The broader crypto-market has been witnessing a relief rally of late. Despite some fixes at the time of publication, the prices of most of the top coins appeared to be getting back on track in the charts.

Amidst the broader market drama, the battle between L1 and L2 solutions has also been intensifying. Indeed, the price tug has been quite intriguing over the past month. Even though token holders have been handsomely rewarded over the aforementioned period, Ethereum, comparatively, has been struggling.

So would the scenario change anytime soon or will ETH become redundant over time?

L1 versus L2

Layer 1 solutions have been getting back to the center of the crypto-stage. With space becoming even more competitive, tokens associated with such networks have rallied in recent times. A few days back, Cosmos, Polkadot, and Tezos were the highlight, and now, the spotlight is back on altcoins like Solana, LUNA, Avalanche, and Fantom.

Recent funding programs launched by these networks have been successful in generating liquidity and attracting new users to the ecosystem. As depicted in the chart attached, Solana, Fantom, Avalanche, and Terra have all seen notable TVL upticks over the past month.

Solana and Terra’s liquidity has hovered around the $ 8 billion mark lately. Fantom and Avalanche’s growth, on the contrary, has been quite steady.

L2s solutions have undeniably gained the attention of the general public lately. Arbitrum’s growth over the past few weeks, for instance, has been quite phenomenal.

However, the solutions, together, represent 1% of the total daily gas spent on Ethereum now. Optimism, along with Arbitrum, has led to the recent surge and accounts for 50% of the total L2 gas consumption. The cumulative increase is not a healthy sign as such, and the same could have triggered the migration of users to L1 networks.

Where does Ethereum stand?

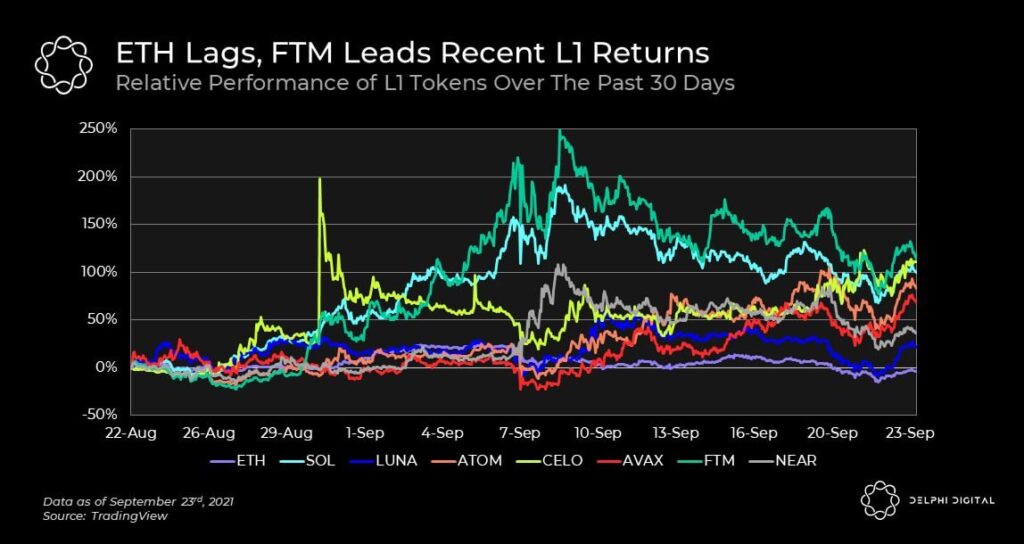

When relative performance is compared, altcoins like Solana, Fantom, and CELO have been able to fetch HODLers over 100% returns over the past month. Other L1 tokens like NEAR, LUNA, ATOM and AVAX were also able to give investors quite high returns.

Ethereum has evidently found it difficult to keep up with the aforementioned tokens. In fact, as the following chart shows, ETH yields have been negative over the past month.