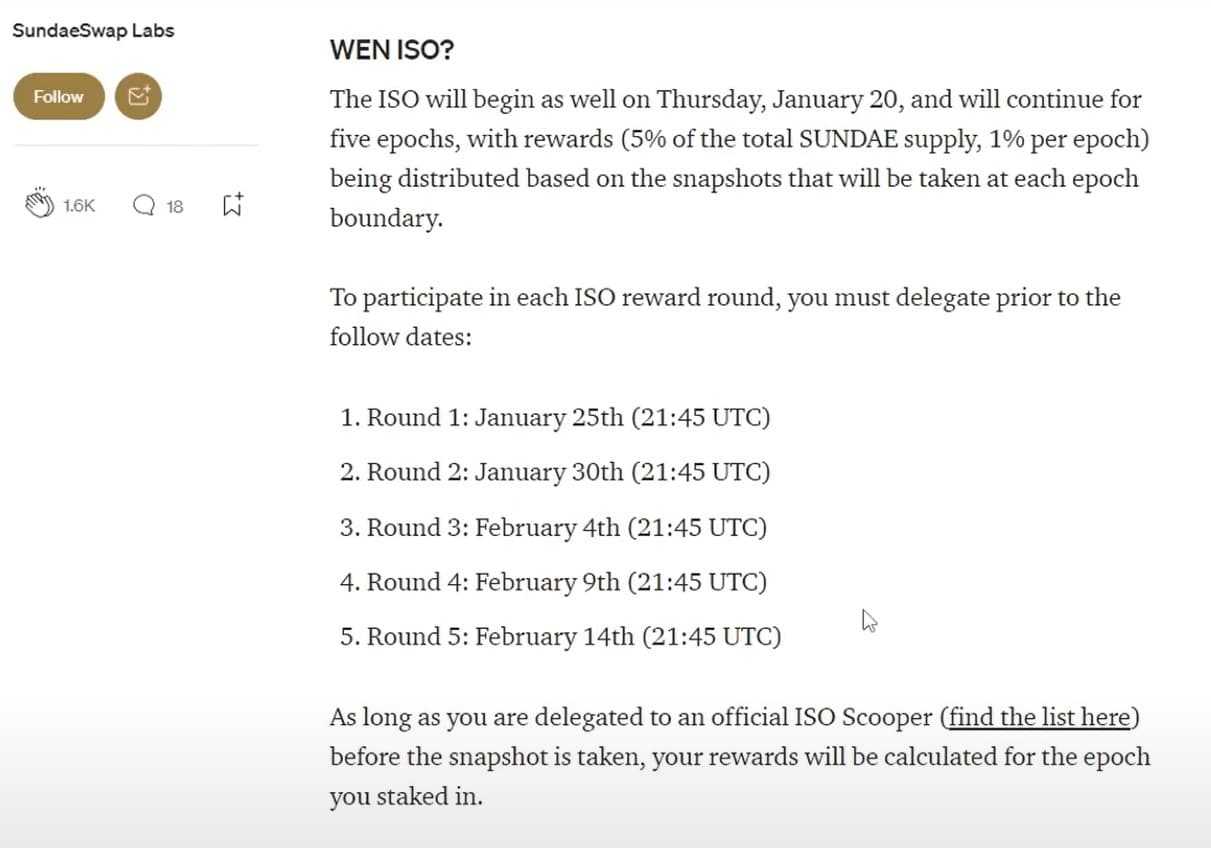

The first round of ISO rewards was calculated on January 25th, and users could participate in the ISO between epochs 316-320. Users who delegated their ADA to qualifying ISO scoopers prior to 21:45 UTC on January 25th could earn SUNDAE tokens for all five ISO rounds.

The ISO began on January 20th and continued for 5 epochs, with rewards (5% of the total SUNDAE supply, 1% per epoch) being distributed based on the snapshots taken at each epoch. Users could participate in the ISO rounds by delegating their ADA to the qualifying Scoopers before the following deadlines:

Getting involved in this ISO would have been a great way to earn some SUNDAE tokens. If you missed the banana boat on the SundaeSwap ISO, no worries, there are plenty of other ways to earn on the SundaeSwap DEX, more on that below. If you are interested in staking ADA into ISPOs for other projects, you can find a Youtube Video from Learn Cardano all about staking ADA into ISPOs.

Getting Started & Wallet Support

Like with any DEX or DeFi protocol, the first thing users will need is a crypto wallet to interact with the platform. The following Cardano wallets are currently able to interact with the SundaeSwap DEX:

- https://ccvault.io

- https://namiwallet.io

Support for additional wallets will be coming soon. In addition, users can import their Yoroi or Daedalus wallet addresses into the Nami wallet. Both ccvault and Nami Wallets are browser extension wallets. Therefore, using them should feel quite familiar for anyone who has used a Metamask wallet with a DEX such as Uniswap or SushiSwap.

Once users have their Cardano wallet of choice, they will likely want to fund the wallet with some ADA before interacting with the DEX. Cardano can be found at most major exchanges such as OKX, Binance, Kraken, Coinbase, Huobi, KuCoin and more.

Once a user has their wallet, and it is funded with some ADA, they are now ready to connect their wallet to the SundaeSwap interface. Once on the SundaeSwap site, users will want to click “connect wallet” in the top right.

SundaeSwap Platform Features

SundaeSwap is a robust platform, more than just a plain vanilla DEX. In ice cream terms, think of SundaeSwap as well… The sundae of ice cream. This is no boring vanilla cone or lame single scoop of strawberry in a cup. Instead, this sundae is complete with all the flavours, sauces, sprinkles, cherries, whip cream and everything an ice cream enthusiast could want.

The SundaeSwap team has even made it clear that they have some extra tricks up their sleeve and holding some cards close to the chest, which makes it sound like some exciting announcements are yet to be made. Enough with the ice cream metaphors; let’s get into the current features of the DEX.

Swap

In case it wasn’t already obvious, swapping assets is the heart and soul of a DEX. Users can use SundaeSwap to swap assets within the Cardano ecosystem.

Swapping is fairly straightforward and familiar to anyone who has used a DEX. Users simply choose the token they wish to swap and receive, enter the amount and hit swap. If the desired token is not found, users can search for a token using its name, symbol, or pasting its policy ID. Note that all swap fees are paid in Cardano’s ADA token, so be sure to have some extra on hand.

One thing I like about SundaeSwap is the advanced slippage options that users can select and the dropdown menu that shows additional information such as estimated tokens received and minimum tokens received in the event of slippage so users can avoid nasty surprises. This helps combat issues that may arise with market congestion, delayed orders and slippage:

As with any good DeFi protocol, there is nothing sweeter than high APYs and passive income. The earning selection for SundaeSwap comes in a few different flavours such as:

Providing Liquidity

Advantages:

- Earn passive income from trading fees

- Higher APY than simply staking ADA

- Users can participate in yield farming with the LP tokens received by providing liquidity for extra rewards

Disadvantages:

- Users need to provide 2 assets to make a liquidity pair, not just ADA

- Risk of impermanent loss

- Funds are held in a smart contract and not a user’s wallet, opening up risk exposure to smart contract hacks, bugs, and failures

Providing liquidity is the first step to yield farming, but this can also be done as a stand-alone activity. When users provide liquidity, they get back an LP token. This token represents the liquidity provided by the user, and users can then stake this LP token by yield farming for extra rewards. By providing liquidity, liquidity providers (LPs) earn a share of the trading fees processed through a particular liquidity pair.

Yield Farming

Advantages:

- Users passively earn fees from trading activity on the DEX

- Earn extra rewards on top of liquidity providing in the form of the native SUNDAE token

- Highest APYs

Disadvantages

- Same risks and disadvantages as providing liquidity

- LP tokens may need to be locked up for a period of time to earn rewards

Once users have received their LP tokens from providing liquidity, they can get into yield farming. Yield farming rewards are not offered for every asset pair on a DEX. Users need to check beforehand which asset pairs offer yield farming rewards. At the time of writing, the pairs that offer yield farming rewards are:

- SUNDAE/ADA

- LQ/ADA

- WMT/ADA

- CARDS/ADA

The list of eligible pools will be adjusted by the community vote later as the ecosystem grows and with the launch of stablecoins.

Yield farming is a form of staking used by DEXs to reduce the volatility of their liquidity pools. The SundaeSwap team has set aside 500,000 SUNDAE tokens to allocate to yield farmers over the first six months of the DEX’s operation.

The process of yield farming of the SundaSwap DEX works as follows:

- Liquidity providers receive LP tokens in exchange for depositing a pair of assets into a pool.

- If the LP tokens received are for qualified pools, Liquidity Providers will be able to stake their LP tokens into the yield farming contract and obtain additional yield on top of the fees they receive for being a Liquidity Provider.

- Initially, yield farming contracts will be set for 30-day terms. Terms will roll over automatically. Users do not need to withdraw and re-stake to continue earning yield.

- At the end of each yield contract term (30 days), users may withdraw their initial LP tokens and any LP tokens earned as yield from qualified pools. Early withdrawal results in no farming rewards being earned. Withdrawing from a rolled over term early will not invalidate yield earnings from completed earlier terms.

- The SundaeSwap DAO will swap these additional yield-generated liquidity tokens for SUNDAE.

SundaeSwap Utility and Governance Token

The SundaeSwap (SUNDAE) Token is a utility token central to the operation of the SundaeSwap DEX. As the protocol establishes a DAO and is placed in the hands of the community, the SundaeSwap token will represent voting power within the organization.

Governance began at the launch of the DEX and allows the community to be involved with the platform’s future and make important governing decisions. Through SundaeSwap’s profit-sharing mechanism, users who participate in building the protocol through governance will earn rewards for their participation. Holding the token can also lead to reduced fees for some platform users; further info on that can be found on the SundaeSwap Finance page.

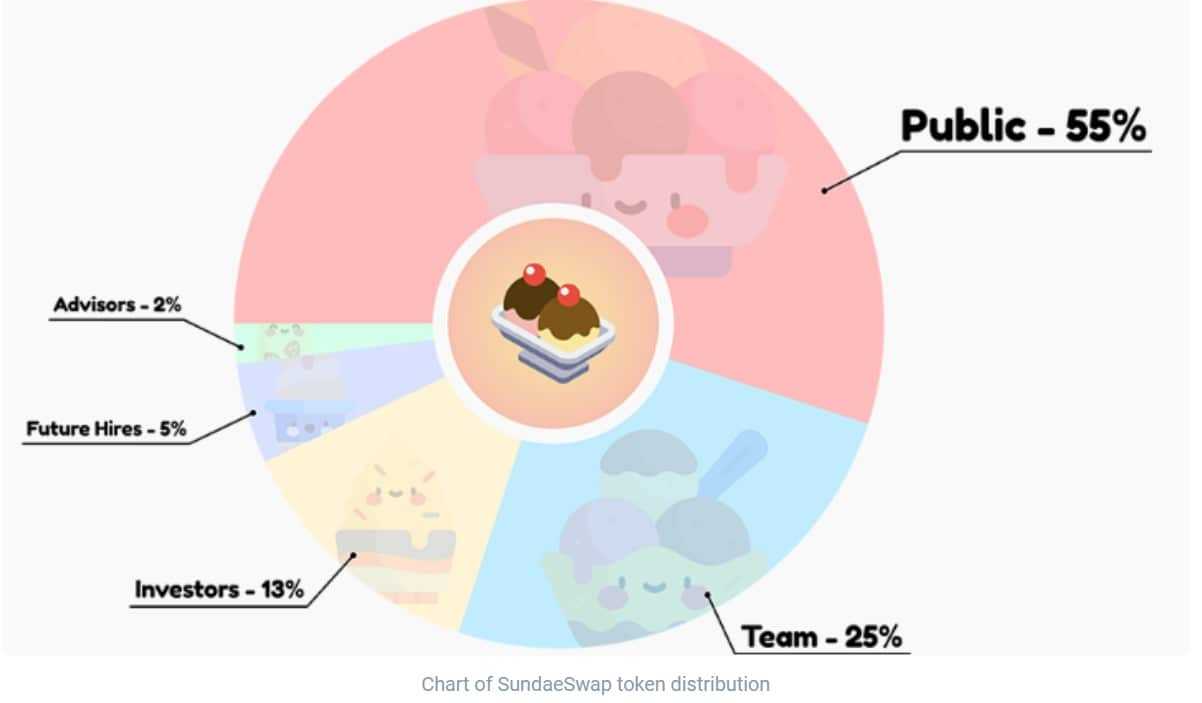

The entire SUNDAE supply will be 2,000,000,000 tokens, with the majority distributed to users of the protocol. 55% of the SUNDAE supply went to the public, 5% to the initial stake pool offering, 25% went to the team, 13% to investors, 5% to future hires and 2% to investors:

SundaeSwap Governance

It is part of SundaeSwap’s mission to be completely decentralized. For this to happen, it is vital for the community to assume responsibility for managing the DEX and its development, plus take control over the treasury. Community guidance through smart contract-controlled voting and governance is a foundational step in creating an ownerless protocol that facilitates direct, trustless interaction between community members and engagement from users.

Due to limitations on Cardano’s current transaction size parameters, SundaeSwap’s governance capabilities couldn’t run entirely via smart contracts within the SundaeSwap protocol. As a result, SundaeSwap Labs’ development team created a temporary governance category called Sundae DAO in Discord and a Governance forum to discuss and vote on governance proposals.

Closing Thoughts

The SundaeSwap launch did mark a historic day for the Cardano ecosystem as the first DEX. It was an important milestone in building out the Cardano DeFi ecosystem.

While the platform did encounter a few snags at first, as new software launches often do, it was great to see the transparency of the SundaeSwap team in acknowledging the issues and the team’s ongoing communication with the community regarding pain points. The team acted quickly and professionally to keep everyone abreast of the situation and quickly rectify many of the problems. Since the first week of hurdles, the SundaeSwap DEX has been chugging along nicely. It has plenty of satisfied users and active trading activity.