Polygon continues to be a substantial force in DeFi. The protocol’s ease of use and lower fees have been major draws for developers, leading to a wide variety of new projects coming to life on the platform.

Meanwhile, the folks over at Amun Tokens are dealing with DeFi index tokens left and right. In June, the platform announced the launch of two index tokens, $DFI and $DMX, engaged in the Ethereum ecosystem. Given Polygon’s increased existence recently in DeFi, it was just a matter of time prior to the group at Amun let loose a Polygon-based token also.

That time has come, as Amun announced today their latest token headed to pre-sale: PECO. This token aim to encapsulate the very best and brightest jobs being constructed on Polygon.

Amun, PECO, & The Polygon Ecosystem

Amun released their Medium post announcing PECO today in collaboration with the Polygon Foundation and leading Polygon projects. The Foundation is supplying $5M in MATIC tokens to seed the index’s launch, according to the Medium post, and numerous prominent jobs are supplying seed capital for liquidity.

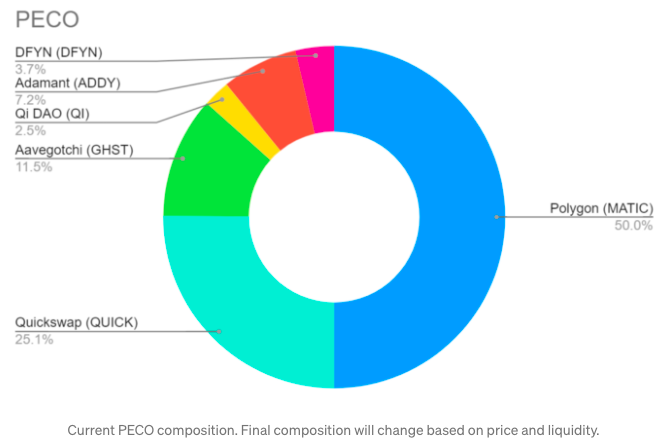

The token initially launches on October 19 and will start with 50% MATIC until the network matures further. Protocol tokens comprise the staying 50%; have a look at the preliminary PECO settlement on launch listed below:

As the Polygon network grows and develops, the PECO portfolio will be rebalanced monthly. PECO will be readily available on both Polygon and Ethereum, and early individuals can make approximately an extra 30% perk tokens in the pre-sale by means of airdrop.

Amun & DeFi Growth

The Amun whitepaper cites the need for scalability in DeFi and looks to provide ERC-20 tokens that address an index of the top DeFi tokens available.

Earlier in the year, Amun let loose DeFi index token $DFI, intended to offer financiers direct exposure in “blue chip DeFi projects.” This allowed consumers to come to one token for a wide exposure of DeFi’s biggest coins, without incurring individual swap costs. Additionally, Amun released their DeFi Momentum Index, $DMX, which seeks to automate weights based price momentum calculated by a relative strength index. This index looked for momentum riders who “missed out on the last bull run.” Both indices were at first made up of 8 tokens per index.

Amun is building out a wide breadth of DeFi exposure during what seems to be an ideal time. A Bank of America report today pointed out DeFi’s development and mostly untapped capacity, and Polygon and it’s subsequent platforms have actually been massive development chauffeurs in DeFi.